UK car production drops 8% in first half of 2024

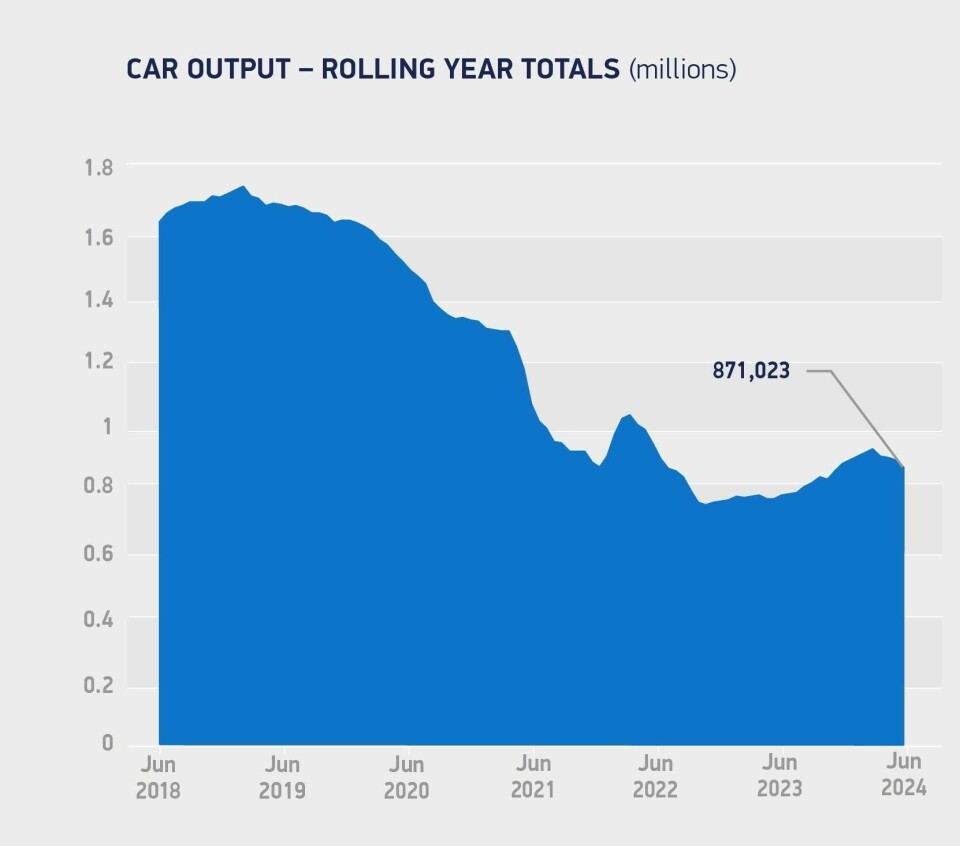

Car production in the first six months of 2024 has dropped by 7.6%, according to new figures released today by the Society of Motor Manufacturers and Traders (SMMT).

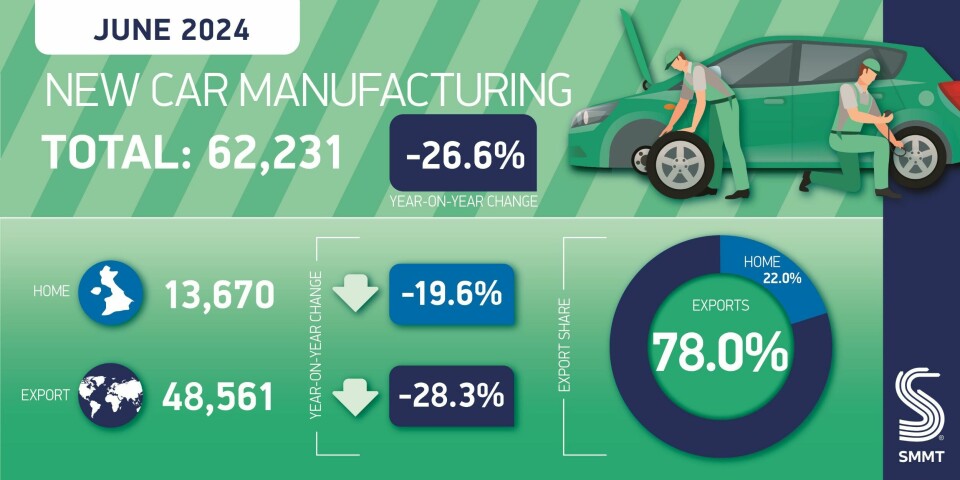

So far this year, 416,074 units have been produced in UK factories, down 34,094 compared to the first six months of 2023. June’s output affected the overall output in the first half of the year due to a 26.6% decline caused by multiple model changes in the shift towards EVs, requiring retooling of manufacturing lines.

Despite the transition to EVs, battery electric, plug-in hybrid and hybrid production was down 7.6% to 157,224 units, in line with overall volumes.

Overall output for the UK market was up 17.7% to 106,157 unites, but this couldn’t offset a 13.9% decline in production for export, with more than seven in 10 cars made destined to be exported. Most of these exports (55.4%) are destined for the EU, at 171,745 unites, while US, China, Turkey and Australia accounted for a combined 29.4% of exports.

“The UK auto industry is moving at pace to build the next generation of EVs, a transition that can be a growth engine for the entire British economy,” said Mike Hawes, chief executive, SMMT.

“The new government’s commitments to gigafactories, a decarbonised energy supply and a faster planning system will help boost our competitiveness and sustain employment in a sector that delivers well paid, skilled jobs nationwide,” he added. “Amid fierce global competition, however, industry and government must work quickly to deliver those commitments, creating an industrial strategy that enables the growth the economy craves.”

Looking ahead, the SMMT expects the transition to EVs to impact UK light vehicle production, which is set to decline 9.3% this year to around 910,000 units, as structural changes are undertaken in British plants.

By 2028, output is expected to recover to just over 1.1m units when more than half of all UK car and van production is set to be zero emissions, and reach 1.167m by the end of the decade.

The SMMT report said: “With the right political, industrial and economic conditions, by 2035 the UK could cumulatively have produced more than 9m zero emission light vehicles, 600,000 more than anticipated under current outlooks and worth over £290 billion [$373.5 bn] at factory gate prices.”