Europe’s automotive industry is under pressure. A McKinsey report outlines five major disruptions that threaten its future. From software to supply chains, the industry must move fast to avoid losing ground to global competitors.

A McKinsey report has found (or re-found) that Europe’s once-dominant automotive industry is at risk of losing its competitive standing. Once a powerhouse of manufacturing and innovation, European carmakers are now under continuous mounting pressure. Shifting consumer expectations, a lag in electrification, and fierce competition from China, have placed OEMs and suppliers in a precarious position. More than 13 percentage points of global market share have been lost since 2017, and supplier profitability has fallen sharply, from 7.4 per cent to 5.1 per cent.

”Nearly two-thirds of vehicles produced in Europe are destined for non-EU markets, and 43% of the industry’s total value comes from sales outside the continent”

The findings make for stark reading. From a purely economic perspective, the automotive industry accounts for 7 per cent of Europe’s GDP, and supports 13.8 million jobs. It is also deeply embedded in adjacent sectors, driving demand for everything from raw materials to semiconductors. Yet this economic stronghold is now under threat. McKinsey estimates that €370 billion ($401.4bn) in gross value added—nearly a fifth of total automotive value in Europe—could be lost amid the transition to electric vehicles. The challenge is not just maintaining relevance, but ensuring that the transformation does not come at the cost of jobs, investment and long-term profitability.

A perfect storm of disruptions has thrown European production off-course

McKinsey’s analysis highlights five major forces reshaping the European automotive sector and disadvantaging European vehicle production. These trends are not merely headwinds but structural shifts that will define the industry’s future.

Global trade tensions have destabilised supply chains, in turn, impacting vehicle production. Nearly two-thirds of vehicles produced in Europe are destined for non-EU markets, and 43 per cent of the industry’s total value comes from sales outside the continent. Yet escalating tariffs and shifting trade policies are making access to key markets more difficult. The US has raised tariffs on Chinese EVs to 100 per cent, while the EU has followed with increases of up to 45 per cent.

These measures may provide temporary protection for European OEMs, but they also risk fragmenting supply chains, pushing up costs and reducing competitiveness. In response, several Chinese manufacturers are now looking to establish production facilities in Europe, which could redraw the competitive landscape.

”While 85 to 90% of the value in traditional ICE manufacturing remains within Europe, only 50 to 60% of the value of battery-electric vehicles does”

Powertrain’s failing to power European prowess

The uncertainty around powertrain technology adds another layer of complexity. EV adoption is growing globally, but its economic benefits are unevenly distributed. While 85 to 90 per cent of the value in traditional ICE manufacturing remains within Europe, only 50 to 60 per cent of the value of battery-electric vehicles does.

Batteries alone account for more than a third of a BEV’s total value, and they are overwhelmingly manufactured outside of Europe. Without significant investment in battery production and supply chains, Europe risks becoming a downstream market rather than a centre of innovation and manufacturing.

Consumer expectations have also shifted. The McKinsey Mobility Consumer Survey found that 59 per cent of EV buyers and nearly half of traditional car buyers anticipate an increased reliance on in-car connectivity. More than half of all consumers will only purchase a vehicle if it offers seamless smartphone integration, either as a free feature or a paid upgrade. Premium customers now expect an intuitive, personalised digital experience, so for OEMs, the challenge is no longer just about vehicle performance but about how well they can integrate software and user interfaces into their products - and at a more fundamental level, how producers can cater their vehicles to adapt to customer needs.

”In China, 53 % of customers said they would switch brands for better ADAS features. This is a warning sign: in an industry where differentiation is increasingly defined by software, Europe risks falling behind”

The rise of software-defined vehicles is another crucial battleground. McKinsey estimates that the global market for automotive software and advanced driver assistance systems (ADAS) will be worth around €165 billion ($179.9bn) by 2035. While European manufacturers have incorporated some ADAS features, they are increasingly outpaced by Chinese and US competitors.

In China, 53 per cent of customers said they would switch brands for better ADAS features. This is a warning sign: in an industry where differentiation is increasingly defined by software, Europe risks falling behind.

The expansion of Chinese vehicle production

Finally, the report focuses on Chinese automakers having transformed from niche players to global challengers. While vehicle demand in Europe and North America has shrunk, China’s middle class is expanding. Between 2023 and 2035, the number of Chinese consumers able to afford a car is expected to more than double, leading to a projected 2 per cent annual growth in demand.

Chinese brands have capitalised on this, expanding their domestic market share by 18 per centage points between 2020 and 2023. At the same time, European OEMs have lost five per centage points. Now, these Chinese companies are aggressively targeting European markets. While some European automakers have sought partnerships with Chinese firms to gain access to battery and software technology, a recent McKinsey survey found that only 11 per cent of European suppliers see China as a priority market for future growth.

