Car plants are popping up across Mexico as OEMs recognise the benefits of manufacturing in the country, but this may put pressure on the labour supply. AMS looks at the latest projects – and potential pitfalls

- FCA's reshuffle continues

- Ford's big investments

- GM pours money into Mexico

- Kia's new factory troubles

- Toyota restarts investment

- Honda sends CR-V to the US

- Audi joins VW in Puebla

- Mercedes moves in with Nissan

- BMW finally comes to Mexico

- VW still growing in Puebla

The significance and scale of these potential threats will become clear in the next few years, and while this is happening, the substantial recent investment in Mexican vehicle production and the attendant supply base will have come to fruition. These investments are embedding Mexico firmly in the top league of global vehicle production. Between 2010 and 2015, vehicle companies invested close to $25 billion in existing and new facilities in the country, and between 2016 and 2019 six new vehicle plants will come on stream: Kia (2016), Audi (2016), Renault-Nissan (2017, but Mercedes models also in 2018), Ford (2018), BMW (2019) and Toyota (2019). Expansion at others, notably Volkswagen, will also take place and Mexico will continue to receive production allocations transferred south from the US and Canada as North American vehicle-makers optimise their production footprints; on occasion, this will see some production – for example, GM pick-up trucks – move north, but this is very much the exception to the rule.

Between 2010 and 2015, OEMs invested almost $25 billion in production facilities in Mexico. Between 2016 and 2019, six new plants will be opened

Low wages have certainly been one serious pull factor, with base wages in Mexico being around one-fifth of those in the US. For vehicles like the Chevrolet Sonic and many other small and compact models made in Mexico, the cost advantage over a US manufacturing location is around $700 per vehicle. But there is more to Mexico than cheap labour.

The country’s free-trade agreements with over 40 nations – more than either the EU or the US – mean that Mexico is an attractive production location for global models, which can be sold in most if not all major markets worldwide. This was one of the key reasons behind Audi’s decision to make the second-generation Q5 SUV in Mexico. Audi can save around $1,100 on import duty in the US on a $45,000 vehicle, while for Europe the saving is around $4,500.

Although the US may soon have similar free-trade agreements in place, reducing Mexico’s advantage in this area, such agreements have yet to be concluded. Since the Audi plant is already in place, and others are on the way, the existence of these factories will sustain the country’s advantage. Having built its new plant, Audi will retain Q5 production there for the foreseeable future, as will BMW at its forthcoming factory for the 3-Series sedan.

Furthermore, domestic vehicle demand is rising and therefore adding to the attraction of Mexico as a production location. In the first five months of this year, car demand rose almost 14% year-on-year to nearly 377,000 units, while light truck demand rose almost 23% to nearly 210,000 over the same period. However, imported car and light vehicle demand rose faster than demand for domestically produced models.

Growing demand brings labour problemsRising vehicle production has brought with it increased demand for skilled labour, and with new investments coming on stream, retaining such personnel has proven challenging; vehicle companies have been unable to avoid paying higher wages. While Mexican component plants can still get away with paying as little as under $1 an hour, car factories are now paying $3 an hour – admittedly minuscule by comparison with wages in Michigan, but literally ‘top dollar’ in Mexico. In addition, skilled and experienced workers can move jobs much more easily than in the past, with improved pay.

Light vehicle production in Mexico is predicted to rise to more than 5m units by 2020 – an increase of 50% over the previous six years

The Mexican government funded Audi's new training centre

The Mexican government funded Audi's new training centreThe Mexican government has recognised this problem and has channelled funds into the public universities and technical collegiate system to produce more engineers at all levels. A $37m, state-funded training facility built on the grounds of Audi’s new plant symbolises this government commitment. The car companies are also opening their own training facilities. For example, BMW is training its own machinists, electricians and other skilled trades from scratch, such have been the problems it has faced with recruiting skilled labour near to its upcoming plant at San Luis Potosí. With a Ford plant also planned for this area, the problem will only intensify.

The investments discussed in this review – and elsewhere in AMS' special Mexico 2016 edition – will likely result in more than 30,000 jobs being created over the coming years. A recent report in The Wall Street Journal looked at both existing plants that are being expanded and new plants soon to come on stream (for which recruitment has started but has not necessarily been completed) and calculated that future job creation by carmakers in Mexico may be as follows: Audi: 4,200; BMW: 1,500; Daimler-Renault-Nissan: 5,700; Ford: 6,600; GM: 5,600; Kia: 3,000; Toyota: 2,000; Volkswagen: 2,000. These recruits, plus the existing workforces, will help to raise light vehicle production to over 5m units by 2020 – an increase of 50% over the 3.4m in 2014, which was itself a record.

