Lower-than-expected EV sales continues to have repercussions for production plans, with Volvo the latest vehicle maker to delay 100% EV target.

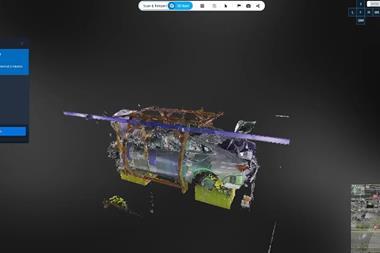

Volvo fully intended to be in the vanguard of the switch to an all-EV future. The company was adamant it would only sell and make electric vehicles from 2030. The internal combustion engine would die, as would hybridised versions. A new range of EX crossovers and ES sedans was being steadily unveiled. The EX30 will be made in China and Belgium; the European plant was added to the production plan to avoid EU tariffs on Chinese EVs, as well as acting as a supply point for the US, again to avoid the US’ tariffs on Chinese EVs. The EX90 will arrive shortly, produced in the US, but initially shorn of many of the software features that were planned. An EX60 will arrive, as will sedans, ES60 and ES90 for sure and other sedans likely too. the XC40 which already comes with a fully electric option will be replaced by an EX version due course. A new factory is being built in Kosice, Slovakia, to concentrate on EV production; and meanwhile the company’s other European plants, in Sweden and Belgium, are being converted to EV production.

Full electric ambitions challenged

But, while this plan will continue, its timeline has changed, i.e. lengthened; and most significantly the 2030 deadline by when the company had planned to have become fully electric, has changed. Now there is no date by when the Volvo will be fully electric. Instead, and as part of what is becoming a wide-ranging strategic change, the plan to go fully electric has been dropped.

Plug-in hybrids and indeed some mild hybrids (which are not far off being pure ICE vehicles in many people’s eyes) will continue. So now, rather than being 100% electric in 2030, the company plans to be 90% electrified, i.e. full battery or plug-in hybrid, with 10% allowed for mild hybrids; the company added an “if needed” at the end of its announcement regarding the continued sale of mild hybrids, in an apparent wish or hope that this will not be needed. However, given the current resistance to EVs and indeed to PHEVs in some markets, it is highly likely, almost certain some might say, that mild hybrid demand will continue in some parts of the world. Indeed, it would not be surprising if Volvo sales outside Europe and the US were above 10% mild hybrid well into the 2030s.

Unveiling this change of plan, CEO Jim Rowan reiterated the company’s commitment to electric powertrains. But he accepted the reality that consumers were not taking up EVs as quickly as had been hoped and that different markets were moving in this direction at different speeds, all slower than hoped for. The removal of price subsidies in major European markets, notably Germany and Volvo’s home market of Sweden have not helped. Rowan remains very bullish regarding EVs, insisting that “an electric car offers a superior driving experience and increases possibilities for using advanced technologies that improve the overall customer experience.” In some ways this statement is not surprising given the commitment which Volvo had earlier made to EVs, but many will question its veracity.

Costs and charging infrastructure concerns

It is clear from consumer surveys that many would-be customers for EVs are put off the idea because of concerns over charging infrastructure and indeed costs. If you are lucky enough to have private parking, off-street, with your own charge point, then an EV may well make sense, subject to driving range expectations. Off-street domestic charging is typically much cheaper than on-street parking (the difference varies country by country, depending on VAT rates and the general energy price environment) and is clearly more convenient. But, especially in cities, most people do not have their own charge point and are therefore reliant on public networks; adding charge points at fuel stations or car parks may well address some consumers concerns, but filling a car with petrol takes a few minutes and payment is simple. But, despite the increasing availability of rapid chargers (complete with an often-bewildering number of different Apps to pay with) and VMs claiming that new EVs can get to 80% charge status in 15 minutes or so, consumers remain sceptical; also, the significant price premium of an EV over its ICE vehicle equivalent needs to be considered.

Of course Volvo is not the only car company facing up to the reality of a slow transition to EVs with hardly a week going by now without one or other major VM announcing a change to its EV timings and volumes; and in the case of the Volkswagen group the slower than hoped for EV transition has led to substantial changes to its investment plans and the likelihood of factory closures.

Rethinking the business strategy

Back to Volvo, the change in EV strategy is not the only change at the company. We have noted the partial production shift of EX30 from China to Belgium and the plan to open a third European plant in Slovakia. Also, Volvo has announced that it plans to stop its subscription leasing sales model. Existing programmes in Germany, the Netherlands, Norway and Sweden will be handed over to a third-party provider but in the UK and the US the scheme will end entirely. Again, it is the lack of consumer acceptance of the idea which – as with EVs – is causing the change of strategy; the subscription models were based on consumers paying a fixed sum each month for two years with maintenance, insurance, tyre changes, cleaning and potentially the delivery of packages directly to the boot of the car. There was no upfront payment and no commitment to buy the car at the end of the two-year period. But not enough customers took to the idea, with some reports suggesting that less than 7,000 people had gone for this option worldwide, clearly not enough to make it financially worthwhile for Volvo.

So, Volvo is not going to be fully electric anything like as fast it wanted to be, and it will need to stick with conventional sales channels for longer than it appeared to have wanted to. Having wanted to lead so much change across the industry, it is having to face up to the reality that consumers are not for turning, or at least not as quickly as companies like Volvo would want them to be.

No comments yet