What Must Change? How European OEMs and tier-suppliers must move to recalibrate their advantage

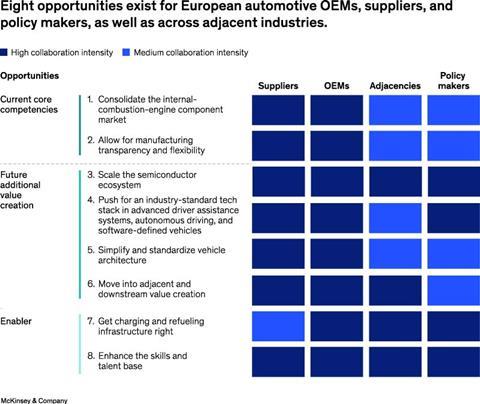

If Europe is to regain its competitive edge, it must move decisively. McKinsey’s report outlines several key imperatives:

1. Enhancing manufacturing agility and transparency

According to a 2024 ACEA and CLEPA survey, 31per cent of industry respondents identify increased adaptability across production lines as a key response to demand fluctuations. To manage the transition from internal combustion engines (ICE) to battery electric vehicles (BEV), OEMs are refining their manufacturing systems to accommodate both powertrain types within a single platform.

A more integrated approach between OEMs and suppliers can further enhance this flexibility. Mckinsey points to flexible manufacturing approaches, where simplified programmable automation allows production lines to switch seamlessly between different vehicle technologies at scale. Transparent forecasting, achieved through enhanced digital connectivity, can reduce lead times and improve supply chain stability.

Standardising component requirements and increasing modularity across vehicle platforms would enable suppliers to optimise production, reducing R&D and operational investment costs. For instance, moving away from exclusive supplier agreements could increase efficiency, while modularised components such as steering motors would enable common manufacturing processes across multiple brands.

2. Consolidating the ICE component market

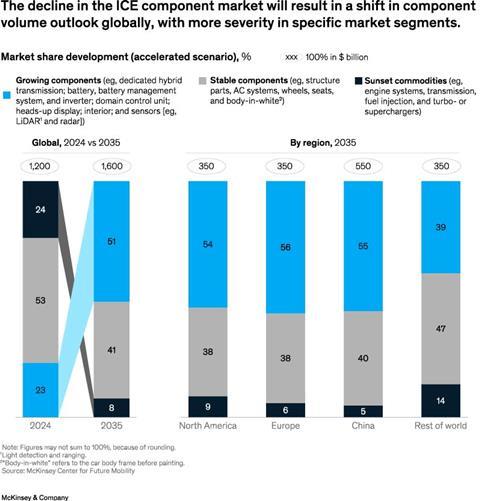

The decline of ICE vehicles is inevitable. With 40 per cent to 50 per cent of an EV’s components—including batteries and semiconductors—falling outside the traditional automotive supply chain, the demand for legacy powertrain parts is dwindling.

McKinsey analysis projects that €230 billion ($297.3bn) worth of ICE components, primarily produced in Europe, will become obsolete as BEV adoption accelerates. ICE-related market share is expected to shrink from 24 per cent of the total automotive component market in 2024 to just 8 per cent by 2035.

To mitigate the economic disruption, OEMs and suppliers must forge resilient partnerships that optimise cost structures and stabilise demand. Long-term contracts and volume agreements across the supply chain can prevent abrupt cancellations, which drive up costs and complexity. Coordinated consolidation of ICE component production—through strategic realignments and the relocation of key manufacturing assets—can preserve economies of scale while facilitating an orderly market transition.

”By 2028, only 8% of new global front-end semiconductor capacity will be added in Europe, compared to 52% in China and 10% in the United States”

3. Strengthening Europe’s semiconductor ecosystem

Resilient access to semiconductors is pivotal for European automakers, yet the region remains overly reliant on foreign suppliers. As of Q1 2024, Europe fulfils only 70 per cent of its semiconductor demand with local front-end supply. The forecast is equally concerning: by 2028, only 8 per cent of new global front-end semiconductor capacity will be added in Europe, compared to 52 per cent in China and 10 per cent in the United States. Meanwhile, China is expected to account for 60 per cent of the global capacity build-up of mature automotive-grade semiconductor nodes (22 nanometres or greater).

While full self-sufficiency in semiconductor production is neither realistic nor necessary, strategic investments in wafer fabrication, equipment, and backend processing could reinforce Europe’s market position. A projected $205 billion investment will be required by 2028 to maintain competitiveness in front-end chip manufacturing.

More crucially, Europe must bolster its semiconductor start-up ecosystem to rival the US and China, both of which have attracted nearly twice as much capital into semiconductor companies since 2010. Collaboration between OEMs, suppliers, and policymakers will be essential to secure supply agreements with leading semiconductor manufacturers, ensuring stable production while accelerating domestic capacity expansion.

”30% of European industry executives view ADAS performance as a critical differentiator by 2035”

4. Standardising advanced driver assistance systems and autonomous vehicle software

European automakers risk ceding leadership in advanced driver assistance systems (ADAS) and autonomous vehicle (AV) technology to Chinese and US competitors. New entrant OEMs outside Europe dedicate 43 per cent of their R&D workforce to software development, compared to just 16 per cent among European incumbents.

