The US is leading the way in the transition to EVs, with significant government support to increase domestic battery production and new technologies. Ian Henry explores how the US is becoming competition to China, and what it means for the rest of the world.

The face of US automotive manufacturing is undergoing a rapid transformation as it moves into electric vehicle production, with the process of change accelerating in the light of somewhat confusingly named Inflation Reduction Act (IRA). Enacted in late 2022, the act provides $430 billion in support for US manufacturing, much of which is directed at EV battery production, although the act’s provisions also apply to other sectors using battery cells, notably solar panels and energy storage for domestic applications.

In response, almost immediately upon the provisions of the act becoming clear, Tesla confirmed it would increase battery cell production in the US (and delay adding cell production to its new car plant in Germany), and Volkswagen paused its expansion of cell production factories in Europe and redirected investment to the US. Money, especially in the form of government subsidies, talks.

The T’s and C’s

The act works in a number of ways, giving consumers and fleet buyers tax credits of up to $7,500 per new vehicle, through to 2032, provided the vehicles concerned meet certain requirements. The credit is limited to cars with a sticker price of up to $55,000, or $80,000 for trucks and SUVs. Intriguingly, used EVs also qualify for the credit, this time of $4,000 or 30% of the sticker price, whichever is lower, on vehicles priced below $25,000. There is also an income threshold which limits the tax credit on vehicle purchase to people earning $150,000. Similar principles apply to large commercial vehicles, while the government has also increased tax credits available on charging equipment installed at home, up to $1,000 per unit; and for commercial charging units, the credit is up to $100,000 per unit.

“The scale of the US government’s encouragement to the industry to change its manufacturing plans is vast and beyond what the EU or individual countries (outside China) have done or can do to support their local or regional production and sourcing arrangements”

Ian Henry

One intriguing quirk in the system is that commercial vehicle tax credits can be applied to leased vehicles when they are assembled outside North America (possibly because some categories of commercial vehicle sold in the US are all imported). Also, the IRA allocated $3 billion to electrify the US Postal Services’ fleet of delivery vans and trucks. In another administrative tweak, it has been reported that in 2024, the tax credit will switch from the buyer to the dealer, with the dealer responsible for reflecting this in the sale price. Whether the consumer gains the full benefit of the tax credit once the switch has come into force remains to be seen as the pricing, taking the act’s provisions into account, will be more opaque than the current system where the consumer gets the direct benefit through the taxation system.

Specifically, the vehicles must use a battery produced in North America, with 50% of the components in the battery coming from a plant in the region, rising by 10% a year, to 100% in 2029. In addition, battery minerals also have to be sourced from and processed for use in battery components in the US or a country with which the US has a free trade agreement; the required content level starts at 40% in 2023 and rises to 80% after 2026. By directing an increasing level of local content (or content cumulated between the US and its free trade deal partners), the US government is clearly expecting to see an increase in domestic EV or PHEV production, and moreover reduce the country’s dependence on China, especially for batteries. Failing to meet the battery minerals content stipulation reduces the tax credit in half; the other half of the tax credit applies to vehicle assembly taking place in the US.

Consumers are advised to check the vehicle identification number (VIN) to confirm the tax credit applies, although the onus is very much on the vehicle manufacturer and dealer to ensure the vehicle qualifies for the credit. This applies not just to the assembly location but also the local content level of the battery and minerals therein. The administration burden that is on vehicle companies and their supply chain to be sure they comply with the act and can demonstrate this should not be underestimated.

The impact on US manufacturers and overseas competitors

The scale of the US government’s encouragement to the industry to change its manufacturing plans is vast and beyond what the EU or individual countries (outside China) have done or can do to support their local or regional production and sourcing arrangements.

The initial signs are that the policy objectives are going to be met and that the act is working. Moreover, it is not just the domestic brands who will have to change their battery sourcing arrangements; European, Korean and Japanese vehicle companies operating in the US are increasing US EV production and battery production or sourcing in response. Initial analysis of Q1/2023 US sales suggested that almost 65% of EVs sales qualified for the tax credit under the final assembly location, initial minerals content levels and price cap rules, and the bulk of those which didn’t meet the full tax credit rules, qualified for half of the credit available, based on assembly location.

