Taking examples from across the world of automotive tier supply, AMS looks at the seven key considerations from supply base consolidation, vertical integration and outsourcing to the changes that the move to electric, autonomous and connected vehicles might mean for the supplier industry

1. Supply base consolidationWhile car companies make most of their own body panels, engines and transmissions, they tend to outsource most other components. Moreover, vehicle companies like to deal with a limited number of large suppliers who are perceived to be financially secure and strong. Transmissions are a good example: there are four principal suppliers for transmissions on the open market, Aisin and Jatco of Japan, ZF of Germany, and Magna-Getrag, all of which operate worldwide. Although Hyundai-WIA has a proportion of the Hyundai-Kia business and Univance has business with Japanese vehicle-makers in Japan and North America, the market for transmissions made outside the car companies themselves is concentrated in these four major companies.

1. Supply base consolidationWhile car companies make most of their own body panels, engines and transmissions, they tend to outsource most other components. Moreover, vehicle companies like to deal with a limited number of large suppliers who are perceived to be financially secure and strong. Transmissions are a good example: there are four principal suppliers for transmissions on the open market, Aisin and Jatco of Japan, ZF of Germany, and Magna-Getrag, all of which operate worldwide. Although Hyundai-WIA has a proportion of the Hyundai-Kia business and Univance has business with Japanese vehicle-makers in Japan and North America, the market for transmissions made outside the car companies themselves is concentrated in these four major companies.

In seats, when looked at globally, supply is dominated by Adient (formerly Johnson Controls/JCI), Lear, Faurecia, Magna, Toyota Boshoku, Tachi-S and TS Tech; however, Magna has a limited presence outside North America, while the Japanese suppliers are, unsurprisingly, much stronger in Japan than elsewhere. One of the interesting aspects of seating is that, in Europe at least, a strong in-house activity has been retained by BMW, Mercedes and VW which still make around one third or more of their own seats.

Another highly concentrated market at the tier one level is turbochargers; here Honeywell and BorgWarner have dominated the market for many years in both Europe and North America. Mitsubishi Heavy Industries and IHI of Japan have similarly led in Asian markets, and both the Japanese companies now have growing positions in Europe and North America. Interestingly, the turbocharger market has recently seen two new entrants, namely Bosch-Mahle and Continental, who have arrived in response to entreaties from vehicle companies; Ford and VW, especially, did not want to become too dependent on a limited supply base in a rapidly growing market.

Other markets with highly consolidated tier one structures are lighting, where Automotive Lighting (Magneti Marelli), Hella, Valeo, Koito and Stanley have more than 80% of the global market, and airbags, where Autoliv, ZF-TRW and the troubled Takata have the vast majority of the world market. As noted below they also have complex supply chains, involving a mix of in-house and outsourced supply of components.

2. Vertical integration and outsourcingSeating production, which has a very strong degree of concentration, is also notable for a high degree of vertical integration. Seat companies tend to make most of their frames, mechanisms and foam themselves; this has increased in recent years and the independent supply base for seat components has lost share. JCI, before it spun its seat business off as Adient, had acquired Keiper and Hammerstein, suppliers of frames and mechanisms respectively; it had also acquired seat fabric supplier Michel Thierry to give it control over this area of the seat supply chain.

Meanwhile Lear, which had largely eschewed production of seat foam in Europe, has recently started foam production in the UK to supply its own seat assembly operations and control an important aspect of its cost chain. Mirroring JCI’s acquisition of Michel Thierry, Lear has acquired seat leather supplier Eagle Ottawa to gain stability in this area of the business. However, some seat components remain outsourced: for example motors (from Valeo and Asian suppliers), heaters/coolers (from Kongsberg and Gentherm among others), airbags and simple plastic trim around the base of the front seat especially. Headrests are supplied by a mixture of independent suppliers and by the seat companies themselves.

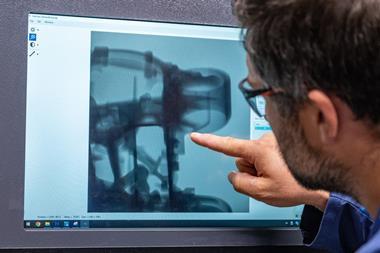

Turbochargers – another very concentrated market at the tier one level – also have an interesting mix of in-sourced and outsourced parts. Blades and vanes, for example, are made by the tier one turbocharger suppliers, but housings, casings and similar parts tend to be supplied by specialist casting and machining companies; interestingly, as the pressure on margins has increased, some German and French casting companies have forward integrated into machining to take control of this part of the manufacturing process and value chain.

