The UK automotive industry faces a 14.4% production decline in July 2024, largely due to model transitions and supply chain issues. Despite this, the sector’s value holds steady at over £20 billion, with electrified vehicles comprising 37.5% of output.

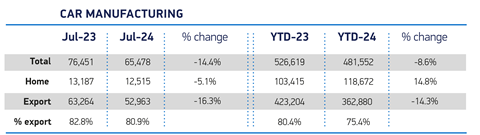

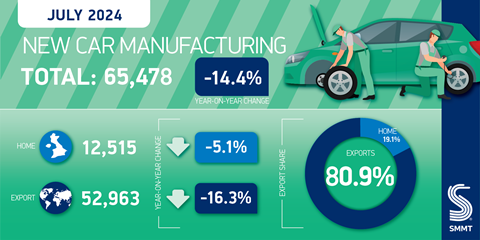

The UK automotive industry is currently experiencing a significant slowdown, with car production dropping by 14.4% in July 2024, totaling 65,478 vehicles. This decline, as reported by the Society of Motor Manufacturers and Traders (SMMT), has been attributed, mainly to model changeovers in produciton and temporary supply chain constraints.

Despite a sharp 18.6% drop in production volume, the industry’s overall value remains steady at over £20 billion for the first seven months of 2024, reflecting the resilience of UK automotive manufacturing.

In July 2024, the UK automotive industry faced a 5.1% decline in domestic production, equating to 672 fewer vehicles compared to the same period last year. Export volumes, which account for 80.9% of total output, dropped by a sharper 16.3%. The European Union absorbed the lion’s share at 51.3%, with the United States (17.6%), China (8.6%), Turkey (5.5%), and Japan (3.1%) trailing behind.

Meanwhile, electrified vehicles maintained a robust 37.5% of production, only slightly lower than the 39.5% recorded in July 2023, underscoring their rising strategic importance in the UK’s automotive sector.

Stats and Dats:

-

Domestic Production: Production for the UK market fell by 5.1%, which equates to 672 fewer units compared to the same period last year.

-

Export Market: Exports, which account for 80.9% of total production, decreased by 16.3%.

-

The European Union (EU) remains the largest export market: taking 51.3% of the UK’s exports

-

This is followed by: the United States (17.6%), China (8.6%), Turkey (5.5%), and Japan (3.1%).

-

Electrified Vehicles: Electrified vehicles (including EVs, plug-in hybrids, and hybrids) maintained a 37.5% share of total output, only slightly down from 39.5% in July 2023. This underscores the increasing importance of electrified vehicles in the UK’s production strategy.

Broader industry context

The slowdown in UK car production is reflective of global trends in the automotive industry, where the transition to electric vehicles (EVs) is creating significant disruptions. Manufacturers are dealing with supply chain disruptions, increased production costs, and the need to rapidly scale up battery production. These challenges are compounded by the necessity for substantial investment in new technologies and workforce retraining.

“As the billions already committed to new models start to deliver a return, volume growth will resume, providing we seize every opportunity to enhance our global competitiveness”

- Mike Hawes, SMMT’s Chief Executive

According to Automotive Manufacturing Solutions, the global automotive landscape is characterised by a mixed production environment, with some regions ramping up EV production quickly, while others face delays due to supply chain bottlenecks and the complexities of transitioning existing manufacturing processes.

The European battery production sector, in particular, is under pressure to increase speed and agility to meet growing demand, a situation further complicated by tariffs on Chinese EV imports. This stresses the importance of local production capabilities, particularly in Europe, where manufacturers must navigate a complex regulatory environment.

Strategic outlook and Implications for the automotive production industry

Despite the current challenges, the UK’s automotive sector remains cautiously optimistic about the future.

SMMT Chief Executive Mike Hawes commented: “Following significant growth last year, some readjustment in output was to be expected. Indeed, an ongoing degree of volatility is likely as the industry restructures to transition to zero emission vehicle production.

”As the billions already committed to new models start to deliver a return, volume growth will resume, providing we seize every opportunity to enhance our global competitiveness.

“We need investment in skills, healthy markets, cheaper green energy, and fair trade deals that help British-built vehicles reach international customers more easily, all of which should be wrapped in an over-arching industrial strategy that ensures automotive continues to be a key driver of economic growth.

The resilience of the sector is further highlighted by the fact that, despite a significant drop in production volume, the overall value of production has remained stable. This is a testament to the high value of UK automotive manufacturing, even in the face of global and local challenges.

For OEMs and tier-suppliers automotive manufacturing sector, understanding and navigating these changes is essential.

The ability to secure supply chains, adapt production lines for new models, and invest in future-proofing operations will be key strategies for success in this evolving landscape. The transition to electrification presents both challenges and opportunities, and those who can innovate and adapt will be well-positioned to capitalise on the growth of the EV market.

No comments yet