McKinsey found that since 2010, US investment in ADAS start-ups has outpaced Europe by a factor of 3.5. Meanwhile, 30 per cent of European industry executives view ADAS performance as a critical differentiator by 2035.

To bridge this gap, OEMs and suppliers must collaborate on a unified ADAS technology stack. Standardised interfaces—such as middleware abstraction layers and security frameworks—can streamline integration and accelerate time-to-market. Joint initiatives in data collection and AI training models would further enhance safety by leveraging a broader range of real-world driving scenarios.

Regulatory harmonisation on data sharing and system interoperability could also establish a level playing field for autonomous vehicle deployment across Europe.

”Only 42% of European R&D employees meet required proficiency levels in digital and analytics, compared to 51% in North America”

5. Redefining vehicle architecture for cost efficiency

Innovations in vehicle architecture hold the key to reducing manufacturing complexity and enhancing sustainability. By 2035, 35per cent of all new vehicles are expected to feature zonal-based electrical/electronic (E/E) architectures, which consolidate control units into fewer high-performance domain controllers. This shift could reduce material costs by 10per cent to 20per cent, lower engineering expenses, and accelerate development timelines by 20per cent to 30per cent.

In addition to E/E restructuring, new manufacturing techniques such as gigacasting—where large aluminium body structures are cast as single components—can drive down costs. AI-powered design optimisation and end-to-end supply chain automation further bolster cost competitiveness. However, success requires an industry-wide commitment to standardising component commonality, recycling processes, and material reuse, such as aluminium wiring and high-voltage battery cell chemistry.

”New OEMs outside Europe have a disproportionately high share of software-focused R&D talent (43%), whereas European incumbents still prioritise hardware”

6. Expanding into adjacent and downstream value streams

The automotive industry’s transformation is unlocking new revenue opportunities in adjacent markets. By 2035, the total value pool for energy infrastructure (including charging services) is expected to reach €370 billion ($400.9bn)while shared mobility services will grow to approximately €900 billion ($975.3bn). Digital services, including predictive maintenance and in-car entertainment, will contribute another €180 billion ($195bn).

OEMs and suppliers must rethink their market strategies to capitalise on these trends. Joint data-sharing initiatives could facilitate the monetisation of connected vehicle services. Cross-industry alliances may also be necessary to scale emerging business models, such as vehicle-to-grid energy solutions and fully interoperable charging infrastructure.

Read more European automotive production stories

- Automakers win reprieve on 2025 EU CO2 vehicle emissions targets

- Will Volkswagen’s surplus German plants become Chinese production operations?

- The urgency for enhanced Design For Manufacture (DFM) in vehicle production

- European auto suppliers keep slashing jobs amid EV slump

7. Accelerating infrastructure investments for electrification

The expansion of EV charging and hydrogen refuelling networks is a prerequisite for sustainable mobility. McKinsey estimates that Europe must invest €130 billion ($140.9bn) to install 2.5 million public EV charging points by 2030, up from 1 million today. Hydrogen infrastructure requires an additional €14 billion ($15.2bn) in generation capacity and €6-7 billion ($6.5bn-$7.6bn) for 1,500 hydrogen refuelling stations.

To ensure efficient capital deployment, industry stakeholders must align on common standards and pricing structures. Transparent pricing across charge point networks, streamlined permitting processes, and grid modernisation efforts will be critical to fostering a viable charging and refuelling ecosystem.

”Without urgent action, the continent risks becoming a secondary player in the global automotive market, with fewer high-value jobs, lower profitability, and diminishing influence”

8. Strengthening the European automotive talent pipeline

The transition to electric and software-defined vehicles demands a workforce equipped with new skills, yet Europe is falling behind in critical talent areas. Mckinsey found that only 42 per cent of European R&D employees meet required proficiency levels in digital and analytics, compared to 51 per cent in North America.

Meanwhile, new OEMs outside Europe have a disproportionately high share of software-focused R&D talent (43 per cent), whereas European incumbents still prioritise hardware.

To address this skills deficit, OEMs and suppliers must collaborate with universities and training institutions to develop targeted reskilling programmes. European initiatives such as ALBATTS and the Automotive Skills Alliance provide blueprints for workforce transformation. Meanwhile, joint OEM-supplier training partnerships can ensure that upskilling efforts align with industry needs. Notably, the European Battery Alliance has already reskilled over 100,000 workers to meet the growing demand for battery expertise.

A critical moment for Europe’s automotive production industry

The McKinsey report makes one thing clear: Europe’s automotive industry is at an inflection point. Years of leadership in design and engineering will not guarantee future success. Without urgent action, the continent risks becoming a secondary player in the global automotive market, with fewer high-value jobs, lower profitability, and diminishing influence.

The path forward is difficult but not impossible. European manufacturers must embrace innovation, invest in software and electrification, and build strategic partnerships.

Policymakers must support this transition by fostering a competitive investment environment and ensuring that regulatory frameworks encourage rather than hinder industry growth. If these steps are taken, Europe can reclaim its position at the forefront of automotive excellence. But the window for action is closing - fast.

No comments yet