Building on the rising value of vehicle exports and components, the Indian government wants 50% of vehicles made in India to be exported by 2030 but there is some way to go before this ambition can be realised.

As part of its plans to boost its automotive industry the Indian government want to increase vehicle and component exports. However, while there are positive signs, its wishes may be stymied by the current disruption to international trade and rules of origin complexity.

In the year to March 2024, vehicle exports totalled 672,000 and accounted for 13.7% of Indian production, down from just under 14.5% in the year to March 2023 but because of changes in volume of domestic demand, export volumes rose to 672,000 units in 2024. These recent volumes are broadly consistent with the pre-COVID level, i.e. 662,000 in 2019.

However, in ratio terms, exports have fallen from 19.3% of production in the year to March 2020 to the c14% level referred to above, reflecting the strength of domestic demand rather than exports. And in the half fiscal year to October 2024 the export ratio was just over 15%, equivalent to volume growth of just over 12% year-on-year. In unit terms, exports between April-October 2024 were just over 438,000, versus nearly 391,000 a year earlier. Although recent export growth is clearly positive, India’s vehicle manufacturers have some way to go before they get back to pre-COVID volumes and will likely remain heavily dependent on domestic demand for some time to come.

“India’s leading policy “think-tank”, NITI Aayog, is bullish about the Indian auto components sector and forecasts it will grow to US$145 billion in revenue by 2030”

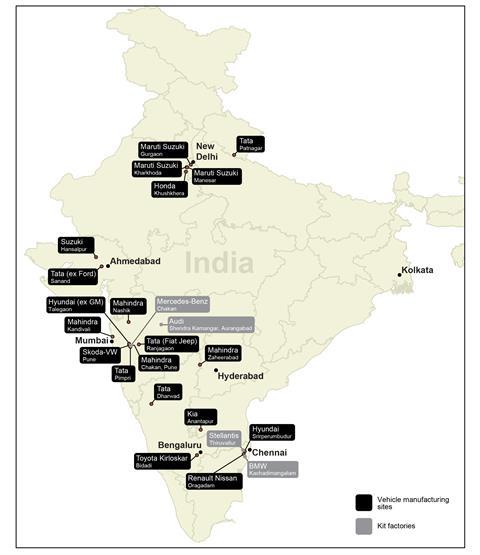

Growing export reach for Indian built vehicles

That said, it should be noted that India exports vehicles to more than 100 countries, including Honda and Suzuki models back to Japan. Traditionally Indian vehicle exports have been concentrated in Africa and Latin America, but exports to the Middle East have grown strongly in recent times, especially to Saudi Arabia and the UAE. Shipments to Australia are also growing, and these will remain important export destinations.

In terms of potential growth in exports, it is worth noting that India has signed a free trade deal with EFTA in Europe, meaning Iceland, Norway and Switzerland could well see a rise in imports, potentially including Indian-made Range Rovers. Tata is investing in JLR production at its site in Panapakkam in Tamil Nadu and had earmarked some of this output for export from 2026. Which models these will be and at what volumes remain to be confirmed. However, it seems unlikely now that these will be EVs as JLR has reportedly (and perhaps surprisingly) found it difficult to source EV components in India at a competitive price.

To date India’s exports have been mostly of B and C segment sedans and compact SUVs. The arrival of Tesla – if it proceeds with investment plans – and the possibility of Tata making Range Rovers for export would significantly change the profile of India’s vehicle production and the value of its exports.

Currently, the biggest vehicle exporter is Maruti Suzuki which had around 42% share of the country’s exports in 2023-2024. Figures for the first half of FY2025 (April to September 2024) show that Maruti Suzuki exported 147,000 units (up 12% year-on-year) and Hyundai exported c85,000 units (down c1%); meanwhile, Volkswagen’s exports rose 74% to 35,000 units, Nissan’s exports rose 64% to 33,000 units and Honda’s rose 229% to nearly 32,000 units – the addition of Elevate exports to Japan was a key factor here.

Back in 2020-21, Maruti-Suzuki had exported around 96,000 vehicles and exports have grown strongly since then. Now the company intends to export as many as 800,000 units per year by 2030-31. This would more than double the potential export volume in the current financial year. It currently exports 17 of the 18 models it makes in India, across Latin America, Africa, the Middle East and South-East Asia. Some exports also go to Europe and Japan, but these are not core export markets. Suzuki’s exports to Japan centre on the Fronx, a B-segment SUV.