Despite the recent investment rush, there are some potential complications. Ford’s announcement of expansion in Mexico, summarised below and detailed here, caused a political storm and has been opposed not only by the United Automobile Workers and the (failed) Democrat presidential candidate Bernie Sanders, but by the official Republican candidate, Donald Trump. While Ford and other vehicle companies have been moving to Mexico for many years, and plan to continue to do so, the possible installation of Trump in the White House could cause significant disruption to the industry. It may seem unlikely, but a Trump presidency could see an end to, or the gradual erosion of, the free-trade deal with Mexico, the implications of which would need to be addressed in the near future.

FCA’s reshuffle continuesFiat Chrysler Automobiles is in the midst of a seemingly never-ending process of realigning its production geography and Mexico is very much part of this change. For example, the Fiat 500 is currently made in Mexico (as well as in Poland, its home production location), for export to Brazil and China, but Mexico is expected to lose the next 500 to Poland, which will become the sole source globally. In addition, the Dodge Journey and its sister vehicle, the Fiat Freemont, are expected to move from Mexico to an Italian factory. The reason for this is that FCA needs capacity at Toluca, where the 500 is currently produced, to make other models, including the Jeep Compass and Patriot, which are expected to move there from Belvidere in Illinois. US factories will instead concentrate on larger Jeeps and Ram pick-ups, which are more profitable.

Ford invests in vehicles, engines and transmissionsThe OEM announced a new vehicle plant for Mexico in April this year, causing dismay in the US. The factory in San Luis Potosí will cost $1.6 billion and have capacity for around 350,000 units per year, possibly more. Ford has said only that it will make small cars there, but the most likely contenders are replacements for the Ford Focus car and C-Max compact MPV, which are currently produced at Wayne, Michigan. The OEM is also spending $2.5 billion on new engine and transmission facilities in Chihuahua and Guanajuato; the new development at Irapuato will be its first gearbox plant in Mexico, making transmissions for Ford plants worldwide.

GM pours more money into MexicoGeneral Motors is in the midst of a $5 billion investment programme across all its Mexican plants. Some of this money helped to facilitate a highly symbolic development, namely the importation of one of its smaller vehicles from Mexico to the US; the Chevrolet Cruze (similar to the Astra in Europe) is one of the most successful vehicles in the US at present and the Lordstown plant in Ohio cannot meet demand, despite running on three shifts. Owing to spare capacity at GM’s plant at Ramos Arizpe, Coahuila, which has focused on trucks until now, Cruze production will be added there to help meet demand.

In contrast with moves elsewhere in the industry, GM is also transferring some truck production back from Mexico to the US. Light-duty versions of the Chevrolet Silverado will be added to the line-up at Flint, Michigan, alongside heavy-duty versions of the Silverado and its sister vehicle, the GMC Sierra. While GM’s US unions are understandably happy about this development, its Canadian workers fear that the company wants to close the Oshawa plant in Ontario and move production to Mexico. Oshawa currently makes vehicles such as the Buick Regal and Chevrolet Impala – very much models which could be more profitably made in Mexico.

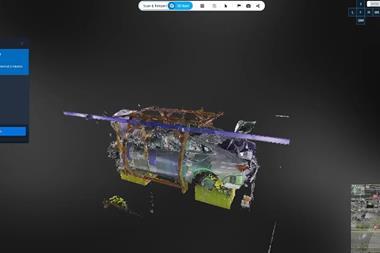

Kia's new plant opened after just 13 months of construction

Kia's new plant opened after just 13 months of constructionKia’s new factory runs into troubleIn November last year, the Korean carmaker announced the completion of its first Latin American factory in a remarkably quick 13 months. It is a full manufacturing complex on a vast site at Pesquería in the north-eastern state of Nuevo León which, at 5m sq.m, moves Kia toward the top of the league table in terms of size. The $1 billion factory itself covers 273,000 sq.m and will be able to produce up to 400,000 compact cars per year, starting with the Forte – accounting for 10% of Kia’s global manufacturing output.

