Valmet Automotive is experiencing rapid growth with a new Daimler contract to build its GLC SUV, partnership with a leading Chinese battery supplier and engineering acquisitions in Europe

It might have been a chilly -12°C outside the Uusikaupunki plant on the day of our visit, but things are certainly heating up for the Finnish contract manufacturer. The company has recently added a new, highly automated bodyshop for production of the Mercedes GLC; this is in addition to an existing line building Daimler’s A-Class model. We spoke to Jyrki Nurmi, senior vice-president, engineering services, about the company’s approach to setting up a new production line.

It might have been a chilly -12°C outside the Uusikaupunki plant on the day of our visit, but things are certainly heating up for the Finnish contract manufacturer. The company has recently added a new, highly automated bodyshop for production of the Mercedes GLC; this is in addition to an existing line building Daimler’s A-Class model. We spoke to Jyrki Nurmi, senior vice-president, engineering services, about the company’s approach to setting up a new production line.

Can you offer an overview of the GLC project?Perhaps I can explain how the processes and responsibilities for this project work. Daimler is the customer and they are involved in the project but we are in the driver’s seat [regarding production]. So [the manufacturing processes] for both A-Class and GLC production are developed by Valmet Automotive. Daimler gives us strict specifications regarding the quality of the car, and we must fulfil these specifications. However, we do not copy Daimler’s [production] processes... we develop our own concepts and work forward from these. The project has gone well and we have been able to reach every milestone so far.

How does the GLC bodyshop differ from the A-Class facility?The GLC is a much more complex vehicle to build, so we have introduced new technologies into this bodyshop. The vehicle uses both steel and aluminium in its structure so we couldn’t just use the traditional spot-welding process. We have introduced new [self-piercing] riveting processes and we a have a nailing process for the cast aluminium [suspension] towers, and [flow-drill] screw fixing. So we have added three new joining processes for the GLC. We ran some tests before we started production, so we were well prepared. There are more robots in the GLC bodyshop and I think we are at a 98% overall automation level here. There are a very small number of manual operations on certain sub-assemblies and loading parts into magazines for the robots to weld, but spot welding is 100% automated and gluing is about 95%.

Has Valmet always been keen to embrace automation?We take a flexible approach to this and it depends on the customer’s requirements. For example, we have start-up companies as customers and they may have different approaches or budget limitations that must be considered when setting up the production system. VA [Valmet Automotive] has developed a highly flexible manufacturing system that enables high or low levels of automation and manual operations, according to the customer needs and possibilities. We introduced robots here [at Uusikaupunki] in the early 1980s and we have grown step-by-step since then. If you look at our assembly line, the operations are almost entirely manual. Flexibility is very important as the line has to produce more than one product. Today, it is assembling the A-Class and GLC, but in the past the same line has produced vehicles for Saab and Porsche.

The new bodyshop for the GLC is very sophisticated. Is it flexible enough to build other models in the future?That bodyshop is designed to able to build other variants for that [X253] platform, however, it’s always difficult to add a completely different vehicle and we would need to make some modifications to build another platform. We always focus the investment on the customer project rather than possible future operations.

How challenging has it been to recruit the number of skilled staff you have needed for the current level of expansion?So far it has been relatively easy, but we will see how successful overall we have been at the end of this year. In terms of assembly and other production staff, we have been very successful; in the first stage we recruited 250 people from 2,500 applicants. Of course, here in Finland there isn’t a lot of automotive manufacturing, but if people have the right mindset then they can learn quickly.

Have you diverted any of the people from the A-Class operation to the GLC project?Yes, this is what we normally do. When we start a project we always use some of our key team leaders to launch the new project; they provide advice and experience to the new engineers. This has been one of the keys to our ability to get new projects up and running very quickly.

"Daimler gives us strict specifications regarding the quality of the car, and we must fulfil these specifications. However, we do not copy Daimler’s [production] processes... we develop our own concepts and work forward from these" - Jyrki Nurmi, Valmet Automotive

It has been stated that the GLC project has been the most challenging in VA’s history. Why is that?The schedule for the GLC project was very tight. In fact, it was the same as that for the A-Class – and the customer said this was a ‘world record’ – but the GLC is a much more complex vehicle to build. In the A-Class bodyshop we had 200 robots but in the new GLC bodyshop we now have over 300 robots and it’s a much more sophisticated build process. We had very good cooperation with Daimler; the teamwork was excellent. There were a small number of people from Daimler onsite and this allowed us to consult quickly on any issues, but we were still driving the project. Another big challenge was the integration of new technologies; we had to quickly learn how to apply these and find the right people to operate the new systems. Daimler cars are all high quality but the GLC is a premium quality vehicle, so ensuring we met the high quality standards and a tight production schedule was another serious challenge.