The Middle East, Africa and Mexico dominate Indian vehicle exports

In 2019, (pre-COVID) India’s vehicle exports were worth US$7 billion. These fell to US$4.6 billion in 2020. Since then, there has been a steady increase: US$5.5 billion in 2021, US$6.6 billion in 2022, US$6.7 billion in 2023, rising to nearly US$7 billion in 2024.

The biggest export market in value terms in 2024 was Saudi Arabia, with US$1.2 billion, up from US$590m in 2019. The second biggest export destination for Indian-made vehicles was South Africa, worth US$1.13 billion in 2024, up from US$772m in 2019. Mexico was ranked third with US$884m of exports, a decline of around 34% from nearly US$1.35 billion in 2019. Japan was fourth in 2024, with US$684m, having not appeared in the top twenty export destinations before 2023.

The UAE was some way back in fifth, receiving exports of $525m in 2024 up from US$243m in 2019. Chile (US$265m in 2024) was the only other market with more than US$200m of exports. Indonesia (US$145m), Peru (US$140m in 2024, down from US$213m in 2023), Australia (US$121m). Turkey (US$112m) and Tunisia (US$104m) were the other markets with over US$100m worth of vehicle exports. There are no European countries, Turkey aside, in the top 25 destinations for Indian vehicle exports.

India’s automotive trade highlights according to international customs data collated by Trademap.org.

The USA is the largest export market for Indian components

In components, India’s export value totalled just over US$7 bn in 2023. Interestingly in view of current trade disputes and the uncertain global tariff environment, the USA was the biggest recipient of Indian automotive component exports, amounting to cUS$2 billion in 2023. It is worth adding that some of this component export value will be accounted by spare parts rather than OE components; for example, the 16th biggest market for Indian automotive components was the UAE where vehicle production is zero.

The rapidly changing tariff situation in the US could significantly impact on component sourcing for US-made vehicles and Indian exports may yet get caught in the crossfire. In practice it seems likely that Indian component production growth will be reliant on domestic demand and possibly some South-East Asian exports; however, India’s position outside the ASEAN and CPTPP trade groups may also limit export potential to these markets.

Read more on India’s ambitious plans for its automotive industry:

India’s leading policy “think-tank”, NITI Aayog, is bullish about the Indian auto components sector and forecasts it will grow to $145 billion in revenue by 2030, with the export proportion trebling from US$20 billion at present, or just around three per cent of global trade in components (despite India being the fourth highest country in terms of vehicle production) to US$60bn by 2030

In terms of vehicle exports, the Trump tariffs have added a complication for India, although because the US is not a major market for Indian made vehicles (export to the US from India were just US$9m, or less than 0.15% of Indian vehicle export value), it is a major market for JLR of the UK, owned by Tata of India.

Components may be hit, with Indian suppliers such as Samvardhana Motherson, Sona BLW/Comstar (a key supplier to Tesla) and Bharat Forge expected to experience the biggest hit. However, India’s component exports to the US are relatively small compared to Mexico’s cUS$81billion; Indian exports to the US were worth around US$3bn in 2024 which was up from US$2bn in 2023. In the short term these will likely be impacted by the 25% tariff regime, but India and the US had been in negotiation regarding their first Bilateral Trade Agreement before the Trump tariff regime and this may give India a slight advantage over other countries in their current turmoil in world trade.

Some observers think that India may be able to take on some of the component supply currently enjoyed by China if the high tariffs on Chinese goods remain.

Ford to return to India with an export base?

Although Ford stopped vehicle production in India in 2021, with its car factory being sold to Tata, engine production has remained, and this is a substantial operation. Ford engine operations in India employ around 12,000 people in Sanand, and this factory has recently seen investment of US$250m to modernise the engine assembly lines.

Somewhat surprisingly in 2024, Ford announced it planned to re-open its Chennai factory where vehicle production had also stopped in 2021. The return of Ford vehicle production to India would increase employment by as much as 3,000, and the OEM is apparently considering making LCVs and pick-ups in India. If this happens, it is understood that the vehicles produced will initially, be for export markets rather than for local demand. There have also been reports of a manufacturing collaboration with Volkswagen in India, which would be consistent with the two companies shared production operations in Poland, Turkey and South Africa. However, given its tax problems in India, Volkswagen may not wish to further complicate its situation in the country.

However, since the reports that Ford was considering re-opening its factory in India first appeared last year, in February 2025 there were other reports that this plan had been delayed. It is not entirely clear yet whether Ford is merely pausing investment or if political considerations in the US mean that it may need to re-focus its investment and management resources to returning more manufacturing back to the US, from Canada and Mexico especially.

No comments yet