The global battery industry has entered a transformative phase. EV demand is pushing annual battery needs past 1TWh, while prices fall below a key cost threshold. China remains dominant, but market shifts and consolidation are poised to reshape supply chains worldwide.

A new report by the International Energy Agency (IEA) has found the battery industry has now entered a rapid advancement phase as demand surges and prices continue their downward trajectory. In 2024, electric vehicle (EV) sales climbed 25% to 17 million units, driving annual battery demand past 1 terawatt-hour (TWh) for the first ever time. Simultaneously, the average cost of a battery pack for an EV fell below USD 100 per kilowatt-hour—a critical threshold for competing with conventional internal combustion engine models.

The report found a key driver behind the cost reduction to be the sharp decline in battery mineral prices. Lithium; a cornerstone of battery production, has seen an 85% price drop from its 2022 peak. Beyond raw material costs, the battery industry’s evolution has played a significant role in cost reductions.

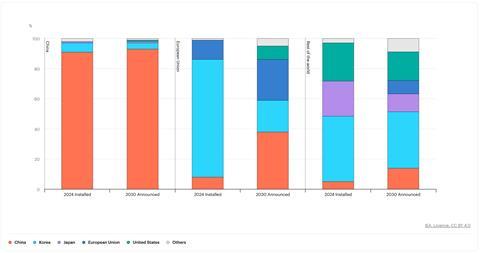

Years of investment have led to global battery manufacturing capacity reaching 3 TWh in 2024, and if all announced projects materialise, capacity could triple within the next five years.

As AMS has pointed to on many occasions, the industry is shifting from a fragmented, regionalised model to a globally integrated market, where standardisation is taking precedence over diverse technological approaches.

Success in this new landscape will depend on manufacturing efficiency, economies of scale, supply chain partnerships, and the ability to bring innovations to market swiftly. The IEA report finds this evolution is likely to spur further consolidation as firms seek to enhance competitiveness. Simultaneously, government policies aimed at diversifying supply chains geographically are reshaping industry dynamics.

”In 2024, battery prices declined faster in China than anywhere else, dropping nearly 30%—making Chinese batteries at least 30% cheaper than European alternatives and 20% cheaper than those manufactured in North America”

China’s dominance persists but consolidation looms

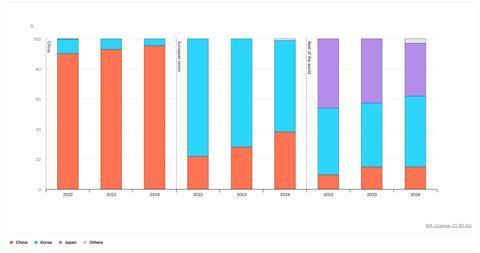

According to the report, China remains the undisputed leader in battery production, accounting for over three-quarters of global supply. In 2024, battery prices declined faster in China than anywhere else, dropping nearly 30%—making Chinese batteries at least 30% cheaper than European alternatives and 20% cheaper than those manufactured in North America. These cost advantages have been instrumental in making EVs in China cheaper than their petrol and diesel counterparts.

The IEA found several factors contribute to China’s price advantage:

-

Manufacturing expertise and economies of scale: Over 70% of all EV batteries ever produced have come from China, allowing manufacturers such as CATL and BYD to dominate through accumulated expertise, innovation, and high manufacturing yields.

-

Vertical integration and supply chain control: Chinese firms benefit from a tightly integrated ecosystem, spanning from raw mineral extraction to battery cell production. This integration, facilitated by strategic acquisitions and cooperative networks, accelerates innovation while lowering costs. Reports also suggest that manufacturers benefit from access to below-market prices for critical minerals.