In airbags, the yarn is made and fabric woven by specialist suppliers; the fabric then moves to specialist coaters, before being sent to cut-and-sew operations, some of which are independent and some of which are parts of the main airbag companies. The airbags themselves are then sent for final assembly with electronics and inflators (some made by the airbag companies and some by third parties) – and in both of these areas there is a complex arrangement of cross-supply, particularly of inflators. Both before and especially since the Takata inflator airbag scandal, TRW and Autoliv had always supplied some inflators to each other and Takata (under the direction of the vehicle companies), while Daicel also supplied inflators to all the airbag assemblers, but did not make airbags itself.

3. Global or local operationsCar companies have long operated global sourcing programmes, looking for the most economic supply point worldwide. Looked at from the supplier’s point of view, this leads to an interesting variety of location strategies, especially when OEMs choose to make the same vehicle in more than one location. This has led to suppliers setting up what are effectively mirror production locations across the world.

"Autonomous and connected cars require substantial processing power, sophisticated sensors, mapping technology, new security features and substantial skills in algorithm development. Each bring new names to the sector and highlights the dynamic nature of this market."

For example, Kongsberg, which makes seat heating systems, has recently opened new factories in Mexico and Poland to supply a German vehicle company’s needs worldwide over a 12-year contract. This involves supplying standard components across the car company’s range, rather than delivering onto just a single model. A similar deal has seen Tristone Flowtech supply engine and battery cooling systems from factories in China, Mexico and Poland. In turbochargers, Continental is setting up common production systems in Europe, North America and China to supply its new RAAX turbochargers to VW operations in all three regions.

From a global perspective, another development has been the expansion of Indian companies beyond their home market; this has been largely by acquisition. For example, Motherson Sumi has acquired Visiocorp (mirrors), Scherer & Trier (interiors) and Peguform (bumpers); Varroc has bought Visteon’s lights business; while Amtek has bought a number of casting and forging companies in Germany, notably Rege, Tekfor and Zelter.

4. The changing geography of component productionThe expansion of vehicle companies into new production locations has led to a corresponding change in their suppliers’ manufacturing footprints. This is especially evident in eastern Europe and Mexico, where global vehicle companies have expanded significantly in recent times.

BMW’s decision to open a plant in Mexico is an interesting case. This involves much more than BMW simply telling suppliers to follow it to Mexico. The carmaker, moreover, is not committing to using the same suppliers for Mexican production as it uses in the US; for example, it will source painted bumpers and other plastic parts from Chinese company, Minghua, which is building a new $100m plant in Mexico to supply BMW.

The German carmaker is also changing how it works with suppliers and the balance of work carried out by suppliers and its own workers is also changing.

Several recent investments in Mexico have been with other vehicle contracts in mind, but place these suppliers in an excellent position for BMW deals. For example, Austrian lighting company ZKW has opened a headlamp plant in Silao, which will employ 320 and make up to 700,000 headlights a year by 2019 (far more than BMW alone will need). ZKW’s winning of this contract also shows how BMW does not want to remain overly dependent on a small number of major suppliers of lighting.

Meanwhile Edscha (a German company which is part of Gestamp of Spain) is also opening a plant at San Luis Potosi, near to BMW, to make hinges and powered sub-systems for opening rear lift gates.

It is worth noting that it is not just labour-intensive work which is growing in Mexico, to take advantage of Mexico’s much lower labour costs than those of the US. High-tech, high-value-added components and materials are also witnessing strong growth in Mexico: for example, PPG is expanding its coatings business, while Bosch is adding ABS and ESP production at its Mexican plants, while adding an R&D facility as well.

In many cases the arrival of suppliers in a country follows the arrival of their principal customers in that location. For example Kia’s decision to open a plant in Mexico has led to Hanwha, a long established supplier in Korea, also opening a Mexican plant to make bumpers. In Europe, numerous Korean companies have opened plants in and around the Hyundai and Kia factories in the Czech Republic and Slovakia. These include Hyundai-Mobis (interiors, front-end and chassis models), Dymos (seats) and Sungwoo Hitech (metal stampings). Kia, meanwhile, has brought over Dong Hee for fuel tanks, Hanil E-Hwa (interior trim) and Sewon (wiring harnesses) among many others.

