Megacasting: a new frontier or unfounded flare-up for automotive production?

From Tesla to Volvo, Megacasting is gaining traction. While it offers efficiency and sustainability benefits, challenges remain. Stellantis, however, remains unconvinced.

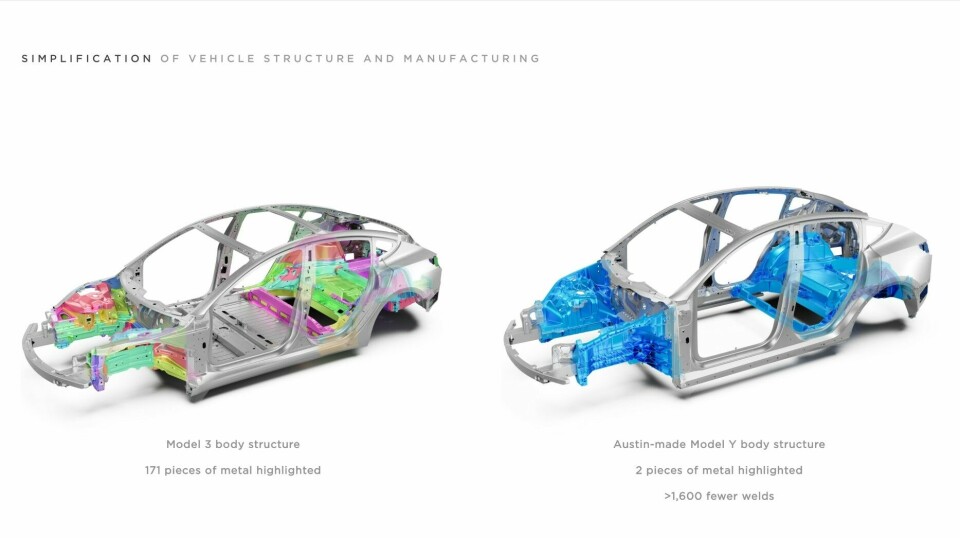

In many ways, automotive production works to counterbalance opposing forces; now finding itself simplifying material processes to offset growing complexities that seem to be at open variance with it. The minimisation of parts has therefore quickly become a valuable centrepiece, as well as a necessary solution for vehicle manufacturing for this very reason. This complexity has been further enhanced by the shift to Electric Vehicles (EVs), prompting fierce competition as OEMs battle to keep their costs down and their production processes optimised.

Mass use of Megacasting, (or ‘Gigacasting’ - depending on whose definition you employ), was first pioneered by Tesla, which started using a custom ‘Giga Press’ in late 2020 to make chassis parts for the Model Y.

And the approach has since, quickly spread throughout automotive production at a global level. But we also know that despite apparent homogenisation in many production processes, the most flexible and versatile OEMs will craft their operations with adaptation in mind; fit for their own purposes, and determined by what’s necessary (and pressing) at the time. So to what extent is Megacasting a one-size-fits-all solution?

AMS interviewed Volvo Cars’ Anirudha Shivappa, Advanced Engineering Leader, Body Structures, to get an idea of what the OEM is doing in this area, and why. Volvo Cars is building a new foundry in its Torslanda car production plant in Gothenburg, Sweden, where it will build its next generation of fully electric cars. The foundry will be connected to the body shop and deliver parts at the same cadence as the car production.

Shivappa explains that with Megacasting, Volvo Cars will replace around 100 stamped parts with a single cast part, meaning that it can eliminate a high degree of complexity related to production, assembly, as well as supply chain. Shivappa says Megacasting is an intelligent move for the OEM since it also allows for more design flexibility throughout a car’s lifetime – opening up the possibility for constant updates to vehicle architectures.

“We have done some internal study concerning Tesla’s Gigapress. Today, we don’t see the benefit.

“The technology also helps us improve in terms of material utilisation,” he says. “By eliminating 100 stamped parts, we eliminate the scrap produced in each stamping production, which tends to amount for around 50% of the blank weight. We remelt all the casting scrap in-house, thereby achieving 95% material utilisation in our process.

