As the automotive industry seeks to reduce costs and improve efficiencies and productivity, there are a growing number of new partnerships being formed. Experts from automation specialist Magswitch discusses how these new relationships are proving more necessary and beneficial than previously.

To get some insights into what a technical partnership looks alike and how they can deliver great benefits, AMS spoke with Cengiz Kizilkan, President Global Sales Automation & Executive Director Europe for Magswitch Technology, and Markus Oerder; CEO of Magswitch Technology Europe and until end of June also General Manager of Univer.

Could you outline the partnership between Magswitch and Univer, how you will work together and what you offer each other?

Cengiz Kizilkan (CK): The main part of this partnership between Magswitch and Univer is that by combining our expertise and product portfolios in single sided clamping technology and end of arm tooling (EOAT), respectively, we can provide a lot more services and products for complete end of arm tooling systems, fixtures and even small cells to our OEM customers who frequently request this from us.

It was obvious to Markus and me that we need to go a little bit deeper into the conversations about this opportunity and one and a half years later, here we are, everything is signed and done. We are looking forward to meeting the upcoming challenges and realising the growth potential.

Markus Oerder (MO): From my side, I’ve worked in the automotive sector for 25 years, and I see a lot of companies looking for synergies and joint ventures in projects. When the initial meeting was proposed by a member of my team working with Magswitch I thought there might be some competitive conflict of interest, but in the meeting my colleague presented his idea of this technology and immediately I understood how this partnership would work.

It was not thinking about how we can sell our products, instead we found an idea about how to improve the market. Through the synergy of the components, the magnet technology from Magswitch combined with our expertise in EOAT, we understood that we could bring something new to the market. And this was the main step in starting this joint venture.

“With more joint ventures, carmakers are becoming bigger companies and they require suppliers to be able to provide full-service support, at a global level” – Markus Oerder

How important are technical partnerships like yours?

MO: I’m CEO of the company and my responsibility is to look to the future and how we can improve our company, but in this function, it’s also very important to look at what is the market doing. What we see in automotives is that we have been working in the same way, the production way of working, for a long period of time with little change to the process. So, I think it’s important to find partners who look to see how things can be improved, what can we change, what kind of synergies do we have.

Like most of the other companies, we see the synergy in a partnership, combining our experience and technologies together to find a new way to improve the business. Another consideration is that individually we are too small. With more joint ventures, carmakers are becoming bigger companies and they require suppliers to be able to provide full-service support, at a global level. So Univer’s partnership with Magswitch allows us to offer technologies and services on a bigger scale.

Focusing on bodyshop operations, because this is your area of expertise, how are the requirements of this area of production changing? Are there still challenges with legacy systems?

CK: You’re right, there are a lot of legacy systems still in use, and this can make the introduction of new technologies difficult, when [as an individual company] you do not have the capability to deliver the level of support required. It’s not just about the engineering phases, but also being on site, and this is where the fit with Univer really works. Having a team which can deliver full EOAT solutions, full size fixtures, on site integration and debugging support, will allow us, together with our Magswitch technologies, to support these rapidly changing and technologically demanding installations. And much more effectively deliver the solutions for mixed powertrain and dedicated EV related manufacturing systems.

Our challenge had been that it was not possible for us to achieve the necessary organic growth which was needed for us to support the integration of our technology worldwide. With Markus and his team, as experienced providers of full solutions it is now giving us the opportunity to accelerate the introduction of these new technologies.

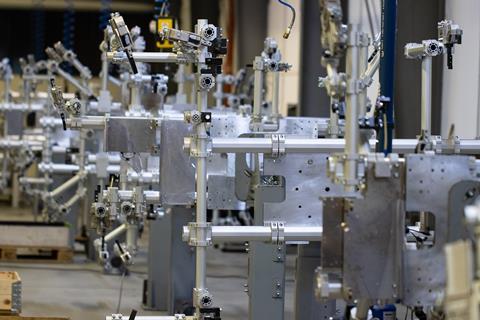

For example, Markus and his team have been developing these solutions, and they have installed a small, complete line for EV battery manufacturing. There are also opportunities around the electrification of the production lines themselves as the industry looks to reduce reliance on compressed air systems. So, whatever the technology is, you also must deliver the support structure and we are now able to do this thanks to the increased capacity and capabilities from Markus and his team.

Are you seeing the relationship between you and OEM and tier clients changing? Are you working more upstream with them in the development of their processes and operating as more of a solutions provider?

MO: Yes, this will change our position and the relationship to the market tremendously. Especially with the line builders and OEMs. Univer is a family-owned company founded in 71, and my team in Germany are responsible for implementing these products and solutions into the automotive market. We are focusing on developing and improving our products and improving our production, to reduce cost, to be able to deliver on time and to be flexible in meeting the different demands from our OEM customers.

