SMMT’s latest figures show UK production breaking records for total investments from both public and private sources with £23.7 Billion in commitments. Confidence grows for production innovations and a sustainable future.

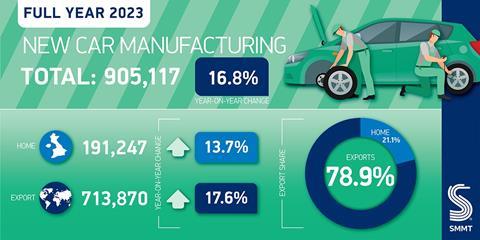

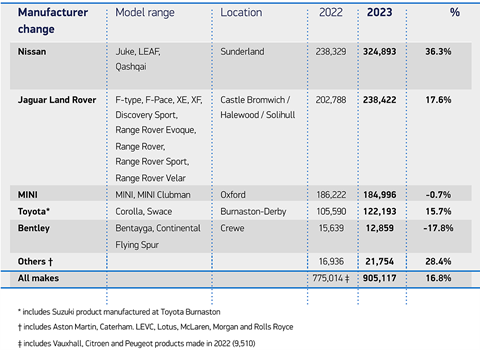

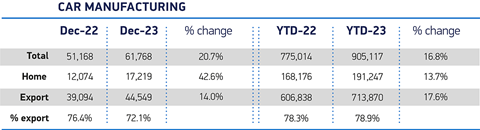

In 2023, amidst a backdrop of economic challenges and complex geopolitical issues, the UK’s automotive industry managed to not only weather the storm but also to achieve impressive production milestones, according to The Society of Motor Manufacturers and Traders (SMMT). It was a year where the industry’s resilience translated into real numbers and set the pace for a future of electrification. Last year saw the UK automotive sector successfully reverse a trend of uncertainty, with car production rising by a robust 16.8%, representing a growth of over 900,000 units, to hit an output of 1.25 million, marking the best output since 2019, (in which year, 1,303,135 vehicles and 78,270 commercial vehicles were produced).

“Output rose every month last year apart from August,” commented Mike Hawes, SMMT Chief Executive, “where shutdowns sometimes made that a very volatile month.” Electrification is seeing obvious growth, with increasing numbers of electrified vehicles hitting 346,000.

“Vehicle export volumes to Europe have not collapsed, as many feared due to Brexit and resulting tariffs and trade friction” - Daniel Harrison, Automotive Analyst at Ultima Media

This rebound was, despite not being close to where the UK production sector used to be, still a significant leap, showcasing the industry’s ongoing recovery and adaptation in post-pandemic and post-Brexit Britain.

Record investments powering the industry

2023 was a hallmark year for automotive investments in the UK, with £23.7b committed to the industry from both public and private sources, eclipsing the total investments of the previous seven years.

High-profile commitments by industry heavyweights like BMW in Cowley, Oxford, Nissan, and Tata Motors underscored a collective bet on the UK’s automotive prowess and its strategic direction towards electrification and high-tech manufacturing.

Export dynamics and EVs

The UK’s automotive export landscape presented a nuanced picture. UK vehicle production remains an export dependent industry. The European Union continues to be the primary export destination, accounting for over one in six (60.3%) of UK exports, up 23% on last year, demonstrating the interconnectedness of UK automotive production with European markets. However, the decline in exports to the US and China prompt a strategic revaluation, even as exports to other nations like Turkey, Austria, Japan and Canada grew - with Australia, interestingly, growing by 62%, pointed towards emerging opportunities.

A significant transformation is underfoot with electrified vehicles, which now represent 38% of the UK’s total automotive production output, “this represent more than a third of total output”, said Hawes. This move towards EV production isn’t just about meeting domestic goals like the ZEV mandate but also about keeping pace with global environmental targets and consumer trends demanding sustainable mobility solutions.

The Government’s role in steering growth

The active role of the UK government in 2023, through both policy and financial support, was a testament to the sector’s importance. The government’s backing provided the industry with the stability and confidence needed to secure large-scale investments and navigate the transition towards advanced manufacturing and electrification. Projections for the UK automotive industry are optimistic yet tempered with realism, anticipating a modest increase in production volumes.

The recognition of the challenges inherent in model transitions—especially towards EVs—signals a period of change that is as promising as it is complex. Looking ahead, the industry faces challenges such as high energy costs, labour shortages, and the intricate web of international trade relations. Yet, the sector’s proactive stance on these issues, including securing investments in gigafactories and advocating for supportive government policies, indicates a readiness to tackle these hurdles head-on.

Daniel Harrison, Automotive Analyst at Ultima Media provided commentary, saying: “These improving production figures are a welcome recovery for UK automotive manufacturing, but let’s be realistic, these volumes are still well below pre-pandemic levels of 1.4 million+.

”Nevertheless, what is does demonstrate is that vehicle export volumes to Europe have not collapsed, as many feared due to Brexit and resulting tariffs and trade friction - doubtless eased by the deferral of the tougher rules of origin for batteries and EVs traded between the UK and EU.”

Hawes, commented: “Receding supply chain challenges, new model introductions and a massive £23.7 billion of investment put UK vehicle production firmly back on track in 2023. Industry will now focus on the delivery of these commitments, transitioning the sector at pace to electric and scaling up the supply chain.

”With global competition as fierce as it has ever been and amid escalating geopolitical tensions, both government and industry must remain singularly focused on competitiveness, with all the jobs and growth this will bring. We are in a much better position than a year ago, but the challenges are unrelenting.”

Harrison added: ”The real test will come once those rules [of origin] are re-imposed and EV volumes significantly rise, and whether the UK can develop the domestic battery supply chain to support UK automotive manufacturing.”

No comments yet