Aluminium production is very energy-intensive and can consequently come with a high carbon footprint. We counter this by committing to source aluminium with a low carbon footprint, making Megacasting less carbon-intensive than a welded steel rear floor.”

So clearly, the material consideration of aluminium usage (and related sustainability considerations) have influenced the carmaker’s approach to Megacasting. Shivappa says, “this has been an important consideration since 2020, when we started to investigate the potential of Megacasting in our future operations. At Volvo Cars, we believe in choosing the right material for the right application.

“The Megacasting business case showed huge benefits, such as reducing manufacturing complexity and potential weight savings. The sustainability benefits coming from the use of low-carbon footprint aluminium, and simplified logistics, made it clear that this was a step in the right direction.” On the supply side, the time taken to transform raw material into a finished product that is ready for assembly in the car will be shortened from months to days. This obviously also has an immediate impact on production timelines.

The challenges of implementing Megacasting into production

But application of the production tech is not without its challenges. “The biggest challenge,” says Shivappa, “is that it is still new, both in the industry and for Volvo Cars. To progress, we need to swiftly build our in-house knowledge and competence in various areas such as material quality, simulation capabilities etc. We have also worked to ensure we have sufficient time for commissioning and ramp up, to learn, address challenges, and get ready for production.”

“By eliminating 100 stamped parts, we eliminate the scrap produced in each stamping production, which tends to amount for around 50% of the blank weight. We remelt all the casting scrap in-house, thereby achieving 95% material utilisation in our process.”

Stellantis prefers fast implementation over the complexity of Gigacasting

In terms of this novelty, and the challenges that come with any incipient technology, not all OEMs are convinced of its mega-benefits.

In a roundtable discussion together with AMS focused on manufacturing innovations, Stellantis’ chief manufacturing officer, Arnaud Deboeuf, made it clear that Gigacasting was not something that the OEM would be pursuing. At the carmaker’s annual ‘Factory Booster Day’ – an annual gathering of suppliers and innovators focused on addressing manufacturing challenges – Deboeuf made it clear that the carmaker was more interested in solutions that could be implemented quickly, and without major factory rework, rather than those that might require considerable redesign and implementation costs.

Deboeuf says, “What we are sharing today is that we are doing step-by-step improvements, super-pragmatic, based on the problems we at Stellantis have. Our clients [and plant managers] are raising problems, and our partners are bringing solutions. We implement them quickly and with a global view.”

According to Jean-Christophe Marchal, senior vice-president of vehicle process engineering at Stellantis, the carmaker prefers digitalisation that plant managers can implement directly without large capital expenditure or large teams required for installation. “We are looking for solutions which the plant managers love, want to implement, and can manage by themselves,” he said. “We don’t want process engineering teams to spend time adapting or modifying the path for equipment or containers, and we want to avoid digging or building anything on the shop floor.”

Furthermore, Stellantis has not found benefits for gigacasting that outweigh other complications and cost, for example related to investment, as well as implications for repair and aftermarket of body parts.

Deboeuf says, “We have done some internal study concerning Tesla’s Gigapress. Today, we don’t see the benefit. So today, it might be good for Tesla—I don’t know—but for Stellantis, we just don’t see the benefit.

“We don’t see the benefit in manufacturing, we don’t see the benefit in CapEx, and we don’t see the benefit in after-sales. So today, we are not taking this direction.”

Volvo Cars considers that what it is seeing now, is the first generation of rear floor Megacasting. “We have a journey ahead of us to learn, improve and optimise it,” says Shivappa. “We are also investigating further use of Megacasting, both internally and with external partners such as universities. Put simply, if a Megacasting concept can deliver all the performance requirements with a good business case for any new application, it will definitely be evaluated and developed.”

Does Megacasting have a future in automotive production?

The die casting industry is making rapid developments in Megacasting for automotive production, with machines up to 20,000 tonnes being studied for development. Applications such as front structure, body side, battery tray and even full underbody were showcased at the Euroguss Die Casting industry fair this year, and many of these concepts are likely to materialise in the coming years. Significant improvements in process-technology and efficiency are set to further reduce the production costs of Megacasting as a vehicle production solution.