[sam_ad id=17 codes='true']

Do you find that VA’s strong engineering competence always meets or exceeds that required by your customers?I would say yes – as long as the customers’ request is within reason. We have certainly benefitted from working with a number of different, premium-quality customers. We came to understand that if we simply copied the OEMs’ [operations] it would be too expensive for us, so we had to be leaner, develop simpler solutions. So, for example, we developed our own concepts for production operations that suited both our customers’ requirements and the volumes being produced. There were turnkey system suppliers available to us, but they were more used to working with OEMs on manufacturing systems capable of producing 100,000-plus vehicles per year. It was much harder for them to develop something for the lower volumes we were producing at that time. So this is how we developed our own cost-effective operations and competences. If you look at our GLC bodyshop, it’s very compact – no wasted space, very lean, with automated transfer of the underbodies.

You have some experience building electric vehicles and you currently producing some hybrid versions of the GLC. Are you planning to target this segment in the future?Definitely, this is currently a growing market. We built the plug-in hybrid for Fisker Karma and the Think City electric car, so we certainly have the capability. Also, we will be offering development-engineering services for drivetrains and batteries.

In production

Manufacturing facilities at Valmet Automotive’s Uusikaupunki plant are divided into four main areas: a bodyshop each for the A-Class and the GLC, a paintshop and an assembly line. There are also parts warehouses, but some of these have been restructured to make space for the new GLC bodyshop. The company has been building the A-Class for Daimler since 2013, with the aim to produce 100,000 units between 2013 and 2016. As production of the GLC ramps up, volumes of the A-Class will be steadily reduced.

Many of the lessons learned in production of the A-Class have been further developed for the manufacture of the GLC SUV

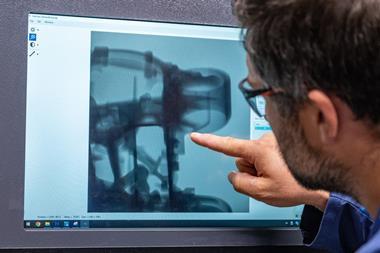

Many of the lessons learned in production of the A-Class have been further developed for the manufacture of the GLC SUVThere are over 200 ABB robots in the A-Class bodyshop, which operates at around a 90% automation level. This area currently has 150 people working two shifts. Communications manager Mikael Mäki notes that this is the second-largest robot welding shop in Finland, the biggest being the new GLC bodyshop. The only manual operations are loading parts into the robot welding cells, and a small amount of sub-assembly welding and adhesive application. Quality checks on the bodies are also automated with four robots, fitted with Perceptron vision systems, performing a series of checks on the line. If a BIW fails the initial check, the system will measure it again before it is removed from the line for a more detailed inspection.

Each of the bodyshops has a single, dedicated line. Mäki explains that the entire focus and design of these lines is to produce one type of vehicle; this is an area that illustrates the difference in approach between OEM and contract manufacturer, with the need for flexibility in the model mix being less important than producing a single vehicle model of high quality, on schedule.

The A-Class BIW features some aluminium sections that require riveting and adhesive joining techniques. In addition, there are fully automated rolling and hemming stations for doors, hoods and tailgates. All the body panels and vehicle components (for both A-Class and GLC) are sourced from the same suppliers used by Daimler and shipped to Finland. This not only helps simplify the logistics operation but ensures a consistency in quality. Mäki explains that this is important as VA does not replicate the German manufacturing operations, so it ensures consistent high quality in the finished product.

Compact and cost-effective bodyshop

The GLC bodyshop features the very latest in automation systems. Mäki notes that much of the experience gained in setting up and operating the A-Class bodyshop was used for the new GLC shop. Furthermore, both bodyshops were designed entirely by VA and not copied from the Daimler plants producing the same models. In terms of building the vehicle, everything about the GLC is much more complex than the A-Class; the GLC features a larger proportion of aluminium in its structure and a close look at a finished BIW reveals the multiple use of different steel grades and aluminium to make this vehicle both strong and lightweight. It is also easy to see where the different joining methods (weld, rivet, screw and glue) are applied.

