Automotive manufacturers are streamlining production with Design for Manufacture (DFM), cutting complexity, reducing costs and driving EV innovation. In In this article, experts reveal the key strategies and digital tools that are reshaping vehicle production.

“The ability to simplify, means to eliminate the unnecessary so that the necessary may speak”

- Henry Ford

“The ability to simplify,” said Henry Ford, “means to eliminate the unnecessary so that the necessary may speak.” This adage could not be more fitting for automotive manufacturing. The ongoing battle to reduce vehicle complexity is foundational for global automotive OEMs and tier-suppliers everywhere - and the need is growing.

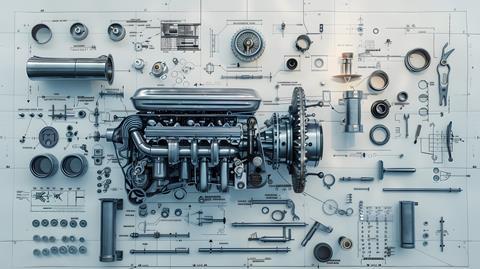

If you were to imagine, stretched out before you, a conveyor belt of endless vehicle components flowing into a high-tech, and electrified smart factory where millions of cars take shape with seamless precision, engineers and designers would be standing at the conveyor-head, busy ensuring that every part is formed to allow flawless integration from inception. This is one of those rare occasions where the term ‘streamlined’ truly is applicable.

This relentless pursuit of fine-tuning across every stage of production is known as ‘Design for Manufacture’ (DFM), and its concern is with creating components and processes to fully optimise their manufacturability, reduce their costs, and enhance their quality, ideally, prior to launch. Incorporating DFM principles from the outset is what allows for the identification and mitigation of production challenges before they ever materialise.

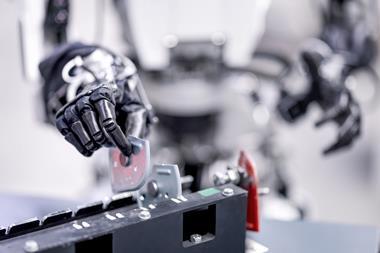

Tom Black, Information Systems product manager, Agile Delivery Practice Lead at automotive tier-supplier ABB robotics, says, “DFM is a collaborative process between R&D and manufacturing engineers that helps eliminate issues that stand in the way of delivering innovative products to market faster. Best practices include involving manufacturing and quality experts early in the design process, continuously iterating and refining designs based on feedback, and leveraging simulation tools to identify potential issues.”

Electrification, simplification and the interdepartmental ‘spirit of closeness’

But presently, there is another added layer of complexity. With the accelerating transition to EVs and the inherent technological complexities that come with it, closer collaboration to foster faster release cycles is key. “Collaboration is critical to DFM,” adds Black. “Enabling alignment and close collaboration between R&D and manufacturing quality/engineers, leading to higher product success rates, reduced lead time, more cost-effective solutions, and transparency in designing and manufacturing.”

The sentiment was echoed by Dr. Daniel Kirchert, Founder and CEO, NOYO AG, at the last Design4production event, who said, “we are seeing a huge transformation and the rate of change is fast,” emphasising the importance of having “the spirit of closeness between design, engineering and production.”

BMW’s Neue Klasse of design and engineering collaboration

An example of this “spirit of closeness” can be seen in BMW’s Munich plant undergoing a major transformation to become a fully electric production facility, highlighted by the introduction of the new EV sedan based on the Neue Klasse platform. Set to begin serial production in 2026 following a €650m overhaul, the model marks a major step in BMW’s electrification strategy, with the facility phasing out internal combustion engine (ICE) and hybrid vehicle production by the end of 2027.

A key feature of this transformation is the close collaboration between design and engineering teams. Production is being integrated right from the product development phase, allowing material decisions and manufacturing processes to be optimised early on. The synergy is expected to drive a 25% reduction in manufacturing costs compared to 2019 levels.

