Korea: the switch to EV production accelerates

Korean vehicle makers invest in flexible production and add more EVs. Foreign OEMs continue to invest in production for export.

Auto production in Korea is dominated by Hyundai and Kia and their supply chains. In 2023 the Hyundai-Kia group which includes the new premium Genesis brand, sold just over 7.3m vehicles, nearly 7% up on 2022. By 2028, the Hyundai-Kia group is forecast to produce around 8.3m units worldwide; outside its Korean home, it has major manufacturing operations in North America, India, China and Indonesia in particular, along with smaller operations in Brazil and Vietnam.

Much of the additional 1m units expected by 2028 will be electric vehicles; Hyundai aims to sell 2m EVs annually, with 17 new BEV models to be launched by 2030,11 from Hyundai itself and six from Genesis. Kia meanwhile aims to reach 1.6m BEV sales by 2030, with at least five more Kia electric models, enabling the brand to complete its series from EV1 to EV9.

Increasingly, these companies’ focus these days is outside Korea, especially in the US, Europe, India and ASEAN countries. In Korea investment focuses on launching new EVs, mostly in existing facilities which are being adapted to make EVs alongside ICE and hybrid models. There are some EV specific moves however and at Hyundai the most relevant recent domestic manufacturing development centres on its investing 2 trillion won (US$1.5billion) in a new EV factory at its Ulsan headquarters. This will start producing vehicles in early 2026.

Hyundai

The bulk of Hyundai’s production takes place at Ulsan (c1.3m produced last year, with capacity of at least 1.5m pa) and where there are several vehicle assembly facilities and numerous component factories. The new luxury Genesis range is also made at Ulsan, although some Genesis production has also been moved to the US, which is a major market for the brand. Hyundai also has smaller sites at Kwangju (c50,000 capacity) where it produces the small Casper SUV; Asan (250-300,000 capacity), where it makes its larger sedans, notably the Grandeur and the Ioniq 6 and 9 EVs; and Jeonju where its trucks and vans are made.

Kia

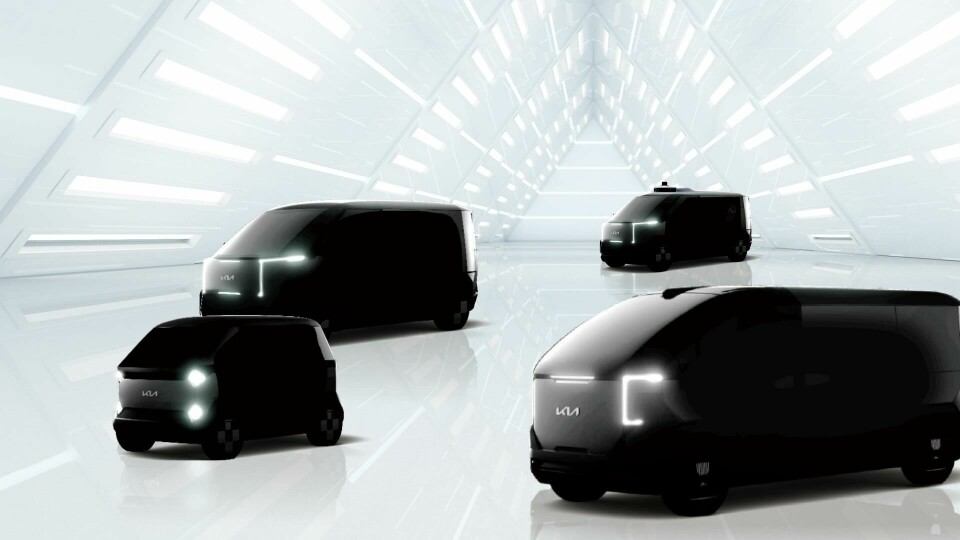

Meanwhile Kia is opening the first EV-only factory in Korea, at Gwangmyeong. It is also building two Purpose Built Vehicle (PBV) factories; these are effectively in-house special vehicle operations where the VMs take basic platforms and produce purpose-designed conversions, e.g. minibuses, or specific use commercial vehicles. The programme actually started out under the “Platform Beyond Vehicle” strapline, with a 250,000 upa target by 2030, 150,000 PV5 and 100,000 PV7 vehicles. Whereas in Europe, this tends to involve an existing vehicle coming off the assembly and converted in a specialist facility, Kia’s approach is different and builds the specific application vehicles from the ground up. Kia’s first PBV plant will involve investment of 1trn won (c$US$740m) at its Hwaseong site, where it will make up to 150,000 units under the project code SW; the location of the second site is unknown at the moment.

Kia’s main factory its Hwaseong where it can make over 600,000 upa, although actual output has been running at less than 500,000 pa in recent years; the new PBV plant volumes referred to above will be on top of the main Hwaseong factory’s volumes. At Kwangju it makes c400,000 pa and it has a partner company, Donghee Auto at Suhsan which makes some of the smallest Kia models, at a rate of c250,000 a year

Apart from Hyundai and Kia, there are three VMs in the country, GM Korea, Renault-Samsung and the former SsangYong business now called KG Mobility.