The IRA provisions have had some interesting impacts for US manufacturers, including new entrants like Rivian. Initial reports suggested that its entry level R1T pick-up truck and R1S SUV did not initially qualify for the tax credit, although some changes in minerals sourcing appears to get around this and Rivian may soon meet some, if not all, of the requirements for the tax credit. At Ford, the E-Transit and Mustang Mach-E only qualify for half of the tax credit, essentially because their battery materials are non-compliant in terms of their sourcing. Most of these vehicles’ batteries’ minerals still come from China, or Korea in the case of Rivian’s batteries which are supplied by Samsung. Intriguingly, initially at least, the Tesla Model 3 base model also failed to meet the IRA’s requirements, and other non-compliant, failing models included the Jeep Wrangler PHEV and Grand Cherokee $XE. By comparison, at GM, all its sub-$80,000 EVs, Bolt, Blazer, Equinox, Silverado and Lyriq, qualified. Interestingly, new entrant Lucid is offering the tax credit reduction itself, even though it does not qualify as its cars are priced above the $55,000 car sticker price; Tesla’s Model Y, as an SUV, does qualify because it is priced below the $80,000 threshold for SUVs.

In terms of vehicle companies’ initial responses, Volkswagen intends to sell 25 full BEVS in the US by 2030, most of if not all of which should qualify for the tax credits under IRA. This will involve spending $7 billion on EV production in the US. Volkswagen already assembles the ID4 in the US and the ID Buzz will made in the US from 2023; two more electric SUVs will soon be added to its US manufacturing line-up, and more EVs will follow. At least 80% of the 25 BEVs VW intends to sell in the US will made in the US or Mexico as part of an ambitious plan for the brand to reach a 10% market share by 2030. VW reportedly expects to gain between $9-10 billion in IRA subsidies in response to its increased US investment.

Meanwhile Toyota has announced plans to invest $5.6 billion to build EV batteries in the US in response to the IRA’s provisions. There will be a new Toyota owned battery plant in North Carolina, with an investment of just over $2.5 billion , while just over $3 billion will be invested in two other planned plants which are owned by a joint venture with Panasonic. Production will be fully up and running at all three plants by 2026. Interestingly, and despite being one of the first vehicle companies to launch EVs, Nissan does not expect its EVs to be fully compliant under IRA provisions until 2026, mainly because of difficulties in getting hold of sufficient minerals in the US or other approved locations.

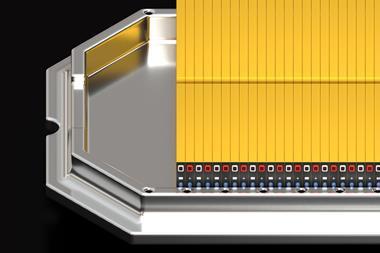

BMW supplier Envision AESC – described in some US press reports as Japanese, rather than Chinese – will build a new battery cell plant in South Carolina to supply BMW. This will see $810m invested in a 1.5m square foot plant employing nearly 1,200 people, making enough batteries for 300,000 vehicles per year. The facility will make BMW’s new energy-intensive Generation 6 cell; these will be used in six different EVs which BMW plans to make in its US factory in South Carolina, starting in 2025. The supply chain for all of these will ensure full compliance with provisions of the IRA. The news cells are said to deliver 30% more driving range and can recharge to 80% from 10% in 30% less time than current units require. These prismatic cells will be assembled using a cell-to-pack method, dispensing with the traditional intermediate module assembly stage; the cathodes in these new cells will use 50% less cobalt than current technology and the anodes will use 20% less graphite (almost entirely all of which will continue to come from China). The Envision factory for BMW follows an earlier investment announcement by the company to build a battery plant for Mercedes in Bowling Green, Kentucky, with a $2 billion investment, again to supply for 300,000 EVs which Mercedes plans to make in its Alabama factory annually by 2027.

Hyundai and Kia meanwhile have found their EVs do not comply with the new rules and will have to accelerate their EV production and change their battery materials plans for the US, including increased battery sourcing there. Fortunately, Samsung, SK and LG are already invested in the US, supplying other vehicle companies as well some deliveries to the Korean companies, so expanding this network should be somewhat easier than starting entirely from scratch.

Korean battery suppliers in the US will have to change their mineral sourcing arrangements for their customers, the VMs, to comply with the act’s rules, and the domestic vehicle companies and their suppliers will also have to change their mineral sourcing plans. In this regard, the US’ trade deals with Cananda and Australia should be helpful as these countries increase their own capabilities in lithium processing, reducing the dependence on lithium processed in China, even though much of it comes from mines outside China.