VW’s €20,000 EV and the importance of DFM

Just last year, VW announced its plan to offer highly affordable EVs in Europe; a critical point for DFM. To hit a €20,000 price point, every design element must be optimised for efficient, high-volume production. This requires simplifying components, ensuring modularity, and integrating new electric-specific parts like battery systems seamlessly into the design.

Thomas Schäfer, head of Brand Group Core and CEO of the VW brand said, “despite the attractive price, our vehicles will set standards in the entry-level segment in terms of technology, design, quality and customer experience. This task has become more demanding due to rising energy, material and raw material costs. One thing is clear: Electromobility from Europe for Europe can only succeed with political support and competitive framework conditions.”

”We’re constantly adding new requirements—regulations, customer preferences, manufacturing needs—but we’re not removing any of the old ones. The result is an increasingly complex design process”

- Jaime Moore, Senior Principal Engineer, Toyota North America

With successful DFM principles in play, material choices, automation readiness, and alignment with local manufacturing capabilities further reduce production costs. In essence, applying DFM principles transforms complex design challenges into scalable, cost-effective manufacturing processes that are essential for competitive, mass-market EV production.

Toyota’s flexible Design For Manufacture approach

At Toyota, the focus is on integrating flexibility directly into the design process. During the AMS Evolution North America event in Detroit last year, Jaime Moore, senior principal engineer at Toyota North America, explained that engineers are now considering manufacturability and logistics from the very start, ensuring that designs remain both feasible and adaptable.

“You don’t have time to make mistakes,” she emphasised, pointing to the importance of getting designs right the first time. The approach, integral to DFM, is needed to reduce lead by strengthening collaboration between design and manufacturing teams. Moore also noted, “we’re constantly adding new requirements—regulations, customer preferences, manufacturing needs—but we’re not removing any of the old ones. The result is an increasingly complex design process,” making simplification a strategic priority.

She further explained that Toyota has moved away from short-term cost-saving measures, such as reducing part sizes, if they ultimately add complexity. “If it doesn’t add value to the customer, we’re not doing it,” she added.

Chinese OEMs lead against European and North American DFM

It is no secret that Chinese automakers have achieved production cycle times at rates far outstripping that of their ‘western’ counterparts. According to a recent report from technology company CoLab, carmakers in the US and Europe need to completely overhaul their new product development timelines to keep pace with China’s aggressive market expansion - one which clearly rests on China’s superior DFM infrastructure. CoLab, which builds collaborative design review and AI solutions for hardware engineering teams and is already working with major names such as Ford and Schaeffler—concludes that accelerating design cycles is essential for survival.

”Chinese firms such as NIO bring new designs to market in approximately 120 weeks, compared to the 200-216 weeks typical for leading European and US brands like VW and Renault”

The European Automobile Manufacturers Association (ACEA) reports that European carmakers’ output has been flat since 2010, even falling slightly from 18.3 million to 18 million vehicles in 2023, with the UK experiencing declines of up to 12%.

In stark contrast, figures from the International Organisation of Motor Vehicle Manufacturers (OICA) reveal that Chinese carmakers have ramped up production by 105%, increasing from 13.9 million to 28.5 million vehicles over the same period. BYD is a great example of a Chinese OEM with a highly optimal DFM infrastructure. Colab’s report has found that among fewer regulations, and robust government support for supply chains, Chinese manufacturers benefit from strong in-house capabilities enabling them to dramatically cut product development times.

Critically, Chinese firms such as NIO bring new designs to market in approximately 120 weeks, compared to the 200-216 weeks typical for leading European and US brands like Volkswagen and Renault.

How agile alliances and lean R&D are key to automotive DFM

Two recent Bain & Company reports offer valuable insights into automotive transformation from both a strategic and a technological perspective. In “M&A in Automotive and Mobility: Hedging Bets until a Clear Future Emerges,” Bain details how escalating cost pressures and mounting uncertainty are prompting automotive companies to pivot away from traditional mergers and acquisitions in favor of more flexible partnerships and alliances.

