The future of internal combustion engines (ICE) is being extended through growing demand for hybrid powertrains as OEMs rebalance EV product line-ups.

The first surge of hybrid vehicle production was meant to be stepping stone to the wider adoption of full electric vehicles. The issue for car makers at that point was that generation of hybrids were based on modified ICE platforms and added more content, complexity and cost to production, something that was difficult to fully pass on to consumers. However, the current slowing of battery electric vehicle (BEV) sales in certain markets is now seeing car makers look to increase hybrid options in their respective product ranges as demand for these vehicles grows. Some are better placed than others, typically those who have been slower to introduce BEVs to their vehicle range, and those that have well established hybrid production operations.

Toyota leverages hybrid experience

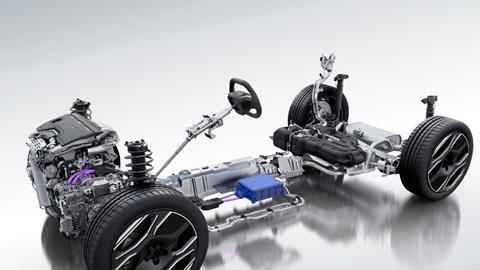

Tighter regulations on vehicle emissions led to the initial development of hybrid powertrains starting back in 1997 with the launch of Toyota’s Prius model. The Japanese OEM continues to develop and produce hybrid vehicles across its range of vehicles and is currently using its 5th generation hybrid technology.

While certainly looking forward and developing BEV models, Toyota has been continuing to develop its hybrid system output, ensuring it can flex a mix of powertrains across its production operations. There are some good examples of this strategy in North America where the car maker has invested in this mix. At its Kentucky plant it has introduced a new flexible engine line that can produce three different engine types simultaneously on one line as part of a wider $145m investment. This line will produce 2.4L turbo and 2.5L engines for hybrid Toyota and Lexus products.

At its plant in West Virginia the company is now producing its 5th generation hybrid transaxle is part of its multi-pathway approach to electrification.

Toyota’s hybrid production also continues at its European plants. In 2022 the company’s Valenciennes plant reach its 1m hybrid vehicle production milestone, building the Yaris model. The same year the company invested €77 million in its Polish (TMMP) and UK (TMUK) plants to upgrade seven lines for hybrid powertrain production. TMMP produces hybrid electric transmissions including the MG1 and MG2 motors, which are combined with a 1.8-litre gasoline engine produced at TMUK to form the 5th generation hybrid electric powertrain.

Production lines at Toyota’s Sakarya plant in Turkey have also been upgraded to produce the C-HR plug-in hybrid, and the plug-in hybrid battery assembly.

Honda has similarly been investing in its powertrain mix, notably at the company’s Marysville Auto Plant which is being upgraded as part of a planned EV hub in Ohio, US. The plant will see the consolidation two vehicle production lines into one, to create a flexible production line that will build petrol, hybrid and EVs.

Ford’s hybrid expansion

Ford has already been producing hybrid powertrains for a variety of models, including its best-selling F-150. The hybrid version of this, known as the F-150 PowerBoost Hybrid, with engines supplied from the company’s Chihuahua Engine Plant in Mexico.

However, responding to slowing demand for its BEV models the company recently shifted its electrification strategy, delaying battery production projects and cancelling a planned three-row BEV SUV. Although continuing to develop and produce pure electric models the company has looked to increase its hybrid offerings, focusing on hybrid versions of popular models such as the Mustangs, Broncos and Mavericks.

Stellantis takes a multi-energy approach to powertrains

Stellantis is another OEM that has hedged its powertrain options while still pursuing BEV development and production. The company notes that it is extending its hybrid offer across its extensive range of brands due to increased demand from the European market and will have 30 hybrid models available in the region this year, with another six launches planned for 2026.

The company says it has seen a 41% sales increase in 2024 YTD against 2023 YTD in EU30 hybrid models and expects customer take rate to increase with the new launches.

Stellantis-brand hybrid vehicles available now or coming later this year in Europe:

- Alfa Romeo Junior and Tonale

- Citroën New C3, New C3 AirCross, C4, C4X, C5 AirCross, C5X

- DS 3 and DS 4

- Fiat Panda and 600

- Jeep Avenger, Renegade and Compass

- New Lancia Ypsilon

- Maserati Grecale

- Opel/Vauxhall Corsa, Astra, Astra SportsTourer, Mokka, Frontera, New Grandland

- Peugeot 208, 308, 308 SW, 408, 2008, New 3008, New 5008

Stellantis’ says it utilises its electrified dual-clutch transmissions (eDCT) as an affordable hybridisation technology, along with an energy recuperation system. The company notes that it is currently producing hybrid vehicles in more than 70% of its plants in Europe. Through the eTransmissions joint venture, Stellantis and its partner currently produce eDCTs in Metz, France, and Turin, Italy, suppling 11 vehicle manufacturing plants, with a combined production capacity is over 1.2m eDCTs per year.

Range extender production on the rise

Range extender production is also increasing, with these ICE units becoming much more specialised and efficient. HORSE is a company that has been making investments in developing and producing these power units. Created from a joint venture between Renault and Geely, the company leverages the R&D and production asset of Renaults including three development centres and eight powertrain production plants.

The company has been active in developing flex fuel engines for the South American car market and recently signed an agreement with Brazilian EV start-up, Lecar, to supply range extenders for its 459 hybrid model. This will use HORSE’s 1.0-litre, three-cylinder HR10 engine, which the engine maker has already successfully used for LCV applications.

The 459 model is classed an Extended Range Electric Vehicle (EREV), so unlike plug-in hybrid-electric vehicles (PHEVs) the ICE unit does not deliver any power to the wheels. It supports charging the vehicle battery via a generator and the HR10 units are produced at the company’s plant in Curitiba, Brazil.

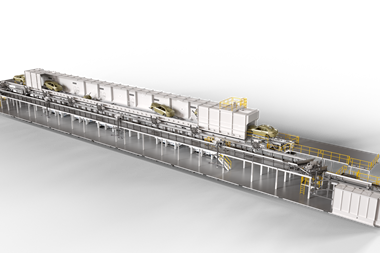

HORSE has recently started production of its HR12, 1.2-litre, 3-cylinder turbocharged petrol engines for use in (PHEVs) at its Valladolid plant. This has required a €4m investment at the plant to modify and scale its assembly line. Initial production will be 1,200 units per month, with a maximum capacity of 6,875 engines per month. The HR12 units will be used in the in Renault’s upcoming Rafale E-Tech 4×4 Hybrid.

Hybrids were perhaps not always that welcome in the production schedules with the additional work content, complexity and costs, but this resurgent powertrain may just prove to be the saviour of the e-mobility goal, or at least a key enabler in ushering in an electric future for the auto industry.

No comments yet