While the US government encourages domestic production, Mexico continues to attract foreign automotive investment. The trend is particularly evident in the arrival of Chinese manufacturers, poised to have a significant impact on regional production.

In spite of the US government’s encouragement to VMs to invest in domestic production, notably through IRA incentives, Mexico has continued to attract investment from major car companies, especially Tesla, Audi and BMW; the Chinese, notably BYD, remain on the horizon and it is reasonable to expect confirmation of Chinese VM investment in Mexico within the next few months.

The arrival of the Chinese in Mexico will come despite the Mexican government having acquiesced in early 2024 and stopped offering overt subsidies to the Chinese; the USMCA free trade deal with the US and Canada is up for review in the next couple of years and US trade authorities have reportedly intimated that Chinese VM investment in Mexico for US supply would not be welcomed. The Chinese will likely still invest in Mexico, although they may – for now at least – not use their planned Mexican factories to supply the US.

Ford, GM, Stellantis, and indeed Volkswagen, have long been present in Mexico but are not actively investing heavily at present. Audi and BMW also have long established Mexican plants in which they are planning to invest further, as is Tesla’s all-new facility.

Audi

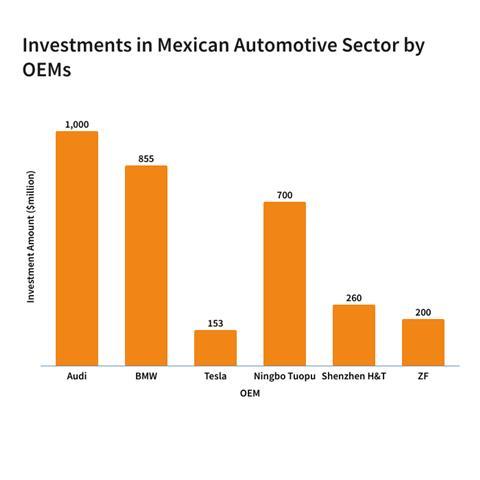

Audi has confirmed US$1bn investment in its Puebla factory to make EVs, although which models this will involve has not been confirmed. This follows BMW’s 2023 announcement of a US$855m investment in its Nuevo Leon factory. This will also be for EVs, with the vehicles to be made on the Neue Klasse platform; production is due to start in 2027. US$540m, ie more than half of BMW’s investment, will be in a battery assembly facility which will add 500 jobs to the factory.

The factory is expected to make two models, the new i3 sedan and a replacement for the iX3 SUV which is currently made in China; the Mexican plant will supply the US market and various global markets and will compete for global business with Munich which will also produce the i3 for Europe and markets further afield. The Mexican factory will compete similarly with BMW’s new plant at Debrecen in Hungary for iX3 export potential.

Stellantis and Tesla

Although not expanding its Mexican operations, Stellantis has confirmed its first North American built EV will be the Jeep Wagoneer S which is now in production at the Toluca assembly plant. This decision to make its first North American EV in Mexico follows the similar “build the first EV in Mexico” approach of Ford (with the Mustang Mach E) and GM (with the Chevrolet Blazer EV).

Meanwhile, Tesla has started building a factory in Nuevo Leon, supported by US$153m of help from the provincial government. However, with an eye on potential changes in the political climate at home, Elon Musk has halted construction of the new factory until after the upcoming Presidential election. Tesla is also attracting several Chinese companies to Mexico to supply to the new factory.

There are already over 30 Chinese component companies in the country, and 18 of these already export to the US, (these suppliers’ exports were reportedly worth more than US$1bn in 2023, a rise of 15% on the value of their export business in 2022). The US, for now at least, does not seem to object to Chinese suppliers delivering into US car assembly plants from Mexico - it is Chinese brands’ vehicle plants in Mexico which do not meet with US approval.

BYD and SAIC

In terms of the Chinese VMs, BYD is leading the way and is expected to announce a factory in Mexico in the near future; but with a nod to the negative politics surrounding Chinese VMs north of the border, BYD has said it doesn’t plan to sell Mexican-made vehicles in the US. This may of course change in the long run, especially if the company can prove it has sufficiently high local (and genuinely non-Chinese) content.

But to begin with, BYD’s Mexican plant is expected to supply the Mexican domestic market and Latin America in general. A second Chinese company, MG (part of the SAIC group), also plans a car plant and an R&D centre in Mexico. The R&D centre will be specifically tasked with designing vehicles suited to the Latin American market.

Chinese tier-suppliers with Mexican ambitions

As noted above, there is a steadily growing number of Chinese suppliers in Mexico. Some of these have arrived or expanded recently, specifically to support Tesla. These include: Ningbo Tuopu (currently expanding a chassis systems factories, where (according to local government officials) it will reportedly generate a remarkable 10,000 jobs, with a US$700m investment), Shenzhen H&T Intelligent Control (US$260m investment) Shanghai Bayon (a producer of castings and plastic components), Suzhou Dongshan (PCB production), Zhejiang Yinlun (which is investing US$80m in air conditioning systems production), and Chinaust (a JV between Lingyun of China and Georg Fischer of Austria which produces chassis and powertrain castings).

European companies make forays into Mexico

But it is not just Chinese suppliers who are expanding in Mexico; ZF is investing US$200m in an R&D centre in Monterey, suggesting that it is not just low labour costs which suppliers will find attractive in Mexico, but that its labour force’s engineering skills are also of interest. By contrast, European supplier Forvia has cited concerns over the security situation in Mexico which, along with rising labour and energy costs, is causing it to review its plans for the country.

It will clearly not all be plain sailing for Mexico’s automotive sector, but there are numerous positive signs, including in EV production, even if Mexican consumers are themselves unlikely to be able to afford many of these vehicles owing to their being targeted at US or European consumers with bigger wallets. If Mexico can attract Chinese investment without damaging its position within the USMCA framework, it may achieve the ideal outcome of being able to split its export business between the US and other markets while simultaneously building firm foundations for the long term.

No comments yet