While the Koreans and most European carmakers have been established in eastern Europe for more than a decade, suppliers continue to open new plants and expand existing operations. This is both for vehicle plants in the region and for supply back to Germany and further afield. For example Italian-German group Aunde (seats and trim) and German wiring supplier Leoni are expanding plants in Serbia to supply Fiat in Serbia, and also BMW in Germany, and Jaguar Land Rover in the UK. Further north in Hungary, Dana is expanding gear production, Mitsuba of Japan is expanding its electronics production, while ThyssenKrupp is opening a new engine and steering components plant. Notably this will be the first ThyssenKrupp plant in Europe making two sets of different components, namely electronic steering parts and cylinder head covers with integrated camshafts.

5. Supply logistics, supplier parks and JIT deliveryAlthough vehicle companies have frequently looked at long-distance, low-cost locations for a wide number of components, their factories require a steady, even flow of parts to the assembly line. This encourages suppliers to be located close to or even within the boundaries of a vehicle plant. In many cases, especially in Europe, vehicle companies have established supplier parks close by, at which complex and frequently highly variable components or sub-assembles undergo the final stages of assembly prior to delivery to the correct place on the assembly line for the specific vehicle onto which they will be fitted.

Seat delivery from close to the car plant is common place in Europe; for example, Nissan Sunderland has both JCI/Adient and Lear located close by, while Faurecia ships seats directly into VW’s factory in Slovakia. However, there can be great difference in terms of what ‘near’ the car plant actually means; at Sunderland the JCI/Adient and Lear facilities are located within 10km, while Faurecia’s Slovakian plant is 60km from VW’s plant.

Vehicle companies like to deal with a limited number of large suppliers perceived to be financially secure and strong. Production of transmissions is a good example

Vehicle companies like to deal with a limited number of large suppliers perceived to be financially secure and strong. Production of transmissions is a good exampleEuropean vehicle companies have also transplanted the supplier park principle across the Atlantic. For example, the new Audi plant, at San Jose Chiapa in Mexico, has been designed with a supplier park next door, with seven suppliers in situ on opening; namely Faurecia, HBPO (Hella-Behr-Plastic Omnium), ThyssenKrupp, Truck and Wheel, TI Automotive, Kuehne + Nagel and Syncreon. Audi uses more than 100 suppliers in Mexico, with around 60 having established new facilities in the country, helping to generate a NAFTA local content ratio of over 70%.

Meanwhile, at BMW’s Mexican plant, now under construction, new supply arrangements will involve:• BMW employees, rather than those of suppliers, assembling modules for sequenced parts prior to delivery to the assembly line. BMW calls this modular in-sourcing and has decided to do much of the final assembly of components and systems itself to provide maximum flexibility in production scheduling.• A GPS-based logistics web-based system that will track components’ progress to the plant in real-time; this will be trialled by three companies initially, and once proven to be reliable will extended to all suppliers delivering to Mexico, including BMW itself. The system will be especially important for the supply of engines. These will come from BMW plants in Germany, Austria and the UK, and will land at the port of Veracruz, which needs significant infrastructural improvements to cope with BMW’s anticipated import volumes.• A number of suppliers based nearby on a supplier park to ensure timely deliveries. The supplier park at San Luis Potosí already has a number of suppliers delivering to a nearby GM plant who will also be considered for supply to BMW.

Across the border and further north, in Tennessee, Nissan is expanding supplier activities around its Smyrna factory, investing $160m and creating another 1,000 jobs close to the plant. Construction started in March 2015 and will improve supplier logistics for the production of the Altima and Maxima sedans, Leaf EV, Rogue crossover, Pathfinder SUV and Infiniti XC60 crossover. The first parts assembled here are steering columns and wiring harnesses, as well as finishing to glass prior to shipping into the plant.

6. Light weighting: changes in materials, production and processesSuppliers are under great pressure to cut weight. This applies throughout the car and not just in the obvious heavy components such as engine castings and transmissions. For example, cutting weight from seats can be achieved by adopting thin-wall seating, with thin foam and lightweight frames, using magnesium, composites or lightweight steels. However, some of these new materials and technologies remain too expensive for volume production at this stage.

