EV transition slowdown and domestic politics challenge the US Big Three in new and unexpected ways

US automakers face a tangled web of tariffs, union issues, and a slowing EV market. The threat of Chinese competition looms large, while the IRA’s complex rules create new challenges. Ford, GM, and Stellantis are each fighting to navigate these obstacles.

In common with their European legacy competitors, notably Volkswagen, the traditional ‘Big Three’ US VMs face similar challenges, notably from Asian OEMs, (especially the Koreans, Hyundai and Kia, who are responding by adding hybrid production in the US), the need to move away from ICE powertrains, and the difficulties of convincing customers to move to EVs, the threat of the Chinese, and an uncertain, changing trade and incentives strategy on the part of the US government. The UAW also has greater embedded power in the Big Three compared to the unions’ power at European and Asian transplants. For some observers, not to mention management at the Big Three, this is a source of competitive disadvantage versus relatively new arrivals from Europe and Asia.

The threat of Chinese EV companies looms large over the industry; the Biden administration has announced a 100% additional tariff on Chinese EVs as a bulwark against imports but the final confirmation of this being imposed, along with other tariffs on components and critical minerals, was delayed twice before finally being confirmed in mid-September.

It is also becoming clear that changes in the regulations behind the Inflation Reduction Act (IRA) mean that it will become increasingly difficult for VMs to qualify for tax credits and other intended benefits of IRA. Chinese content in EV batteries made in the US will continue, typically meaning that they will fall foul of the local content rules to qualify for IRA tax credits; as well as losing these credits for finished vehicles, the cost of producing EVs in the US will rise, with the government’s clear aim behind the scenes to force investment in the domestic EV supply chain.

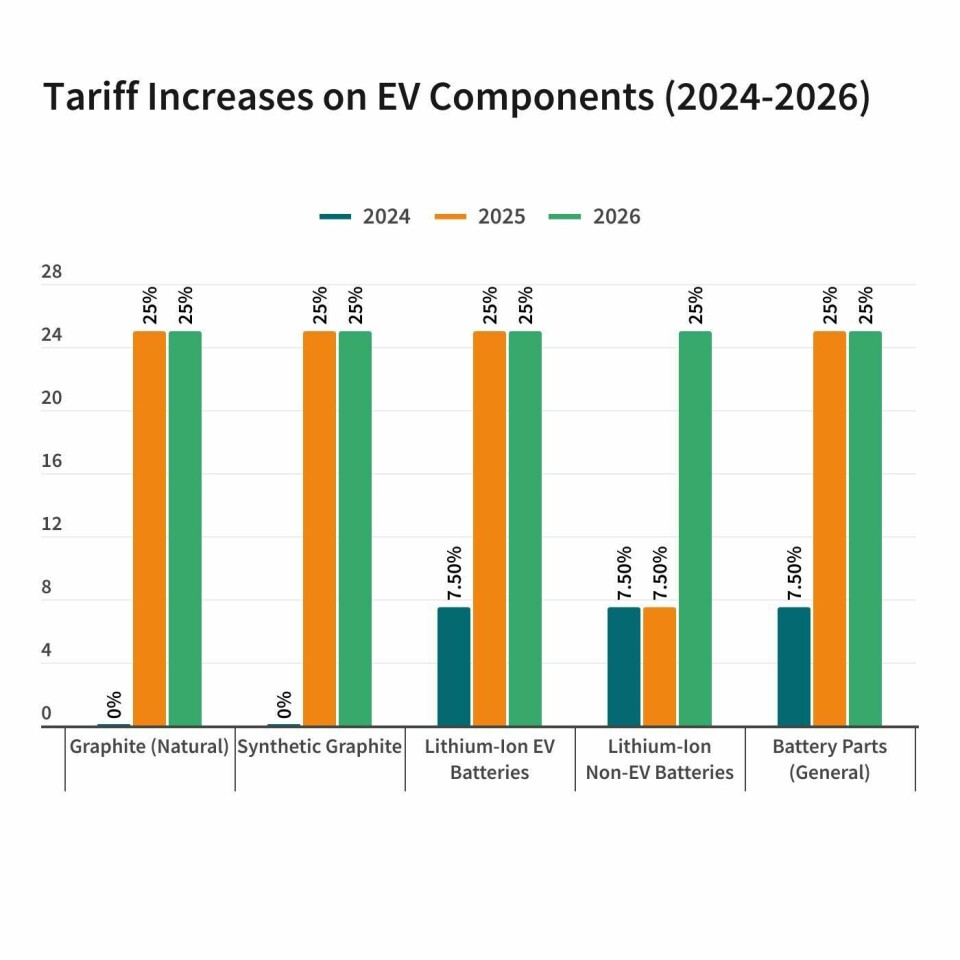

“The tariff rate on lithium-ion EV batteries is also increasing this year, from 7.5%% to 25%, while the tariff rate on lithium-ion non-EV batteries will increase from 7.5% to 25% in 2026”

