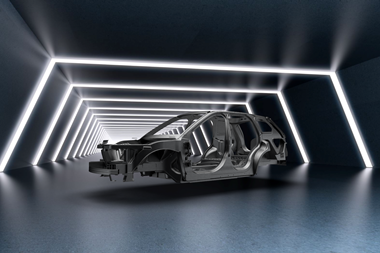

By producing stronger and more versatile materials, steel-makers are helping OEMs to do more with less

The steel industry is innovating at a furious pace – and it needs to. Its long-standing dominance in the automotive industry is coming under threat from a variety of lightweight alternatives. In response to increasingly stringent emissions and fuel-efficiency regulations being introduced in various regions of the world, all OEMs are evaluating the use of lightweight materials such as aluminium and carbon-fibre-reinforced plastic (CFRP) to reduce the structural weight of their vehicles. These materials must be strong enough to protect passengers in the event of a collision and cheap enough for use in mass production.

The steel industry is innovating at a furious pace – and it needs to. Its long-standing dominance in the automotive industry is coming under threat from a variety of lightweight alternatives. In response to increasingly stringent emissions and fuel-efficiency regulations being introduced in various regions of the world, all OEMs are evaluating the use of lightweight materials such as aluminium and carbon-fibre-reinforced plastic (CFRP) to reduce the structural weight of their vehicles. These materials must be strong enough to protect passengers in the event of a collision and cheap enough for use in mass production.

Some OEMs have already made the jump. In 2014, Ford switched from steel to aluminium for the production of the body of its market-leading F-150, and in 2015 BMW started using CFRP in the spaceframe of its 7 Series sedan. In response, steel-makers have been investing significantly in producing stronger and more ductile grades of the metal, allowing carmakers to do more with less material.

The executive vice-president of global automotive at ArcelorMittal, Brian Aranha, says: "[Ford’s switch] was a bit of a surprise for us. However, we see steel’s influence over the automotive industry remains firm. Over the next ten years, steel will regain ground lost to materials like aluminium." Crucially, steel currently has a massive advantage over both aluminium and CFRP: it is much cheaper. Aranha continues: "Our steel solutions can reduce cost as well as weight, and where there are cost increases, they are currently below €1.5 ($1.7) per kilogramme of weight saved.

Conversely, aluminium solutions can mean cost increases of between €3 and €15 per kilogramme of weight saved, depending on the application." As such, steel still accounts for around 60% of the weight of an average car, and OEMs have had significant success lightening their vehicles using the material. This was confirmed at the 2016 North American International Auto Show in January 2016, where around 45 new production vehicles and concept cars were unveiled during the press and industry preview week.

AHSS dominating the marketThe chief marketing officer for ArcelorMittal North America and global automotive, Brad Davey, said at the time: “If you look around [the show floor], what you see is new vehicle after new vehicle where the dominant material is advanced high-strength steel [AHSS]." For example, the 2016 Honda Civic – the North American Car of the Year – features a body comprising 59% high-strength steel and 14% ultra-high-strength steel (UHSS) – up from 55% and 1% respectively on the previous model – enabling a 31kg reduction in unibody weight despite its larger size and higher stiffness. New vehicles featuring extensive steel included: Chevrolet’s Camaro, Malibu and Cruz; the Chrysler Town & Country; Nissan’s Murano, Maxima and Titan; the GMC Acadia; four Mercedes classes – M, GL, C and GLE; the Lexus RX350; and BMW’s X3, 4, 5 and 6 Series.

"Over the next ten years, steel will regain ground lost to materials like aluminium" – Brian Aranha, ArcelorMittal

Steel-intensive vehicles also dominated the 2016 Car of the Year awards. The winner was the new Opel Astra, 200kg lighter than its predecessor. Extensive use of AHSS in the body-in-white (BIW) and structure has cut the weight of the vehicle by 20% (77kg) alone. Another 50kg was saved by using high-strength steel and UHSS in the chassis. Furthermore, the use of UHSS and lightweight polyurethane foams reduces the combined weight of the Astra's front and rear seats by another 10kg.

The runner up in the 2016 Car of the Year awards was the Volvo XC90; around 40% by weight of this vehicle's body is made of hot-stamped boron steel (Usibor from ArcelorMittal). Hot stamping helps to solve a key problem with steels; as strength increases so formability decreases. Its use will increase significantly in the future, but it is more expensive to carry out than conventional cold-forming processes.