However, a new state government has been causing problems by attempting to renegotiate the incentives package which brought the OEM to the area in the first place. The rate of infrastructure development has slowed and Kia has needed to clear extra storage space outside its factory while cars wait to be taken by truck to the nearest main station, in the absence of a rail spur. The plant is currently producing 600 vehicles per day but will eventually ramp up to 1,000 per day, so Kia will want this issue resolved as soon as possible – especially as 60% of the output is destined for the US and Canada.

Toyota restarts investment in North AmericaIn 2019, Toyota will open a new plant in Mexico, its first major investment in North America for many years. The factory in Guanajuato will make the new Corolla, based on the new Toyota New Global Architecture (TNGA) which is being deployed across the OEM’s plants worldwide. The plant will operate new ways of working with suppliers as well as a radically different manufacturing system. A key feature is expected to be much shorter production lines, implying that suppliers will be required to deliver larger assemblies and modules than for existing models.

Honda sends production to the USThe OEM’s plant at El Salto, Jalisco, currently makes the CR-V SUV, but production of this model is moving to the plant in Indiana (which will become the third North American plant producing the CR-V, the others being in Ohio and Canada). El Salto will produce the small H-RV SUV instead, becoming the second Honda de México plant to make this model after the newer factory at Celaya, Guanajuato.

Audi joins Volkswagen in PueblaAt the time of writing, the premium vehicle-maker was set to officially launch its first factory in North America, at San José Chiapa, Puebla. The $1 billion plant will make up to 150,000 Q5 SUVs for all markets except China. Audi has recruited 180 suppliers for the project and production is launching with 65% local content, but some components will be imported, notably a large proportion of the engine from Gyor, Hungary. The new Audi plant will benefit from the well-established presence of Volkswagen in the state, including its supplier network.

Mercedes moves into Nissan AguascalientesIn September 2015, parent company Daimler and the Renault-Nissan Alliance broke ground on a $1 billion joint-venture factory at Nissan’s complex in north-central Mexico. The Cooperation Manufacturing Plant Aguascalientes (COMPAS) will build next-generation premium compact vehicles, beginning with Infiniti vehicles in 2017 and Mercedes A- and B-Class models in 2018. The factory will launch with an annual capacity of over 230,000 units.

BMW will finally join other premium brands in Mexico when it opens its new factory at San Luis Potosi in 2019

BMW will finally join other premium brands in Mexico when it opens its new factory at San Luis Potosi in 2019BMW finally comes to MexicoThis OEM will be the last of the German premium brands to establish a plant in Mexico when, in 2019, it opens a facility in San Luis Potosí with capacity for 150,000 units per annum. The plant will produce the 3-Series sedan, mainly for the North American Free Trade Agreement (NAFTA) area but also for exports. In fact, it will take over 3-Series sedan production from BMW Rosslyn in South Africa, which will instead produce the X3 SUV and therefore free up capacity for the manufacture of bigger, more expensive SUVs at Spartanburg in South Carolina.

Some of the markets served currently by the South African plant will instead be supplied from San Luis Potosí, which will be a full manufacturing facility, with body, paint and assembly capabilities. Around $1 billion will be invested and the plant is set to reach new environmental standards for BMW. For example, the paintshop will be the first in the BMW group to produce no wastewater, with all water for the paint process being continuously cleaned and recycled.

VW continues to grow in PueblaMexico has long been the centre of NAFTA production for Volkswagen’s Golf and Jetta models, as well as the worldwide supply point for the new-generation Beetle. Change is occurring here too, with MQB (Modular Transverse Matrix) platform technology being installed at the 51-year-old Puebla plant. This will facilitate the production of the Tiguan for all markets worldwide except China. The current model is made at VW’s home plant in Wolfsburg, Germany, but such is the demand for the Tiguan in North America that production in Mexico – as with the Audi Q5 – will be more cost-effective. The new Tiguan range will include a long-wheelbase (three-row, seven-seat) version which will not be sold in Europe.

It has been reported that the Mexican plant could also make electric vehicles, although details of which models have not been released. However, it has been confirmed that the new Audi plant in Mexico will make electric versions of the Q5 as well as conventionally powered vehicles.

While Mexico is clearly an attractive location in which to make vehicles for the North American market, it is still possible to import vehicles into the country from even cheaper locations. For example, VW is now bringing the Polo into Mexico from Russia. Volumes are currently limited to 10,000 a year but are a sign that the globalisation of vehicle manufacture still has plenty of twists and turns, even today.