The GLC bodyshop at Valmet Automotive is very compact, designed to maximise efficiency and cost-effectiveness

The GLC bodyshop at Valmet Automotive is very compact, designed to maximise efficiency and cost-effectivenessTo build this model in high volumes has required the application of complex processes and, as such, a very sophisticated new bodyshop. Here, the automation level is at 98% with over 300 ABB robots installed. Some of these are able to perform multiple operations at a single station by changing tooling. As with the A-Class operation, the GLC bodyshop is very compact, designed to maximise efficiency and cost-effectiveness. The automation story continues in the paintshop. All painting operations are fully automated with Dürr robots applying paint and manipulating the doors, bonnet and tailgate.

Sealing operations are almost entirely automated, again with robots intricately applying the sealant; the manual part of this operation represents the very low-tech end of the spectrum with sealant being applied by hand in the few areas that the robots cannot reach. General assembly features a single production line in an S configuration producing A-Class, GLC and hybrid variants. There are at present 100 workstations but this is likely to increase as volume and the number of variants grows.

There is a large sub-assembly area to the side of the main line where the powertrains, suspension and braking systems are assembled on jigs carried by automated guided vehicles, ready to be ‘married’ to the body assemblies. Operations are largely manual but one visually distinctive feature is the tooling. Much of it is painted green, showing that it has been designed and developed in-house by VA for specific vehicle projects; further evidence of the company’s ability to engineer its own manufacturing solutions.

Recent acquisitions and partnerships offer an intriguing glimpse of Valmet Automotive’s (VA) future strategy. Nick Holt spoke to CEO Ilpo Korhonen to get a fuller picture.

Tell us about the engineering resources VA will gain through the recent Semcon deal, and how will these enhance your operations?We have been looking for suitable acquisitions in recent years as part of our strategy to develop our engineering and product development competence. This resulted in the deal with Semcon, who were willing to divest their operations in Germany. Our vision is to become a complete vehicle engineering service provider and Semcon is providing a good basis for us. They have locations at Volkswagen, BMW and Audi, so they cover major German brands.

You now also have a partnership with the Chinese battery manufacturer CATL. Is this part of the same strategy and are you looking to develop your electric vehicle (EV) competence?Basically yes, it is part of an ongoing strategy. Working with CATL and Semcon will speed up development of our engineering capability for the battery, EV and drivetrain business. CATL are experts in [battery] cell technology and have a strong Chinese business platform, whereas we have a strong presence in Europe and have the interface with the German OEMs. We also have the experience of [series] vehicle production; this is a very complementary set of competences and is a good foundation to grow our capabilities and business, especially for the EV market.

VA has been largely focused on European carmakers. Is there a longer-term strategy for a more global approach?There are certainly opportunities for the future, but in the short term our focus remains on the European OEMs. We have discussed global operations with CATL and in the longer term would certainly consider opportunities in China, the US and beyond.

The appointment of Dr Hackenburg from Audi last year and the partnership with RLE indicate that EVs will be a strong focus for VA. How important is this market in your future plans?It’s as important to us as it is to the OEMs. We are in the process of scaling up our EV capabilities so we are ready for this opportunity. We strongly believe the EV business will be very important to us beyond 2020. Also, there are opportunities for us in EV beyond passenger cars and the established OEMs. There are a number new companies developing mobility projects for autonomous buses, delivery and utility vehicles, which we could offer our services to.

Do you see the company offering a complete design, development and production service to the electric vehicle market?Not right now, but in the next few years we would like to be in a position to offer this type of service.

Will VA’s growth lead to further development in the production of components and vehicle systems, leveraging and expanding the existing R&D and production operations in Germany and Poland?Yes, definitely. For example, our production operation in Poland could potentially provide a manufacturing base for batteries. The market for convertible roof systems is stable but not really growing, so we need to explore other component [manufacturing] options. One of those options could be EV drivetrain components.

Given the level of competition in the contract manufacturing market, what makes VA different to its competitors?We have a strong base in car manufacturing and customer satisfaction has been key to our success. We demonstrated strong project management capabilities, to develop production operations in a very short time frame and in a cost-efficient way. This has required a certain degree of ‘process agility’ from us as we provide additional [production] capacity. So we have developed particular core competences where we are able to establish processes to adjust production volumes in a cost-efficient way. As you say it is a very competitive environment, so what was enough [in terms of capabilities] a few years ago, now isn’t sufficient with digitalisation and the electrification of drivetrains, so we have to invest and work hard to develop our capabilities to meet the customers’ requirements in the future.