OEMs and suppliers are facing rising costs and underutilised capacities, while the volatile ramp-up of electric vehicles across different regions adds to the challenge of balancing investments between EVs and legacy internal combustion engine operations. As a result, the first three quarters of 2024 saw deal values decline by about 80% and volumes drop roughly 60%. In this climate, companies are increasingly turning to joint ventures and strategic alliances that demand lower investments.

”Bain & Company’s research reveals that some insurgent Chinese OEMs have managed to achieve average full vehicle equivalent (FVE) development costs that are only 27% of those incurred by the top five German OEMs between 2020 and 2024. Furthermore, many German OEMs are targeting an average reduction in R&D intensity of 35% by 2027, with some aiming for cuts of more than 50%”

For example, GM’s $625 million joint venture with Lithium Americas secures critical mineral access, while a partnership between CATL and Hyundai aims to power future Hyundai EV models. The report emphasises that “the best companies will model different future scenarios and actively consider them in their current decision making while, in parallel, taking the no-regret moves to help strengthen the business today.”

In a complementary analysis, “When Less Is More: Shifting Gears in Automotive R&D”, Bain examines the urgent need for traditional OEMs to reengineer their R&D strategies. The report highlights that innovative OEMs now spend less than one‑third of what traditional players invest per new vehicle, with development cycles shrinking from 48–54 months to just 24–30 months.

Bain & Company’s research reveals that some insurgent Chinese OEMs have managed to achieve average full vehicle equivalent (FVE) development costs that are only 27% of those incurred by the top five German OEMs between 2020 and 2024. Furthermore, many German OEMs are targeting an average reduction in R&D intensity of 35% by 2027, with some aiming for cuts of more than 50%.

Read more Design For Manufacture Stories

- Smart factories and partners power JLR’s circular seat foam

- VW’s Thomas Hegel Gunther: “We cannot afford to make any mistakes”

- BMW’s digital production at San Luis Potosi, Mexico

- How North America aims to make EVs affordable for the masses

The report argues that success will come from simplifying product portfolios, streamlining complexity, and accelerating development through methods such as parallel processing, agile methodologies, and earlier supplier integration. Advances in artificial intelligence are expected to further reduce development times by automating tasks like documentation, quality checks, and even replacing physical prototypes with digital twins and extensive simulations.

Additionally, as traditional OEMs shift focus from combustion engines to emerging areas like batteries, energy management, advanced driver assistance systems, and infotainment, there is a pressing need to realign core competencies and restructure the R&D footprint.

This includes addressing workforce challenges—given that 30% to 50% of traditional OEM R&D staff have over 20 years of tenure compared to just 10% to 25% among their insurgent counterparts—and leveraging strategic outsourcing and offshoring to optimise cost and innovation.

Bain highlights the clear imperative for automotive companies to adopt flexible, forward-thinking strategies in both their business models and R&D operations.

How collaborative innovation and smart tools can optimise DFM

Perhaps ironically, DFM is not a simple affair. It has many tools at its disposal. NIO’s Senior Computer Aided Design Engineer, Stefan-Adrian Ionescu points to the importance of software tools and smart factory principles as key to successful DFM. “At the start of any project,” he says, ”I would suggest a key factor is to try and understand how the customer is planning to integrate the design you should be working on.

“China controls critical resources for EV components. To stay ahead, or indeed catch up, we need to accelerate innovation, optimise costs, diversify supply chains, and leverage heritage and quality for differentiation”

- Stephen Gibson, Head of Product Development for Autoneum

”Ask for plant pictures and videos, if you can’t visit in person (but I recommend the visit in person), ask […] the customer [about] previous lessons learned in similar projects, […] their capability of scaling and […] key contacts within the manufacturing environment. This will help you later to check on your designs being implemented correctly as you have probably requested feedback on the initial design.

“Being hands on also helps with dry fitting your parts/assemblies and understanding where you can potentially optimise with the next iterations of the product.”

