Solid-state batteries are seen as the next big technology step for electric vehicles, potentially reducing battery pack weight and offering improved energy density and range. AMS reports on progress at Solid Power.

The core technology for BMW’s projected use of solid-state batteries to power new generations of electric vehicles (EVs) is provided by US company Solid Power based in Louisville just outside Boulder, Colorado, which was spun out from the University of Colorado Boulder back in 2011.

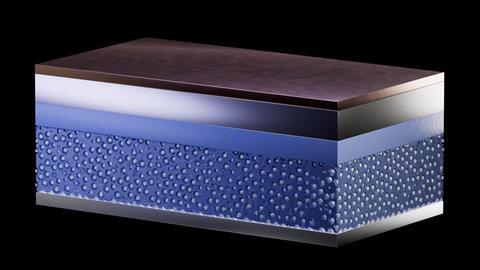

The company describes its all-solid-state battery (ASSB) technology as combining a mix of innovative chemistry with established manufacturing procedures to help produce benefits that include permitting the use of higher capacity electrodes and pack level cost-savings of 15-35% compared with existing lithium-ion counterparts.

The first of those factors is represented by its implementation of sulphide-based solid electrolytes that obviate the requirement for a flammable liquid electrolyte and polymer separator layer. This single layer then acts as both a barrier between the anode and cathode and as a conductive electrolyte. The second is that the cell manufacturing processes it has developed are based on those that are already well-established for existing high-volume lithium-ion battery cell production.

Using sulphide materials

Details of the company’s exploitation of sulphide materials are confirmed by CEO John Van Scoter. “We chose sulphides as opposed to oxides or polymers for our electrolyte because they have a superior combination of ionic conductivity and manufacturability, which should allow us to develop technologies that will increase driving range and battery life at lower production costs than conventional lithium-ion,” he states. “There are many proprietary inputs and unique processes which go into the production of our electrolytes,” he continues. “To our knowledge, we are the only publicly traded company developing true solid-state batteries in which 100% of liquids and gels are removed from the cells.”

Van Scoter also stresses that this innovative chemistry is achieved by means of commonplace materials. “Our electrolyte is made from abundant materials produced at industrial scale in multiple geographic locations, except for the lithium sulphide (Li2S) precursor material,” he states. “We currently source Li2S from leading lithium and chemical companies globally and are also developing our own Li2S production method to further hedge supply risk.”

In fact, Van Scoter further confirms the company has been engaged in exploratory manufacturing operations for some time. “We have been producing both electrolyte and prototype battery cells for several years,” he says. “Furthermore, over the past 18 months we have made large operational investments that are now enabling us to produce our electrolyte at higher volumes as well as larger, more complex EV cells.”

![]()

Developing production for commercialisation

Van Scoter provides more relevant details. “Our new SP2 electrolyte production facility, which is in Louisville, started production in April 2023 and is designed to produce up to 30 metric tons of electrolyte per year, a production level that will meet both our needs and the needs of our customers until we get to larger scale commercialisation,” he says. “We also have two working cell manufacturing lines at our SP1 facility in Thornton, north of Denver: a prototype line for up to 20Ah cells and our EV line, which allows us to produce larger cells between 60 and 100Ah. The EV line is designed to produce cells for automotive qualification and is currently producing cells to be delivered before the end of this year for BMW’s demo car.”

But Solid Power does not design or assemble the battery packs and modules – that is up to its automotive partners. Instead, the company aims to work closely with them on pack level requirements and vehicle integration to ensure cell operation accords with specifications. Apart from BMW, one automotive manufacturer the company acknowledges working with is Ford.

Solid Power’s relationship with BMW dates to 2016 and initially, says Van Scoter, the relationship was focussed on cell R&D. But in December 2022 the relationship was expanded to facilitate technology sharing and even closer collaboration. “Currently the Solid Power and BMW teams are engaging in development and manufacturing activities at Solid Power’s Colorado facilities,” he states. “The work has been aimed at improving manufacturing techniques and at incorporating and utilising new quality control and inspection equipment.”

Furthermore, the agreement will also allow BMW to install its own solid-state prototype cell manufacturing line. That projected facility will be a duplicate of Solid Power’s pilot line and will allow BMW to begin parallel development in Germany, though the timescale for that is entirely a matter for the car maker.

This expanded relationship is already producing positive results. “On our second quarter earnings call, we announced that our 20 Ah cell builds have yielded performance at a level where we shifted our focus to our larger EV cells,” Van Scoter says. “We plan to deliver those cells in 2023 for BMW to use in their demo car.”

Van Scoter says that manufacturability has been fundamental to Solid Power’s strategy since its inception. “Our business model focuses on being an electrolyte materials supplier and licensing our cell designs to third party manufacturers instead of manufacturing the cells ourselves,” he states. “This allows us to be ‘capital light’, which means keeping our capital outlays low while expanding our addressable market by partnering, rather than competing with, existing cell manufacturers. Cell manufacturability is key to that strategy.”

