Hyundai has recently updated 80% of the production line at its Turkish plant. AMS went to admire the automation

Europe is overburdened with automotive factory capacity to the extent that over half of the region’s 160 car plants are running below 70% productivity, according to Q1 figures from analysts IHS Automotive. Car-makers are doing all they can to reduce this huge drain on resources in western Europe, but IHS notes that in the wider region capacity has remained largely the same for the last ten years. Why? Because of factory expansion in eastern Europe and Turkey.

Turkey is a growing hub for car production, making just over half a million units in 2012 to put it ahead of Poland. Combined with Europe’s largest commercial vehicle production, this pushed the country’s total vehicle figure to over 1 million for the year. Much of the LCV production is from Ford’s site in Kocaeli, which makes the Transit and Transit Custom vans for European sales.

Even with this level of competition, the head of Hyundai’s Izmit factory, Uygur Kosal, confidently told AMS that upgrades have made his facility the most efficient and hightech in the whole of Turkey. The Korean manufacturer has updated 80% of the production line to increase capacity from 125,000 to 200,000 units. Unlike most other carmakers in Europe, the company has real need for this expansion. From the establishment of the factory in 2007 up to last year, Hyundai’s sales have risen in Europe by just over 50% to 414,827 cars. Between Izmit and the plant in Nosovice, Czech Republic, the company has a combined capacity of half a million cars and reckons it will supply 90% of its European demand from these two plants by 2014.

AMS visited Hyundai’s immaculately presented 687,214 sq. m site, 120km east of Istanbul, as part of celebrations for the completion of a €475 million expansion. This comes before the start of production in September of the all-new version of the i10 city car, which will be made in Europe for the first time after relocating from Hyundai’s Chennai plant in India. Currently, the plant builds the i20 supermini mainly for the European market and this is the first car to benefit from the highly automated new production line.

AMS’ first sight of the factory was the new 10,200 sq. m press shop. Star of the show here is a four-in-one tandem press made by Hyundai Rotem which has a combined 5,100- tonne capability, divided into presses of 2,300 tonnes, 1,000 tonnes, 1,000 tonnes and 500 tonnes. This automated giant is fully enclosed and has viewing windows for overseers. It is faster than the previous system, increasing panel output from 360 per hour to 410. It spits out its body panels into the waiting hands of the few workers in this section, who lift them onto waiting dollies.

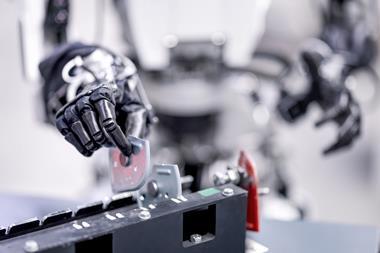

Next up is the 19,775 sq. m bodyshop, which has undergone some of the biggest internal changes. Previously, the level of automation here was around 45%, but now the 142 robots do everything on the 490 metre line. Finished bodies can now be produced at a rate of 36 per hour, up from 23 – all put together using resistance spot welding. The triple-deck main buck is a sight to behold, with three layers of robots able to handle up to four different models. It is similar to the one first seen at the company’s Czech plant back in 2008 (also with a fully automated bodyshop) and suggests that Hyundai is preparing for a time when more models are needed. The company has said previously that Izmit will specialise in small cars, so an obvious candidate would be the expected, but unconfirmed, ix20 supermini SUV.

Increased automation, but still a place for people

Factory boss Kosal told us that bodyshop staff who were no longer needed were found new jobs within production, although the increased automation means that growth in jobs within the plant will be relatively small, with 70-80 planned in the near future. Currently, the factory has 1,656 employees, of which 1,262 are on the factory floor. Just 35 are Korean.

Factory boss Kosal told us that bodyshop staff who were no longer needed were found new jobs within production, although the increased automation means that growth in jobs within the plant will be relatively small, with 70-80 planned in the near future. Currently, the factory has 1,656 employees, of which 1,262 are on the factory floor. Just 35 are Korean.

Kosal told us that 600 more personnel will be taken on when the plant moves from two shifts to three as the replacement i20 goes into production toward the end of next year, with the extra demand coming from right-hand drive production for the UK for the first time; those cars are currently built in India. Taking into account the expanded supplier base near the factory, the company reckons the number employed will rise to around 2,800.

Automation has also increased in the 24,200 sq. m paintshop, but only to 23% compared with 19% before. A total of 23 robots work along the 1,050 metre line, applying the water-based paints.AMS did not get to view this facility, but we were told that capacity has increased by the same amount as the bodyshop, up to 36 cars per hour.

Capacity: 200,000 units/year

Timeline

1997: Production started at Izmit, Hyundai’s first factory outside Korea

The first car produced was the Accent

2002: First exports start with the Verna to Saudi Arabia

2007: Capacity increased to 100,000

Matrix mini MPV production starts

2008: Hyundai’s second European factory, in Nosovice, Czech Republic,

starts production

2009: 500,000 vehicles produced

2010: Hyundai i20 supermini production starts

2013: Capacity expanded to 200,000 ahead of production of new i10 city car in September

In the 28,000 sq. m assembly shop, 450 workers are employed at 101 stations: 28 trim stations, 19 for chassis and 32 final stations. The doors are removed early on and sent to their own station to be trimmed, giving easier access to workers fitting inside the car. Parts are delivered to stations on a just-in-time (JIT) basis by Hyundai’s own logistics company, Glovis, while seats arrive via their own special door in the building from supplier Assan Hanil, a local joint venture company between Korean firm Hanil and Kibar Holding, the same Turkish firm that has a 30% stake in Hyundai’s Turkish plant.

Keeping suppliers close to home

In the Izmit plant, Hyundai is keeping up the Korean tradition of encouraging homegrown suppliers, either owned by the company or not, to support operations abroad. Hyundai electronics company Mobis is one such example, announcing last year that it would build a longdelayed module factory nearby.

In total, 30 suppliers work with the plant. Around 50% of parts by value come from within Turkey, but the plant is looking to increase this figure. One of the biggest omissions by value are the engines, which are only assembled here. Kosal said the full production of engines and transmissions are high on his wish list.

Energy consumption is carefully managed on site with a system to monitor all electricity, water and gas consumption on the lines. It monitors hourly and daily usage, with warnings flashed up on screens when limits are exceeded, as well as delivering a monthly and weekly report for each line’s energy usage and savings. Heating and light are also automated.

There is no railhead at the factory, but the Mediterranean is very close by and completed cars are taken by lorry to a port just ten miles away to complete their journey to the rest of Europe by ship.

According to Kosal, once the Izmit plant hits 200,000 units, the order will be given to raise capacity to 300,000 – the same as at the Nosovice plant in the Czech Republic. This is likely to happen, because, according to analyst Carol Thomas from LMC Automotive, Hyundai is underestimating demand for the significantly upgraded i10. Kosal did not go into detail about how this further capacity increase will be carried out, but he did say there was plenty of land near the factory for expansion.

The company is certainly well versed now in how to expand a factory; Kosal proudly told us that production stopped for just three weeks during the refit at Izmit. If Hyundai continues on its upward trajectory, downtime is definitely something it needs to avoid.