Material objections: tariffs on graphite, batteries and their impact on EVs

The situation is especially complex with graphite, which is essential for battery EVs. This is sourced almost exclusively from China and is likely to continue to come from China, despite the imposition of tariffs on graphite and other key materials emanating from China. The imposition of these tariffs had been delayed several times under the Biden administration but the tariff rate on natural graphite and permanent magnets will increase from zero to 25% in 2026. The tariff rate for certain other critical minerals, including synthetic graphite was raised from zero to 25% in June 2024.

However, shortly after announcing the additional tariff on graphite, the US authorities also granted a two-year waiver under IRA rules for US-made EVs using Chinese sourced graphite. This means that from January 2025, while paying additional tariffs on any imports of Chinese graphite the EVs using this material will still qualify for exemptions or tax credits under the IRA rules. As if this was not complex enough, the tariff rate on lithium-ion EV batteries is also increasing this year, from 7.5%% to 25%, while the tariff rate on lithium-ion non-EV batteries will increase from 7.5% to 25% in 2026.

The tariff rate on battery parts as a whole has also increased from 7.5% to 25%. Whether all these additional tariffs and loss of tax credits will be sufficient to persuade suppliers and VMs alike to continue to invest substantial sums in US EV battery supply chains more quickly than they might have done, remains to be seen. Whatever US consumers’ collective reaction is, it is clear that the administrative tasks for VMs to comply with or take advantage of IRA tax credits and any other allowances is becoming increasingly burdensome, while the costs of building a fully compliant EV supply chain remains stubbornly high.

”The impact of these background changes on the Big Three VMs, Ford, GM and Stellantis varies from company to company”

Finally, as the US presidential election looms large, there is a fear amongst some VM executives that having allocated more than US$200bn across the industry to EV-related facilities, the basis for this commitment could be undermined if the return of President Trump led to a repeal of the IRA or the election of potential President Harris led to a significant change in current arrangements.

The impact of these background changes on the Big Three VMs, Ford, GM and Stellantis varies from company to company. The financial impact of the slow take-up of EVs, the changes in manufacturing location and model launch timings and other issues are now discussed in connection with the domestic US VMs’ current positions and plans.

Ford – loss-making EVs force a manufacturing allocation rethink

Severe financial problems, reportedly losing US$50,000 on each EV sold; total loss of Ford E division in H1/2024 reached US$2.5bn. This has led to a reappraisal of Ford’s product programme which will focus on hybrid versions of Mustangs, Broncos and Mavericks as Ford tries to lower the average price of its model range. Interestingly Ford has cited competition from the Chinese VMs as a key driver in this new approach. However, in reality Chinese VMs’ volumes in the US are minor, limited to Polestars, and given the 100% additional tariff on Chinese EVs which the Biden administration has introduced, it is somewhat misleading to attribute Ford’s problems solely or even largely to Chinese competitors.

The real issue is the dramatic slowdown in EV sales overall and consumer resistance to the technology; the market is signalling that it wants ICE or hybrid powertrains, and Ford is not the only VM to have accordingly adjusted its strategy, delaying a number of EV programmes and taking a significant financial hit in the process.

One of the specific consequences of the financial losses which Ford is experiencing has led to Ford changing its plans for the Oakville factory in Canada. Originally, Ford had planned for Oakville to make EV crossovers but will now make F series Super Duty pickups with a hybrid powertrain. Notably, any all-new EV investment remains in the US.

”Ford’s main investment in an all-new US$5.6bn domestic plant is for a new full-size EV pick-up which will be built in Stanton, Tennessee”

Moreover, Ford’s deƒcision to cancel the three-row electric crossover programme comes at the cost of a US$1.9bn write down and so has replaced this with a hybrid powertrain vehicle instead. Ford justified the change in plan for Oakville and the decision to relocate investment in EVs to its US plants by stating that much lower-than-expected demand for high-price EVs such as the planned Oakville model means that the programme would not be profitable within a year, as had been expected; hence its cancellation. Ford customers’ reluctance to switch to EVs has been evident for some time in its reduced EV production and its required workforce. For example, for the electric F-150 Lightning pick-up, the workforce in Detroit has been reduced by two-thirds.