To do this we have built up a very technical team and are able to cover the needs and demands of the automotive sector. Our products offer modular tooling and the latest clamping technologies but the basic processes in [automotive] manufacturing have remained more or less the same, so the big challenge is to offer an innovative solution for these processes.

We recognised a way to do this with the Magswitch technology, with the magnetic system you approach the process in a different way. You can change the technology and the way you’re working. We can reduce the number of robot couplers and we can make much smaller production lines.

The Univer Automotive team is moving to Magswitch. So, we will not just be a partner, it will be a merger of the two companies. We will operate as Magswitch Technology Europe in the future as one company. That doesn’t mean we will leave Univer behind as the development and production of the products will be more focused in our headquarters in Italy.

And coming back to your question, for me and Cengiz, with 25 years experience in designing and planning body shops, we are 100% sure we can change the relationship to OEMs because we will offer a completely new way of production and offer a lot of benefits to our customers.

“With new EV powertrains and vehicle architectures it won’t always be possible to use the established assembly methods which have been developed and improved over the past decades by each OEM” – Cengiz Kizilkan

Cengiz, if I can come to you because I know you’ve been very busy going into some of the major OEMs and speaking with them about the Magswitch method. Could you explain what the Magswitch method is and the sort of change in approach that carmakers either are making or need to make in order to make their bodyshops more flexible?

CK: So, using the existing [production] systems in a different way for upcoming models, depending on the differences in the products they would like to build, is a big challenge for most of the OEMs. With new EV powertrains and vehicle architectures it won’t always be possible to use the established assembly methods which have been developed and improved over the past decades by each OEM. This can be a limiting factor in the introduction of new platforms into the existing lines.

In a bodyshop you must consider that each cycle time can be split into value-added and nonvalue-added time. Right now, on a conventional manufacturing line, the split is approximately 35% nonvalue and 65% value-added time. Value-added means everything which is contributing to the assembly process. So, for example, product handling times of parts of vehicle bodies, which are transferred from A to B, are considered as nonvalue-added time.

With the Magswitch method we are focussing on speeding up the clamping and pick-up process, reducing the weight of full EOATs and fixtures, so there’s less mass to transfer and faster movement. All this combined with a single sided clamping system, which allows you to use a smaller gripping and fixturing tool than the outline of the part or the assembly, is helping us to reduce nonvalue-added times dramatically. We can go down to 10-15% nonvalue-added time, which allows the equipment (robots) that is adding value to the process, spot welding, etc., to have more time in one cycle, which means you are packing more process into a station, which allows you to potentially remove or reallocate equipment. These savings can be up to 27% on a full-scale body shop as an initial investment. At the same time, floor space can reduced, because of less equipment, by 15-20%. And the technical availability of a manufacturing line goes up. Also, if you have less equipment, less failure times will occur.

We’re seeing a lot of brownfield investment from the OEMs, adding new dedicated lines or trying to flex lines to cope with different powertrains and different architectures. Are they now more receptive to what you’re presenting to them, to changing their approach to some of the production processes?

MO: I think the mentality in the automotive sector is still the same as perhaps five or 10 years ago. It’s always difficult to change because you must invest in something new and with the scale of vehicle production it’s harder to take a risk. But I think the pressure from the market is growing and with electric vehicles, production is changing, as are the cost structures, and the market is very competitive. So, manufacturers are having to look at new ways of managing production of new vehicles, improving processes and reducing costs. We are already working with customers who are now able to invest in our technologies and open to adopting a different approach.

Looking forward, what do you see as the challenges and the solutions for OEMs, to improve processes and efficiencies?

CK: New technology is always difficult to implement, especially in a brownfield plant. The equipment is already purchased, installed, and working on the current models. It doesn’t help the OEM if we cut the last two robots out of a line, because the conveyor system needs to be fed by the last robot. These are the types of challenges that can limit brownfield operations implementing big improvements. Their approach to this is to use single operations to do try-outs and do their own proof of concept of new technologies.

An important part of our discussions with customers is when to introduce the new technologies. We have a customer who, for example, wants to reuse 80% of their existing bodyside lines, but for technical reasons they also need a new assembly line for closures. So, they will use this opportunity to prove the concept of the Magswitch method by installing partially new installations rather than re-fitting the complete line.

However, there are circumstances where applying Magswitch technologies using this approach wouldn’t make sense, and as consultants as well as suppliers, we would advise the customer where to focus on improvements to a line. We would advise on maximising the utilisation of the existing equipment in a way that informs the OEM team so they can learn and implement it to the next generation bodyshop. This is a lot of our work at present and the additional capabilities we have with Markus and his team will allow us to do more of the proof of concepts.

Find more about Magswitch here