The automotive sector has seen a rapid increase in the use of high strength steel grades. But the materials provide a challenge for manufacturing engineers in the forming process

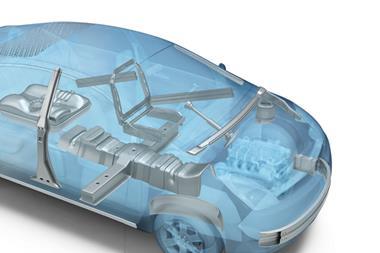

Most advanced-high-strength steels (AHSS) materials comprise specific chemical compositions and microstructures, with a number of strengthening mechanisms used to boost strength, ductility, toughness and fatigue properties. While such characteristics are good news for designers, the challenge for manufacturing engineers is forming these materials, whether that be cold-stamping door beams, seat components or crash boxes; roll-forming bumpers, rocker panels or seat tracks; or hot-forming complex impact-resistant parts.

“Spring-back, for example, has often been considered as a major roadblock for stamping AHSS, but the hot-stamping process eliminates this risk,” explains Jean-Luc Thirion, general manager at ArcelorMittal Global R&D. “When they were first released, AHSS materials were quickly recognised by OEMs as a major opportunity to save weight thanks to their very high tensile strength combined with robustness during processing. This trend has been reinforced by laser-welded blank [LWB] technology, which can combine several hot-stamping grades to optimise crash management.”

The roll forming of ultra-high-strength steels (UHSS) is another way to control spring-back through progressive bending, and the sections that can be obtained are becoming increasingly complex. ArcelorMittal’s MartINsite product range currently has a maximum UTS (ultimate tensile strength) of 1,700 MPa, although this is likely to be extended. One of the drivers in the success of these materials is their lower overall cost, as the roll-forming process is significantly less expensive than stamping parts that feature a constant section in their length, such as side sills or door beams.

The latest, third-generation AHSS materials offer improved strength-ductility combinations, but with lower alloying content to further reduce costs. A case in point is ArcelorMittal’s recently introduced Fortiform.

“Third-generation AHSS materials add a new possibility – the cold stamping of complex parts with steel grades beyond 1000 MPa UTS,” states Thirion. “They can substitute some older generation AHSS materials, such as dual-phase steels, offering potential weight savings of 10-20%.

“The specific microstructures of Fortiform enable us to combine excellent global formability, measured by elongation, for example, and excellent local formability, which can be estimated through the hole-expansion ratio,” he continues. “The differentiation is in the thermal annealing cycles that we have developed to obtain the most appropriate combination of phases. Previous-generation dual-phase steels were a combination of soft phase [ferrite] and hard phase [martensite]. However, the complex annealing cycle used to manufacture Fortiform adds retained austenite, which has a key role in enhancing formability.”

Fine-tuning materials

“We are working closely with carmakers and tier one suppliers, and consider carefully their requests in our product development programmes,” says Thirion. “Moreover, we often collaborate on the development of new products at a very early stage, so that we can include their first feedback as we fine tune our materials.” Several carmakers have already implemented Fortiform or HF (high formability) grades, such as Alfa Romeo on the Giulia, and Peugeot on the 5008. Louis David, master expert in materials and processes for vehicles at PSA, says of Fortiform: “We can achieve weight reductions in our vehicles at zero or almost no additional cost. This is one of the hallmarks of working with steel. Most other weight-reduction solutions are fairly expensive and cost us several euros per kilogram gained. We are replacing high-strength steel or AHSS with Fortiform as it offers even higher mechanical properties with the same level of formability.”

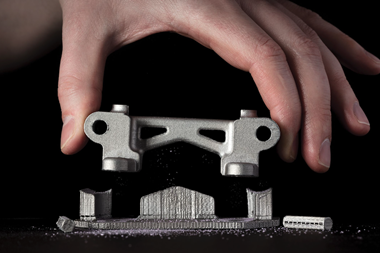

Fabio D’Aiuto, department manager at FCA Metals’ Group Materials Labs, is equally enthused: “Fortiform is interesting for us because it is a new material which offers high performance, particularly in formability. We need difficult shapes and Fortiform 1050 allows us to achieve that, and at a lower cost than other materials.

“Cold forming is associated with good formability, and good formability is something carmakers are always looking for in a steel,” he continues. “Since we started using Fortiform we’ve never had a production or assembly issue. With ArcelorMittal’s help and the right dies, we have managed to create complex parts which can be used on a normal production line, without any special requirements.” Moving forward, ArcelorMittal expects a gradual substitution of conventional AHSS grades with UHSS. It says that the roll forming of martensitic grades should grow quickly as OEMs increase the electrification of vehicles.

“We know that battery packs will be critical modules in these vehicles as it is extremely important to protect batteries against crashes,” says Thirion. “Steels with ultra-high yield strengths are increasingly requested for this application, and roll-formed martensitic grades provide a cost-effective solution to protect batteries.”

According to another material supplier, SSAB, third-generation AHSS grades are the classic definition of a sweet spot for carmakers – high strength with better ductility and improved usability. Ductility means these steels can be cold-formed to produce more complex geometries compared with first-generation AHSS, and they can have sufficient ductility left in the material for crash performance after forming. Docol AHSS materials from SSAB are available in a number of variants, the latest addition to which is Docol HE, a range of hot-rolled AHSS with improved edge ductility and greatly increased local formability, sheared-edge quality and hole-expansion ratios.