Announced in 2014, ArcelorMittal's Fortiform range of ductile AHSS has been developed specifically for cold stamping, and could reduce the weight of components now produced using dual-phase steels by up to 20%. Fortiform 1050 is the first product in this range to be available on the market, and the first serially produced vehicles to use it will roll off assembly lines in 2017. As a result of its high tensile strength, Fortiform 1050 steel is particularly suitable for the production of parts that must absorb energy in the event of impacts. Samples of two other grades, Fortiform 980 and Fortiform 1180 are currently available to manufacturers for testing.

Meanwhile, NanoSteel – a family of nanostructured ferrous alloys developed by a US company of the same name – demonstrates elongations of over 20% at ambient temperatures, which presents opportunities for cold forming that are impossible using current AHSS and UHSS grades. The president of automotive at NanoSteel, Craig Parsons, says: "Ford’s decision to switch from steel to aluminium for the body of the F-150 was the best thing to happen to NanoSteel. It brought the conversation about automotive materials to a wider audience and helped to focus attention on the trade-offs that are present in any material choice. It also accelerated the steel industry’s desire for more alternatives to aluminium, which has opened opportunities for our organisation."

Licensing steel technologyNanoSteel provides its technology to steel producers, such as launch partner AK Steel, on a royalty-free basis. The material is then licensed to OEMs for use in their vehicles. Parsons continues: "This model gives the OEMs the opportunity to have a very similar NanoSteel sheet product from multiple mills around the world. With the advent of global platform designs, a supply chain capable of supporting production in every region of the world is a tremendous advantage to the OEMs."

The new Opel Astra is 200kg lighter than its predecessor due to the extensive use of AHSS

The new Opel Astra is 200kg lighter than its predecessor due to the extensive use of AHSSBy using a single platform for numerous different models, carmakers are able to minimise investments in the design process through to vehicle production, while maximising profit margins and maintaining a limit on the costs passed on to the consumer. The director for automotive product applications at ArcelorMittal global R&D, Blake Zuidema, says: "Up to this point, lightweight vehicle solutions have really focused on individual vehicles. The problem is that most OEMs don't build individual vehicles. They use multi-vehicle platforms that include many different styles, sizes and powertrain options."

In response to this trend, ArcelorMittal started developing its S-in motion range of steel-intensive vehicle platforms, which highlight the weight-saving potential of its materials, in 2010. These platforms can be customised by OEMs to meet their requirements. The company recently extended this range to mid-size sedans and SUVs designed for the North American market. The head of the automotive steel solutions design department at ArcelorMittal global R&D Montataire, Olivier Moriau, says: "ArcelorMittal is not a carmaker, but we are ready to share all of these results and adapt the solutions to specific requirements and architectures through co-engineering projects on future vehicles."

Shaving off kilogrammesBy increasing the use of AHSS so that it accounts for over 50% of the body structure – and making extensive application of its Usibor 1500 press-hardened steel, and laser-welded blanks (LWBs) based on Usibor 1500 and Ductibor 500 – the company has managed to reduce the weight of a mid-size sedan by 86kg (23%) in comparison with a 385kg baseline based on popular North American models. Furthermore, the company has shaved 104kg (20%) from the SUV in comparison with the baseline. Through the use of emerging grades – such as Usibor 2000 and Ductibor 1000 press-hardened steels, the highly formable cold-stamping grades Fortiform 980 and 1180, and LWBs based on Usibor 2000 and Ductibor 1000 – ArcelorMittal has manged to reduce the weight of these platforms by a further 16kg for the sedan and 10kg for the SUV. These third-generation grades should be on the market in the next one or two years.

Detailed cost analysis based on a production run of 300,000 vehicles per year and amortisation over five years show that the S-in motion mid-size sedan produced with currently available grades costs only 7% more – or $1 per kilogramme of weight saved – than the baseline version. Moriau says: “Of course, the figures are very different from part-to-part, but globally speaking this very aggressive application of press-hardened steel and AHSS on the body-in-white structure is very affordable."

Steel-makers can customise platforms for OEMs to meet performance requirements

Steel-makers can customise platforms for OEMs to meet performance requirementsIt seems that steel will remain the material of choice for the production of mainstream vehicles in the near term. However, several premium OEMs – notably BMW, Cadillac and Audi – are pioneering the use of a mixture of CFRP, aluminium and steel for the manufacture of their vehicle structures, employing the right material in the right place.

Jean-Luc Thirion, head of global R&D for automotive at ArcelorMittal: “We are quite aware that the automotive material mix of the future will be made of several materials. The key is to determine what proportion the alternative materials will account for, which will be governed by cost. Materials like aluminium and CFRPs are likely to be exclusive to the premium vehicle segment because their cost remains high.” With carbon fibre and aluminium producers working hard to make their materials cheaper, it will be interesting to see for how long this remains the case.