At recent motor shows, Faurecia has showed its ‘Lightweight and Roomy’ seat, weighing around 2.3kg less than its most recent production seat in C-segment vehicles. As well as saving weight, the finished product is slimmer, adding just over 3cm of space for rear passengers. The reduced weight came through using a combination of conventional and high-strength, lightweight steels, as well as thermoplastics, producing what the company calls the world’s first hybrid generic seat frame.

Rising machine efficiency has almost doubled the number of seat set covers produced by tachi-S in Mexico

Rising machine efficiency has almost doubled the number of seat set covers produced by tachi-S in MexicoThe original stimulus for this seat came from Renault’s EOLAB concept car which was shown at the 2014 Paris motor show which achieved a weight reduction of just over 4kg compared to conventional all-steel seat frames.

This concept seat was subsequently transformed into a production-ready offering for vehicles made on the CMF-C/D platform for Renault-Nissan. The production seats feature frames which weigh just 12kg, which Faurecia claims is a 20% improvement on older designs. They are used on the Nissan Qashqai, Rogue and X-Trail and the Renault Espace, Megane and Talisman. The weight saving is 2.3kg per seat, of which 1.6kg came from using thinner side members and risers, made from high-strength steel; 700g was saved in the mechanisms, while another 300g was saved through using an improved formula reducing foam density. In addition, the foam’s base chemicals emit as much as 20 times fewer VOCs than conventional foam; the new foam, developed in conjunction with Dow, is amine-free, which Faurecia claims is an industry first. Production of it is carried out in France at present, with Faurecia expecting to roll its production out globally in the next few years.

Equipment suppliers can also play a key role in increasing production efficiency in seat part production and can help determine production location as well. For example, while seat cover sewing operations have, in the main, moved to low-cost locations,to counter rising labour costs, improvements in automation allow the cutting stage to remain in traditional locations. Lectra’s automated cutters have allowed Mario Levi, an Italian leather supplier, to improve productivity by as much as 20%. They have also increased yield, ie. how much usable leather it can get from each hide, by 4%. Another leather cutter, ECA, claims that Lectra machines generate 80% hide use efficiency, compared to 60% from traditional die cutters.

Elsewhere, Lectra machines have improved the cut-and-sew operations of the Japanese seat supplier, Tachi-S, in its Mexican plant. Machine efficiency has risen from 56% to 72% and almost doubled the number of seat set covers produced, from 550 to 1,000 a day. Key to this process has been optimising the cutting of fabric pieces from a large roll, reducing the gap between each cut piece by 3mm, a switch which reduced overall fabric consumption by 3%.

7. EVs and autonomous/connected carsThe growth of electric and autonomous/connected cars offers substantial new business opportunities for existing suppliers and also opens up a new market to suppliers outside the automotive industry’s traditional domain. On the one hand, Tesla, which has broken the mould in car production in many ways, uses a number of long-established suppliers for components which are common with conventional cars. As well as developing battery technology in partnership with Panasonic, it uses leading suppliers such as Brembo (brakes), Gentex (mirrors) Inteva (instrument panel), Stabilus (liftgate struts), Zanini (trim parts) and ZF (power steering).

By contrast, many of the established car companies have turned to third parties to develop EV battery technology; Korean suppliers LG Chemical and Samsung SDI and Japanese company Panasonic lead in this area. These three leaders – along with Nissan’s battery partner, NEC – account for over 80% of the EV battery market, mirroring the kind of concentrated supply structure evident in long-established automotive technologies highlighted at the start of this review. Smaller players in automotive batteries – Johnson Controls, A123 Systems and others – appear to have lost out in the full EV battery market and will now focus on supplying batteries in the hybrid market instead.

The development of autonomous and connected cars is extending the supply base even further, and this involves a great deal more than Google or Apple; in fact, Google itself was reliant on existing suppliers such as Continental, Bosch and ZF to produce its trial cars. The new autonomous and connected car market is, however, bringing many new suppliers. These cars require substantial processing power, more powerful and sophisticated sensors, mapping technology, new security features, new connected technology and substantial skills in algorithm development. Each of these areas is bringing new names to the sector as shown in the chart below, highlighting the dynamic nature of this market.