“With a finer microstructure and improved edge ductility, Docol HE allows for the forming of components with cut edges to be done without risking micro-cracks, burrs or failure, which can be costly to production,” explains Daniel Sund, product manager, hot rolled at SSAB. Target components include chassis parts, consoles and seats, as well as components in power trains, clutches, couplings and any other part that is stamped with a stretched edge.

Tier suppliers tool up

Among those processing high-strength steels is Clamason Industries, a UK-based specialist in metal pressings, where 50% of business is generated by the automotive sector. The company forms and stamps material typically supplied by companies such as Tata and ArcelorMittal, from 1.0 or 3.0mm-thick coil, up to 400mm wide. The coil is fed into the company’s progression tooling, where it is cut and formed, dropping off the end complete.

Clamason, which employs 290 people across its UK and Slovakia sites, produces parts in quantities of up to 5m a year for automotive tier-one customers. Helping to meet throughput demands is a recent £1m ($1.3m) project investment with Bruderer UK for a new 300-ton Zani Motion Master press.

“The 300-ton Motion Master gives us the ability to achieve over 80 strokes per minute and take on much larger and more complex components,” explains sales director Ian Davies. “We also opted for a turnkey solution that includes a servo feeder and decoiling line.” Importantly, the press is an H-frame design, which is more suited to processing high-strength steels than conventional C-frame concepts. “In addition, Motion Master technology slows the travel speed slightly at the bottom end of the stroke to boost precision and avoid any risk of fracturing the material,” says Davies. “That might mean we process high-strength steel components at a slightly slower rate than conventional parts – at 45 per minute rather than 60 – to ensure they are to the required specification.”

Davies indicates that processing high-strength steels definitely requires a special set of considerations: “For instance, we typically have to make tooling modifications at the feasibility trial stage. Higher specification tooling is needed, as the toughness of the material results in faster wear than would be experienced using conventional steel. Moreover, we normally have to apply a special coating to the cutting areas of the tools.”

Feasibility trials also help the to determine the amount of spring-back compensation that will be required to generate accurate forms. Among the high-strength structural steel parts produced at Clamason are various dashboard and armrest brackets, many of which benefit from these materials to meet crash test performance standards.

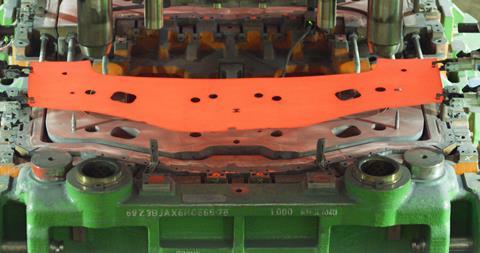

Supply chain manufacturers providing forming services for AHSS materials are likely to be extremely busy in the coming years as more and more vehicle platforms adopt these alloys. The 2019 Honda Acura RDX is a case in point, which thanks to the company’s collaboration with ArcelorMittal, boasts the world’s first UHSS inner-outer door ring. Five different gauges of ArcelorMittal’s Usibor 1500 UHSS combine to form the RDX’s inner door ring, with four gauges used in the outer ring.

Various Usibor steels are blanked at a supply chain company before being shipped to the ArcelorMittal Tailored Blanks facility in Detroit where the enabling technology, called laser ablation, takes place. Once ablated, the steels are welded together, with multiple quality control processes ensuring precision. The blanks are then sent for hot-stamping into the final part required by the automaker.

Elsewhere, the AHSS content in the 2019 Jeep Grand Cherokee has increased, while Ford reports the same with models such as the Explorer and Fiesta, as does GM with its 2019 Chevy Silverado. Volvo and other European automakers also make extensive use of hot-stamped boron steels. In addition, for its 2018 Accent, Hyundai reports that 54.5% of the body is comprised of AHSS – up 13 percentage points from the previous generation model.

With this kind of demand, the AHSS and UHSS family of materials is set to grow as they evolve in line with the varied performance needs of vehicle components. These steel alloys, while improving strength and safety, also provide solutions for fuel efficiency, emissions reduction, durability and quality, all while delivering cost-competitive economics.

Pressed for time

The evolution and growth of AHSS and UHSS has presented specific challenges to press manufacturers. Schuler, for example, developed its ServoDirect Technology to open new perspectives for the cold forming of AHSS, chiefly because the slide kinematics can be adapted to the specific characteristics of the material. Among the latest Schuler servo presses to feature ServoDirect Technology is the MSP 200. With a press force of 2000 kN, this double-rod automatic blanking press offers pre-programmed slide movements.

Likewise, AP&T’s latest servo-hydraulic press is also earmarked as suitable for the forming of AHSS. All the forming operations take place in one step, with reduced spring-back. The entire pressing process is monitored by a closed-loop system, which continuously controls the slide’s movements and quickly corrects any deviations. Not least, the system actively governs the slide’s parallelism in relation to the press table – an integrated function that contributes to both high forming precision and reduced tooling wear.

Like what you’ve read? Then why not become an AMS online member!

As a member you will gain full and unlimited access to our global coverage of automotive manufacturing, including our in-depth coverage of technology, OEMs, regions, suppliers, and materials. Also included are our business intelligence reports and forecasts, and we hope you will also consider joining us at one of our webinars in 2020.

We’ll also keep you up to date with regular newsletters and dedicated member only communications, so you’ll be the first to know about our latest features, reports and webinars.

To gain unlimited access to the exclusive content and features of Automotive Manufacturing Solutions please SIGN-IN or REGISTER FREE today.

No comments yet