GM Korea

GM Korea produced 468,000 vehicles in 2023, its highest volume since 2017; the bulk of these, c429,000, were exported, a rise of 88% over 2022’s volumes. GM Korea operates two factories, the main factory at Bupyeong which makes two Buicks, the Encore GX and Envista and the Chevrolet Trailblazer SUV; and the second plant at Changwon which has taken over production of the small Trax SUV, following its switch from Bupyeong when Changwon ended production of the small Spark car.

GM Korea is unusual in that it is primarily an export company with the US the principal export market. The exports were divided c213,000 Chevrolet Trailblazers (c155,000 in 2022) and c216,000 Chevrolet Trax (up from less than 150 units in 2022, with production having been cut to almost zero during a major model changeover). GM Korea’s domestic sales of just under 39,000 were up 4.1%. Despite its improving production volumes in the country, Chevrolet is not an especially popular brand in Korea, which remains dominated by its domestic giants, Hyundai and Kia.

Renault-Samsung

The Renault-Samsung factory at Busan is now part-owned by Geely of China. In 2023, the partners agreed that Geely’s Polestar brand would use the Korean factory to make the Polestar 4 from H2/2025. At the time of the announcement the partners said this was for supply to US, largely to get around the 25% supplementary tariff which the US levied on Chinese vehicles under President Trump; the Chinese EV tariff has subsequently been raised to 100%. And now that the EU is levying supplementary tariffs on Chinese EVs it may well be that the Polestar 4 cars made in Korea will also be exported to Europe and thereby potentially avoid the tariff on chinse models.

Renault itself announced in February 2024 that it would invest over 700 billion won (US$523m) in Busan to support the transition to hybrid and electric vehicle production, aiming to boost production to 200,000 EVs a year; the investment also covers the establishment of a new hybrid R&D centre. 118 billion won will be spent by 2027 to replace the current assembly lines. Renault Samsung has not actually launched a new vehicle since 2020, when the current XM3 (Arkana in Europe) was launched. The new Polestar model will be an important fillip to production there which fell 40% in 2023 to c107,000 from 2022’s c169,000 units prediction total. Like GM, Renault Samsung is mainly an export operation, with just under 25,000 Samsung vehicles sold in Korea in 2023, and over 82,000 exported. But it will not just be Polesatrs made at Samsung as a new mid-size SUV, dubbed Aurora 1 is due to be launched later in 2024, probably sold as the Renault QM6; additional EVs will be added to the factory, which plans to launch at least one new model per year through to 2026. These vehicles will be sold domestically and across Asia, but the factory is likely to have lost Europe as an export market for Renault vehicles as Renault Europe has launched its own SUV and EV line-up.

KG Mobility

KG Mobility managed to turn in a profit in 2023, the first time the former SsangYong operation, which was acquired in 2022, had reported a profit in seven years. This comes on the back of new model launches, especially the Torres EVX SUV and a revamp of its main assembly lines. This revamp has focused on increasing flexibility of what is made and adding hybrid and full EV production capacity alongside ICE models. There are three assembly lines at its single vehicle plant at Pyeongtaek, 65 kms south of Seoul, one of which, assembly line 3, can make both petrol and electric vehicles, and both monocoque and body-on-frame vehicles. Around 50 billion won (US$36.5m), a relatively modest sum in automotive terms, was spent on revamping the assembly line which is highly automated; a key area which has been automated is the battery mounting stage.

The new flagship model, Torres EVX, is made on assembly lines 1 and 3, with other models made on line 2 and interspersed with other vehicles as demand requires.

Production remains modest by global standards at just 116,000 in 2023, of which c63,000 were sold domestically and nearly 53,000 were exported. The Pyeongtaek factory has an annual capacity of c240,000 units, so there is some way to go for this to be fully used. Future models will likely use BYD technology following an agreement between the two companies, with the initial focus on plug-in hybrids and batteries. Given BYD’s interest in Europe and the European Commission’s recent announcement of significant tariffs on Chinese EVs, it would not be surprising to BYD models made by KG to utilise spare capacity there and also provide a way around tariffs on Chinese-made EVs; Korea and the EU have a free trade deal and provided BYD could achieve 55% Korean content on vehicles exported to Europe it could look at this as a means of getting around the tariff issue.

Beyond Korea, KG Mobility hopes to build a presence in Saudi Arabia as the oil kingdom looks to develop manufacturing capacity and diversify away from oil. In December 2023, KG signed a memorandum of understanding with Saudi National Automotive Manufacturing (SNAM) to establish a component supply chain in the country. This comes after a previous commitment by SsangYong to assemble 169,000 Rexton SUVs over a seven-year period in the kingdom. A site was acquired by SNAM in 2022 but this programme subsequently stalled but may well now be revived with KG itself turning in a profit.