Canadian vehicle and component production operations are feeling the impact of slow EV sales. However, the country has many assets making it attractive to investment, especially in battery production.

Investment in Canada’s auto manufacturing sector has always been reliant on decisions made outside the country, with no indigenous VM to lead the country’s case. That said, Canada is home to two of the sector’s leading component suppliers, Magna and Linamar, and is poised to play a significant role in North America’s growing EV battery supply chain. The country has abundant mineral resources and renewable hydroelectric power, which has been a major factor behind the decisions by Northvolt and others to build battery cell factories in the country, as discussed below.

“Honda has made by far the biggest commitment to EV and battery production in Canada, having indicated that concern regarding the longevity of support for the sector in the US is a key issue”

However, as in other countries where there is no indigenous VM, it is the decisions by VM HQs elsewhere which set the tone for investment in Canada. Here significant decisions have recently been made by Honda, Ford and GM which tell different stories about the role which Canada will play in these companies’ North American strategies.

Honda commits to EV production in Canada

Honda has made by far the biggest commitment to EV and battery production in Canada, having indicated that concern regarding the longevity of support for the sector in the US is a key issue. Honda, perhaps wisely, appears sceptical regarding the permanency of the support for the sector through the Inflation Reduction Act (IRA). The company fears that a change of US presidents could result in the withdrawal of incentives under the US IRA, Honda has chosen to take advantage of what it sees as a more stable investment climate in Canada, especially the tax credits of 10% for investment in the EV supply chain and 30% for investment in clean technology. The Canadian federal government will also spend C$2.5 billion (US$1.8 billion) to support Honda, with a similar sum coming from the Ontario provincial government

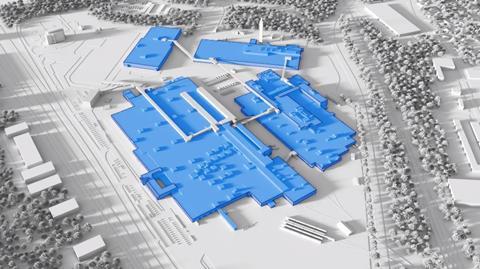

Honda’s planned investment is C$15 billion (US$11billion). The company wants to develop its own battery technology in-house but is understood to be working closely with Yuasa of Japan, despite Yuasa’s lack of experience in EV batteries. The company is looking at establishing a complete battery ecosystem in Canada, having brought in Korea’s POSCO Future M to produce precursor and cathode active material and Japan’s Asahi Kasei to make battery separators. They will supply into the 36GWh per year battery assembly plant at its existing car factory in Alliston, Ontario where a new EV range will be built at a rate of 240,000 vehicles a year. Employment by Honda in Canada will rise by around 1,000 from the current 4,200 level.

It is worth noting that Honda’s battery cell plant is the fourth planned battery facility in Canada. In 2022, LG and Stellantis announced a C$5 billion 45GWh battery site in Windsor, followed by two separate C$7 billion investments, one by Volkswagen’s PowerCo subsidiary in Ontario (which could reach 90GWh annual capacity in the long run) and a 60GWh factory from by Northvolt (its first outside Europe, and its sixth overall), near Montreal.

“The Super Duty model is also made in Kentucky and Ohio and, potentially ominously for Canada, Ford has assured its US unions that any future downturn in demand for Super Duty models will see production cut in Canada with US production given primacy over Canada”

The Northvolt factory, which has been hailed as the greenest in the world, is not without controversy and local environmentalists have been especially critical of the project, while public sector unions object to the support given to the plant while wage claims for public sector workers have been refused. In addition, Umicore is also building a Canadian plant capable of delivering 35GWh of battery materials from 2026, but this is for supply to AESC Envision in the US which is supplying batteries to BMW and other VMs in the US.

Ford favours pickup truck production in Canada

Meanwhile Ford has decided not to make its Oakville, Ontario plant into an EV hub. In 2023, it had announced a US$1.3 billion investment to make two, three-row electric crossovers from 2027. This had already been put back two years and in July the decision was made to cancel the EV investment and instead invest a higher sum, US$2.3 billion, to make ICE-powered Super Duty pickups, at a rate of around 100,000 a year. The investment adds c1,800 jobs, 400 more than had been planned under the original EV plan. The new investment will also see additional stamping activities allocated to the factory and some additional V8 engine production allocated to the nearby Windsor, Ontario engine plant. The Super Duty model is also made in Kentucky and Ohio and, potentially ominously for Canada, Ford has assured its US unions that any future downturn in demand for Super Duty models will see production cut in Canada with US production given primacy over Canada.

“While Honda, Ford and GM and various battery cell companies adjust their investment and production plans for Canada, legacy tier 1s’ Canadian operations have to compete with their US counterparts for continued business”

GM delays e-motor production

Meanwhile GM has delayed its planned electric motor production its St Catherines facility in Ontario. This factory was due to switch production from V6 and V8 engines and six-speed transmissions to making 400,000 electric drive units per year, although it will retain V8 production for a short period. These plans were announced in 2023 but have yet to see electric motor production starting despite production of the V6 engines having stopped. The Canadian union, Unifor, has expressed frustration but in reality, cannot do much about the delay.

Also in Canada, production of the BrightDrop electric vans at GMs CAMI Assembly Plant at Ingersoll, Ontario was halted for six months owing to a shortage of battery modules. Production restarted in April but only on a single shift basis. While GM waits for demand to catch up with capacity, the factory’s two-shift strong workforce is alternating with two weeks on and two weeks off, making battery modules, complete battery packs and assembling vans for a variety of fleet operators including Hertz, Walmart, FedEx, Verizon, and DHL Canada.

And while Honda, Ford and GM and various battery cell companies adjust their investment and production plans for Canada, legacy tier 1s’ Canadian operations have to compete with their US counterparts for continued business. Unsurprisingly there has been a mix of positive and negative developments in this area: for example, Goodyear has recently announced a C$575m (US$418m) investment to expand its Ontario factory to make 2m tyres a year from 2027, adding 200 new jobs, on top of the existing 800 positions. However, on the other side, Martinrea has closed a factory in Ontario, following the loss of Stellantis business at model changeovers in both Canada and the US. Similar investments and closures will inevitably continue in the next few years but the key determinant for the long-term security and health of the Canadian automotive sector will be securing more investment like that from Honda and its supplier network.

![Asahi Kasei Canada groundbreaking ceremony[48]](https://d2oevnekjqgao9.cloudfront.net/Pictures/380x253/1/5/6/326156_asahikaseicanadagroundbreakingceremony48_273505.jpg)

No comments yet