As US carmakers brace for additional challenges—including tariffs on goods from Canada, Mexico, and China —the focus is shifting to building supply chain resilience. “China controls critical resources for EV components,” explains Stephen Gibson, Head of Product Development for Autoneum. “To stay ahead, or indeed catch up, we need to accelerate innovation, optimise costs, diversify supply chains, and leverage heritage and quality for differentiation. The competition is heating up,” he says. “It is disruptive and it will help us to ultimately progress faster.”

But DFM is necessarily concerned with breaking down departmental, as well as technological silos. Colab holds that one promising strategy is to start innovation earlier in the design process, finding that businesses can accelerate innovation and optimise costs at the design stage by updating the request for quote (RFQ) procedure and introducing co-design practices.

“Engineering-led supplier co-design is an easy way to build supply chain resilience,” says Adam Keating, Co-Founder and CEO of CoLab. “Leveraging modern digital tools […] engineers and suppliers [can] do collaborative tech reviews during RFQs to accelerate and remove admin […]. This allows them to design together in parallel and adapt to changes in real-time.

”Success will hinge on the ability to be nimble, on simple platforms and on the strength of the ecosystems carmakers build”

- Adam Keating, Co-Founder and CEO of CoLab

“This is engineering-led supplier co-design and it’s the simplest way for OEMs and suppliers to develop products concurrently while avoiding costly late-stage changes.”

The report found that companies that embrace this innovative model of supply chain collaboration achieve lead times that are 30-50% faster, design cycles that double in speed, and up to a 50% reduction in bill of material (BOM) costs. OEMs also benefit, as these changes empower engineering teams to iterate product designs on a daily or weekly basis, effectively halving design times. Such syntheses are especially valuable when it comes to redesigning parts. For Colab, Keating says, “we’re seeing redesigns that cut BOM costs by 30% or more.”

Despite a slowdown in sales and production in 2024 due to reduced subsidies and stricter emissions rules, Europe is set to launch 160 new EV models in 2025. Yet, to match the competitive pricing and consumer expectations set by Chinese offerings, these models must be both innovative and agile. “The EV race has been going on for nearly five years, which means companies going to market with models now are already very late,” explains Keating.

“Success will hinge on the ability to be nimble, on simple platforms and on the strength of the ecosystems carmakers build.” He warns, however, that the pace of innovation also means that some EVs are out of date by the time they hit the market.

“Product delays and missed milestones can cost millions of dollars, which carmakers cannot afford in a market that is already seeing widespread discounting. Traditional carmakers will need to double product design speeds and eliminate typical four to five year product cycles, or risk collapse.”

According to Andrew Walden, Senior Project Engineer at Ford Pro Special Vehicles, digital tools exhibit ”a massive increase in speed”

Advancements in AI and the integration of digital tools such as collaborative design engagement systems (DES) with existing CAD platforms offer another way forward. These technologies can automate and speed up design reviews, allowing key partners to work in a controlled, parallel environment. This is just one example of the power of digitalisation to boost effective DFM.

The use of digital tools offer “a massive increase in speed,” says Andrew Walden, Senior Project Engineer at Ford Pro Special Vehicles. “We’ve rolled out [this digital solution] to our entire 200-strong converter network in Europe to accelerate design iterations and drive more innovative solutions. Now the converters can see the vehicle sooner, so they can get Ford products into the market quicker and help us be more competitive as a company.”

Topics

- ABB

- Artificial intelligence

- Asia

- Assembly

- Automation

- Automation and Digitalisation

- BMW

- CATL

- Connected Manufacturing

- Design for Manufacturing

- Digital Tools

- Digitalisation

- Editors Pick

- Electrification

- Europe

- EV manufacturing

- Flexible Production

- Ford

- GM

- Hyundai Kia

- JLR

- Manufacturing engineering

- Nio

- North America

- Renault

- Schaeffler Group

- Smart Factory

- Toyota

- Virtual reality

- Volkswagen

No comments yet