A flexible solution

By Nick Holt2019-07-16T15:27:00

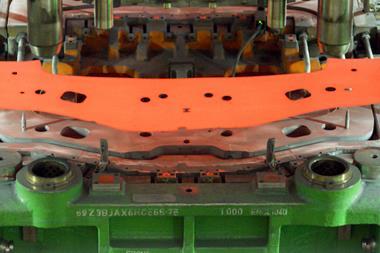

Metal-component supplier Gestamp outlines the challenges ahead and its strategy for meeting higher demand for lightweight parts

With almost all the major OEMs adjusting their manufacturing operations to produce more electrified vehicles, the huge supply chain is also having to quickly adapt to new demands for higher performance and lower costs. Much has been made of the huge investments being ploughed into electric vehicle production but arguably the tier suppliers are most exposed to these changes, given the investment required in new technologies and the lack of certainty regarding volumes.

At a recent media event held at the company’s Bielefeld facility in Germany, Gestamp’s CEO, Francisco Riberas outlined the tier supplier’s future strategy, beginning with the global market context. Riberas commented on the slowing growth of the automotive market, increasing trade tensions affecting the US and Chinese markets, plus the uncertainty in Europe regarding how and when the UK would leave the EU. All of these factors are challenges coming at a time when the automotive industry is required to invest heavily in a new generation of vehicles.