It is worth noting that the company which kickstarted the EV transition, Tesla, is also changing its sourcing arrangements to ensure its vehicles comply with the IRA’s rules. Tesla is considering buying Brazilian lithium company, Sigma Lithium, one of the region’s largest lithium extractors, and it is building its own lithium refining plant near Corpus Christi in Texas, at a cost of $375m. This should give Tesla enough capacity to supply lithium for batteries for 1 million vehicles a year by 2025, a development which would make this facility the biggest lithium processor in North America by a long way. Tesla has also reportedly secured the right to extract lithium from clay at a 10,000-acre site in Nevada, further increasing its US battery content. Other relevant moves by Tesla in this area include talks with Panasonic to build another battery plant in the US and an agreement to source nickel from the Canadian operations of Vale, a Brazilian mining company.

Meanwhile, BMW’s I Ventures subsidiary is also investing in Canada, in Mangrove Lithium, to produce battery grade lithium hydroxide and carbonate. These minerals will likely be used by Envision in the batteries the company delivers to BMW. The Toyota-Panasonic JV mentioned above will use lithium from Ioneer’s Rhyolite Ridge mine in Nevada; this mine will also supply Ford. Meanwhile GM will buy nickel and cobalt sulphate from Queensland Pacific Metals, and cobalt from Glencore’s Australian mine at Murrin Murrin, deals which will benefit from the US-Australia trade deals, meaning the materials used in the batteries made in the US are compliant under the IRA. The same applies to Ford’s agreement to source nickel from BHP in Australia, and spodumene (for lithium processing) from Liontown Resources in Western Australia.

Tesla’s race to the top

While changes to battery supply arrangements get underway, Tesla is accelerating its plans to change the face of vehicle production, both in terms of location and manufacturing processes.

Already a pioneer with the gigacasting process, which enables it to make vehicle underbodies in two large pieces rather than in multiple stampings which require welding, Tesla is reportedly close to perfecting the gigacasting process which could allow it to make the complex underbody in a single casting. This is said to be core to the new “unboxed” manufacturing process which Tesla announced earlier in 2023. This process will in turn will enable Tesla to enter the entry level market for EVs; the aim appears to be to apply this process to the production of the $25,000 entry level model which Tesla wants to launch in 2025.

“The Inflation Reduction Act is changing the landscape of battery production and accelerating the transition to EV production in North America”

Ian Henry

Initially, production is likely to be at the Texas factory which makes the much larger Cybertruck, but production of the planned small Tesla (probably to be called Tesla Model 2, and an autonomous robotaxi vehicle), will later switch to a new plant which Tesla is building in Mexico. Elon Musk has reportedly decided to start production of vehicles using the new giga press one piece casting process in the US so that Tesla’s US engineers can optimise the manufacturing process before transferring production of the Model 2 to Mexico. The large gigapress which makes one piece front and one-piece rear underbody parts for the Cybertruck in Texas have press force of 9,000 tons; the power of the press for the single piece underbody parts will be even higher and will require the building housing the prices to build around it given the initial size of the machinery involved.

Some critics of the Tesla approach point out how damage to the underbody in an accident would likely lead to the entire car being scrapped rather than repaired given the size of the single piece underbody – such concerns do not appear to have put Tesla off this idea, although the insurance industry’s reaction will be interesting to observe. If damage to the one-piece underbody cannot be economically repaired, then scrapping the entire car may follow, with the insurance costs for consumers likely to rise significantly.

The Mexican plant, at Santa Catarina in the state of Nuevo Leon, will cover more than 4,200 acres, apparently more than double the size of Mexico City’s international airport; the existing Tesla Texas site meanwhile covers just 2,500 acres by comparison. Tesla is committed to investing $5 billion in Mexico, employing 5,000, although both numbers could ultimately double, helping Tesla with its ambition of producing 1 million vehicles a year in North America in the near future. Further investment will come from suppliers and the whole project could involve nearer $15 billion investment once complete. This investment comes on the back of investment of $770m to expand the Texas factory, for battery cell testing, and cathode and electric drive manufacturing, a die shop and other unspecified facilities.

A shining example, or an unattainable goal?

The Inflation Reduction Act is changing the landscape of battery production and accelerating the transition to EV production in North America. With $430 billion committed to the programme, the IRA is far from cheap; no other country or region has committed such sums and probably cannot.

The act could be deemed in contravention of World Trade Organization (WTO) rules, but it is unlikely that any WTO referral would have any material impact. The act is designed to boost domestic production and not necessarily boost exports, so the WTO’s provisions may not be relevant.

In Europe, Japan and Korea, the need to protect their own EV industries and battery supply chains will intensify; the US does not wish to lose out to China permanently and it probably will not do so – equally, other parts of the world may suffer collateral damage. Welcome to the new world order.

No comments yet