Working in partnership not competition

From Solid Power’s perspective this approach has two major benefits. Firstly, is avoids incurring the massive capital outlays that can be involved in battery manufacture. Secondly existing cell manufacturers should be able to use Solid Power’s designs and electrolyte on their existing lithium-ion battery manufacturing infrastructure, which lowers commercialisation risks.

“Our business model is unique amongst next generation battery companies in that we seek to partner, rather than compete, with incumbent battery manufacturers,” Van Scoter states. “Ultimately, our goal is to be a leading producer and distributor of sulphide-based solid electrolyte material for powering EVs and other applications.”

Developing manufacturing techniques for solid-state batteries

One avenue of research and development becoming increasingly prominent in the quest to find more efficient and durable batteries for electric vehicles (EVs) is that of solid-state batteries. In Europe, for instance, a multi-company research project called Spinmate aims to develop what it describes as “innovative and scalable manufacturing techniques for solid-state batteries”.

The initial objective is to develop an appropriate pilot line at Technology Readiness Level 6 by 2026. One participant is robotics technology Comau, which is being tasked with developing appropriate cell handling and assembly processes as well as supporting digitalisation capabilities.

Aldo D’Ambrosio, business development manager with Comau, confirms the company’s involvement and is initially at least surprisingly understated about what will be required. “The difference between the assembly processes, both modules and packs, for traditional compared to solid-state batteries is relatively minor from an engineering point of view,” he says.

Cell level challenges

At cell level, though, the situation is different. “The challenges are largely related to cell assembly and in particular to the materials used for solid-state cell development,” explains D’Ambrosio. “These include polymeric or inorganic electrolytes, with different chemistries; innovative anode solutions, such as lithium metal-based electrodes; and ‘anode-less’ technologies in which the lithium-based anode is not inserted in assembly, but chemically created during cell activation processes.” One implication is that such materials may have mechanical properties that are significantly different from those of traditional electrodes and separators, which will require the development of dedicated handling systems.

Moreover, continues D’Ambrosio, another challenge is that the materials used in electric battery manufacturing cannot be joined by traditional methods: “As such, joining strength and efficiency are important considerations when designing a new battery or its automated production system.”

For the Spinmate project, D’Ambrosio says that Comau will focus on developing specific automation to assemble solid-state cells with materials developed by the project’s partners. He mentions lithium metal-based anodes and polymer electrolytes in particular. This will, he confirms, involve “the development of new processes for some of the manufacturing steps”.

Utilising existing equipment

Nevertheless, a fundamental goal of the project is to find ways of using existing equipment as much as possible. “We want to make such equipment both more efficient and flexible enough to handle the new materials that are entering the market,” confirms D’Ambrosio. But he concedes that because some production processes will require different equipment to what is currently being used for traditional cells, some particular developments for each specific process may be required.

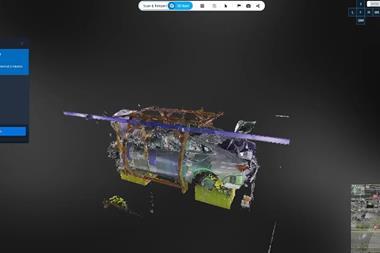

As for the digitalisation aspect of the project D’Ambrosio indicates that the term means much the same in cell and battery production as it does in other aspects of manufacturing. “It is used to build models that can accelerate material and product development, for sensing of products and plants, to create a digital twin of a product, process, machine, or plant, and in the implementation of platforms that can collect data from the field and analyse it,” he says.

D’Ambrosio adds that in the project Comau is developing machine learning algorithms capable of predicting product quality, based on production data. “We are working with digital production models typical of Industry 4.0 and 5.0,” he states.

There are, D’Ambrosio argues, real if subtle differences between the two concepts. “Industry 4.0 is based on the Internet of Things and real-time data communications, which create a type of universal factory that is physical and virtual at the same time,” he says. “It is therefore a paradigm focused on enabling technologies, efficiency and productivity.”

Developing ergonomic and sustainable production processes

In contrast Industry 5.0 focusses on aspects of the surrounding culture such as sustainable production processes and improved ergonomics. “Industry 5.0 is characterised by human-machine cooperation with the goal of adding value to production by creating customised products that respect the needs of consumers and also the environment,” D’Ambrosio argues.

Comau’s estimation of the long-term significance of the project is confirmed by Daniela Fontana, funded project manager for the company. “Comau will simulate a mass production environment based on the technologies developed in the project to determine the efficiency of processes and equipment and identify possible further development needs,” she states. “The ultimate goal is the design of optimised, environmentally friendly and highly efficient machinery and plants.”

No comments yet