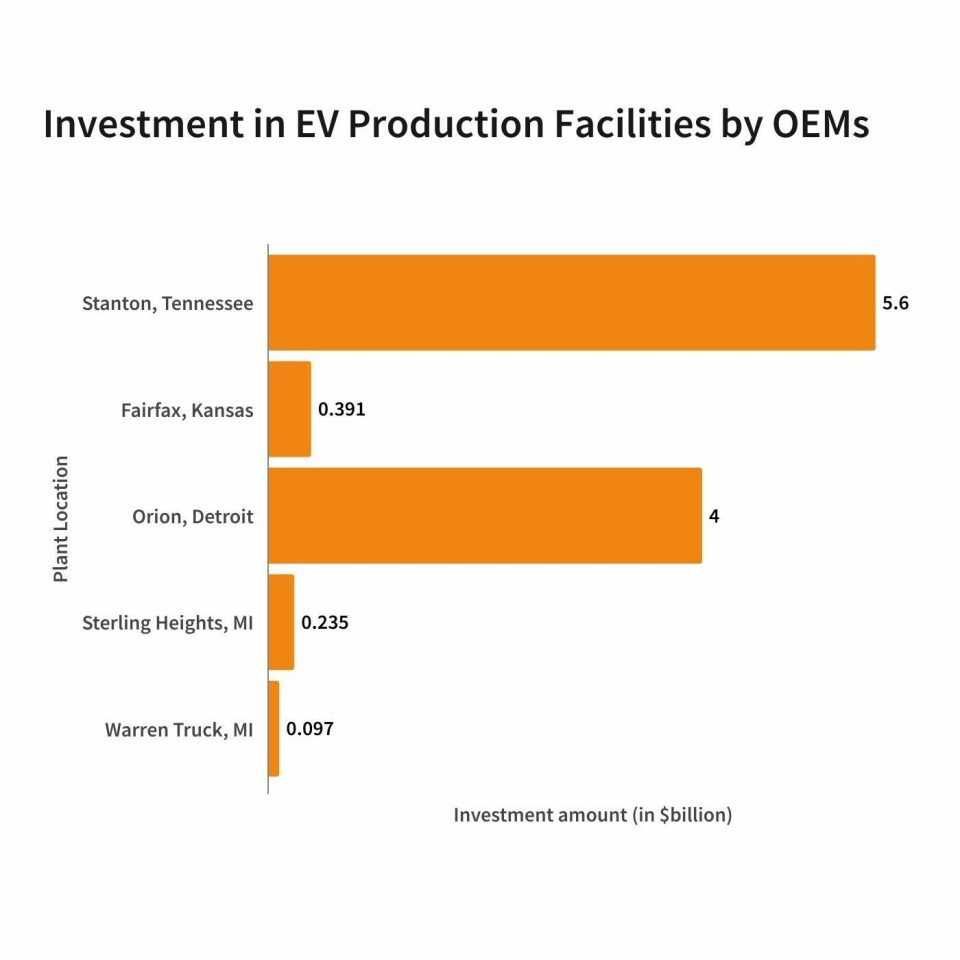

Despite these problems however, Ford is continuing to build EV factories. Its main investment in an all-new US$5.6bn domestic plant is for a new full-size EV pick-up which will be built in Stanton, Tennessee, which will make up to 500,000 vehicles per year. Production of the new vehicle, codenamed T3, is due to begin in H2/2027, having been delayed from late 2025. The new factory is due to employ 6,000 workers and is also expected to be Ford’s largest factory once up and running, surpassing Ford’s Detroit Rouge operations.

Other planned new model programmes include a new commercial van (the North American version of the E Transit) to be made in Ohio from 2026, while the hybrid Transit will continue to be made in Kansas City.

GM: EV slowdown changes production plans - but will Hyundai partnership save GM?

Despite the slowdown in EV sales, GM continues to invest in EVs throughout its US manufacturing network. GM has cut its North American EV production for 2024 by 50,000 down to just 200,999. The Fairfax plant in Kansas will stop making ICE cars soon, switching to the new Chevrolet Bolt. To allow for the new Bolt that Fairfax loses, the Malibu comes to the end of its lifecycle in November this year, while production of the Cadillac XT4 will be paused in January 2025 to allow for the completion of retooling of the plant to prepare it for EVs. US$391m will be invested and vehicles will use the new Ultium platform using batteries sourced from the GM-LG JV. The sum invested in Fairfax however, pales by comparison with the US$4bn GM is investing to completely refit the Orion plant in Detroit to make electric versions of the Silverado and Sierra full-size pick-ups. However the start of production here is being delayed until mid-2026.