-

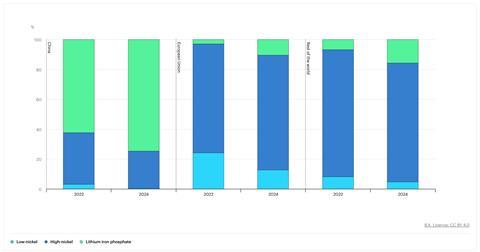

Advancements in lithium-iron phosphate (LFP) technology: Historically considered inferior to nickel-based chemistries due to lower energy density, LFP batteries have undergone significant refinement. Chinese manufacturers have driven their commercial viability, and today they account for nearly half of the global EV market. LFP batteries are about 30% cheaper than lithium nickel cobalt manganese oxide (NMC) alternatives, while still offering competitive range performance.

-

Intense domestic competition: China’s battery sector is home to nearly 100 manufacturers. To secure market share, firms have consistently lowered prices, eroding profit margins in a bid to remain competitive.

However, the era of continuously falling prices may be nearing its end. Fierce competition and shrinking margins are likely to force consolidation, with a reduction in the number of players shaping the market. As larger firms absorb smaller competitors, the industry will see greater pricing power concentrated in the hands of a few dominant producers. Despite this, China is expected to maintain its lead in global battery production in the medium term, reinforcing its role as the primary supplier for the world’s EV industry.

”Several [European] manufacturers have postponed or cancelled expansion plans, and costs remain stubbornly high—roughly 50% above Chinese levels”

Europe’s battery industry is on a knife-edge

For Europe, the IEA report is less a roadmap and more a warning. Battery production on the continent is stalling. Several manufacturers have postponed or cancelled expansion plans, and costs remain stubbornly high—roughly 50% above Chinese levels. The collapse of Northvolt, once the region’s great hope for a homegrown battery giant, is a testament to the scale of the challenge.

Europe must move fast to avoid becoming permanently dependent on imported batteries. The report outlines key priorities, including building stronger domestic demand, securing long-term policy commitments, and embracing LFP technology.

Korean manufacturers, long dominant in Europe, have already lost significant market share to Chinese rivals, but some are now shifting focus to localised LFP production. Meanwhile, partnerships such as the Stellantis-CATL joint venture offer a potential blueprint for reducing costs and strengthening the supply chain.

Beyond China: the global battery arms race

While China leads, the IEA report points to rapid expansion elsewhere. Korea and Japan remain pivotal players, with vast overseas investments and a strong foothold in nickel-based battery chemistries. Korean firms, in particular, have built nearly 400 GWh of production capacity abroad—far outpacing Japan’s 60 GWh and even China’s 30 GWh in international projects. Both nations are now weighing whether to shift more investment into LFP and other emerging technologies, including solid-state batteries.

Read More Battery & EV Stories

-

The urgency for enhanced Design For Manufacture (DFM) in vehicle production

-

Solving EV battery pack development, cost and production challenges

-

TCS’ Anupam Singhal on offsetting EV cost and sustainability doubts

In the United States, battery production has doubled since 2022, reaching over 200 GWh in 2024. Tax incentives have fuelled an investment boom, with nearly 700 GWh of additional capacity under construction. However, the supply chain remains incomplete, with domestic production of cathodes and anodes lagging behind.

Meanwhile, Southeast Asia and Morocco are rising as alternative production hubs. Indonesia, home to half the world’s nickel reserves, is accelerating battery and anode manufacturing, while Morocco, with its vast phosphate deposits, has drawn over USD 15 billion in investment to fuel an LFP-focused supply chain. Both regions are positioning themselves as essential players in the global battery economy.

The path to supply chain security

The race to diversify supply chains is intensifying. With China restricting exports of key battery materials and processing technologies, governments worldwide are scrambling to secure domestic capacity. However, the report makes clear that no country can go it alone.

Building a viable battery ecosystem requires more than just factories—it demands long-term industrial strategy, a robust workforce and sustained collaboration with established battery giants. Trade-offs will be unavoidable. Automation, digitalisation and next-generation chemistries can help close the cost gap with China, but scaling up production to competitive levels takes time.

Meanwhile, international partnerships with battery manufacturers and mineral-rich nations will be critical to securing reliable access to raw materials.

No comments yet