”GM has now turned to Hyundai; the two companies have signed a broad exploratory agreement covering a range of areas, including vehicle development, shared production, and conventional”

On the battery front, GM is broadening its supply arrangements, reducing any potential risk from relying solely on its Ultium LLC JV, with LG of Korea which has two plants already in operation. A third Ultium plant is planned but has been suspended due to the slowdown in EV sales. Nonetheless, GM has signed an agreement with Samsung for a US$3.5bn battery plant in Indiana, with 30GWh capacity, with Samsung being the slightly larger shareholder with 50.01%.

Samsung also has a JV with Stellantis, building two battery plants, also in Indiana. However the Samsung JV is not immune to the cold winds blowing through the sector. Originally this was planned to start production in 2026 but when the final agreement was signed in Seoul in August this year, the production start date for the factory – which is due to employ 1,600 – was given as 2027.

Find out more about the latest developments in North America, here.

Having laid great store by the Ultium JV when it was announced, it is notable that the pace of technical change in the industry means that the Samsung JV will produce a different specification of battery compared to the Ultium project. The idea of a single unifying battery technology, for a single company - let alone the industry as a whole - is proving to be a chimaera; the Samsung JV will make prismatic cells with a lithium-nickel-cobalt-aluminium chemistry that contrasts with the Ultium battery cells which are pouch style products, using a lithium nickel cobalt manganese chemistry.

And in its burgeoning EV supply chain, GM is delaying investment in its Thacker Pass lithium project, called Lithium Americas. This project in Nevada is said to be capable of producing enough lithium to power batteries for one million EVs per year. GM’s delayed investment is leading Lithium Americas to seek alternative funding because if this project has not received all its funding by December this year, GM will have the right to additional rights under this JV. It would appear in GM’s interest therefore to delay its investment, potentially saving cash while ultimately gaining additional control over its raw material supply chain.

”GM made 6.2m vehicles in 2023, versus Hyundai’s 4.2m”

The challenges facing GM continue to mount and, (as it has done many times before) GM has sought a partnership with an overseas company to find a solution. Past alliances with Toyota (NUMMI), Honda (fuel cells, batteries and autonomous technologies), Isuzu (pick-ups and SUVs), Fiat (powertrain and cross shareholdings in Europe) and pre-Stellantis PSA (also cross-shareholdings, and shared vehicle platforms in Europe) have come and gone, although the Ultium alliance with Honda and LG continues in the US.

Now, GM has turned to Hyundai; the two companies have signed a broad exploratory agreement covering a range of areas, including vehicle development, shared production, and conventional. electric and hydrogen powertrains and more. This is conceptually similar to the recent Nissan-Honda agreement in Japan as it involved the two companies immediately beginning assessment of how they can develop formal co-operations. The companies will also look to partner together in sourcing, especially in battery raw materials and steel.

The aim of the partnership is to find ways for the two companies to improve their overall efficiency, boost their individual competitiveness and share costs, as well as bring new vehicles to market quicker than in the past. The announcement was large in grandeur, scale and scope, but – unsurprisingly perhaps – lacking in detail, such as vehicle programmes, locations and more.

”The GM-Hyundai partnership is especially intriguing from Hyundai’s point of view; other than bringing Kia into its orbit”

GM made 6.2m vehicles in 2023, versus Hyundai’s 4.2m – together, this 10.4m places the companies midway between Toyota’s 11.2m and the VW Group’s 9.2m. No doubt, both companies have an eye on the Chinese, especially BYD and Geely, coming up behind, as well as Tesla which – for all its controversies and problems – has the singular advantage of no legacy ICE or hybrid investment to worry about.

The GM-Hyundai partnership is especially intriguing from Hyundai’s point of view; other than bringing Kia into its orbit, the Korean company has largely avoided partnerships or close cooperation with competitors. This is an interesting change of strategy, especially if something long-lasting and substantial emerges. For GM, by contrast, this is the latest in a series of paraeneses, in the US, Europe and Japan, which have been of varying degrees of success, but – the Honda battery alliance apart – have faded into history.

Stellantis – labour and supplier problems compound the challenges of EV transition

Stellantis, too, faces numerous challenges in North America as its transition to EVs is complicated by, not just the market slowdown, but also a series of disputes with suppliers over pricing and with the UAW over the terms of the labour contract which had been agreed at the end of 2023.

The UAW agreement included a commitment to build a US$3.2bn battery plant and a US$1.5bn mid-size truck plant in Belvidere, Illinois. These projects and other smaller commitments were due to mean an additional 5,000 jobs. However, the Belvidere project is being delayed, potentially until 2027. The UAW has threatened a strike in response to this delay, with Stellantis responding saying such a move would be illegal, insisting that it has not violated the terms of the 2023 agreement.

The underlying financial strains on Stellantis were symbolically evidenced when CEO Carlos Tavares announced he was breaking into his annual holiday by making an additional visit to the US in mid-August. This was said to be in addition to his normal cycle of visits every four to six weeks. The aim of this additional visit was reported as the need to develop a strategy to fix some of the company’s biggest current problems.

The most significant of these are understood to be higher-than-planned inventories, unspecified manufacturing issues (including a lower-than-expected run rate at Sterling Heights Assembly in Michigan) and a rather ominous reference to a lack of sophistication in how the company was addressing the local market. Stellantis has been raising prices when economic pressures on consumers mean these could not be afforded. Intriguingly, Tavares even described himself to the press as arrogant for not having addressed these problems before.

”How far these investments will be enough to turn Stellantis around is open to debate, as more investment will surely be required to complete the new strategy”

After a few weeks of silence in this area, in the second week of September, the fruit of Tavares’ visit began to become clear. The company has announced a (comparatively modest) new investment round. It will commit US$406m in three factories in Michigan. Just over US$235m will be invested in Sterling Heights to build the electric Ram 1500 and range extender version of the Ramcharger on the same assembly line as the gasoline version which will remain in production. Central to this plan is a partnership with equipment suppliers and contractors to install new conveyors, automation for BEV-specific functions within the plants and a general re-tooling and re-arrangement through the general assembly area.

Details behind this remain to be confirmed. Sterling Heights will be the first Stellantis plant in the US to make EVs, with the first electric Ram coming off the assembly line by the end of 2024.

Meanwhile, just under US$97m will be invested in the Warren Truck plant to allow it to make an electrified version of the Wagoneer; this will be a range-extender vehicle, using a powertrain similar to that being used on the Ramcharger. The electrified Wagoneer will be made on the same line as the gasoline powered versions of Wagoneer and the larger Grand Wagoneer; notably, the electric Wagoneer will be made in Mexico.

“Earlier in 2024, Stellantis had also had legal problems with a number of its suppliers”

And finally the third tranche of investment in Michigan comes at Stellantis’ Dundee engine assembly plant. This will receive more than US$73m to retool, allowing for assembly, welding and testing of battery trays for the STLA Frame platform which underpins the electric and range extender ram model. These battery trays will be built alongside the new GME-T4 engine and a 1.6 litre 4-cylinder turbocharged engine due next year.

How far these investments will be enough to turn Stellantis around is open to debate, as more investment will surely be required to complete the new strategy. Moreover, in the specific case of Michigan factories, it remains to be seen whether these will counteract or effectively override plans to lay off 2,500 people at Warren following the end of production of the Ram 1500 Classic and the plan for the general assembly area within the Warren plant to switch from two shifts to single shift operation.

In addition, while Stellantis has threatened legal redress if the UAW goes on strike (in response to the proposed change in the Belvidere investment plan noted above), the company has found itself in receipt of a lawsuit from a group of disgruntled shareholders. These have accused the company of making unfounded statements to boost its share price. Inevitably Stellantis denies this, and while such lawsuits may well be commonplace in the US, it is another distraction which the company could well do without.

Earlier in 2024, Stellantis had also had legal problems with a number of its suppliers. For example a transmissions, gear and pinion producer, the private equity owned MacLean-Fogg, won a case in Michigan. The supplier had reportedly asked for a price rise of 26%, which Stellantis reportedly refused (unsurprisingly), and having refused the price rise outright, it tried to force MacLean-Fogg to maintain deliveries despite the dispute.

However, a court found in the supplier’s favour, with Stellantis being ordered to pay increased prices “under protest”. This dispute followed Stellantis having introduced a “no more claims” policy designed to stop suppliers winning price rises. For example, it had won legal fights with interiors supplier Yanfeng and fasteners company Kamax, both of which had been instructed by the court to keep supplying Stellantis while the cases went through legal proceedings.